Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

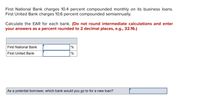

Transcribed Image Text:First National Bank charges 10.4 percent compounded monthly on its business loans.

First United Bank charges 10.6 percent compounded semiannually.

Calculate the EAR for each bank. (Do not round intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

First National Bank

%

First United Bank

%

As a potential borrower, which bank would you go to for a new loan?

Expert Solution

arrow_forward

Given:

Here,

FN Bank Interest Rate is 10.4%

Compounding Period is Monthly i.e. 12

FU Bank Interest Rate is 10.6%

Compounding Period is Semi-Annually i.e. 2

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a $5,000, 6%, 180-day interest-bearing note and a non-interest- bearing note for the same amount and time period with a bank discount of 6%. From the borrower’s point of view, which is the better loan and why?arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) Amount Number of Financed Payments $1,700 18 Monthly Payment $125.89 Payments Made 13 Rebate Fraction Finance Charge Rebate Loan Payoffarrow_forwardBank A offers you a loan at 5.76% compounded 2 times a year. Bank B offers to loan you the same amount at 0.10% less than the rate offered by Bank A but compounded twice as often as the Bank A rate is. Which bank's loan should you accept? As your answer, enter the effective rate (in percent, to two decimal places at least) offered by the bank whose loan you should accept.arrow_forward

- 5) According to a recent WalletHub report, the average credit card balance is $10,848 per American household, at an average 22.75% APR. How long will it take for a credit card balance of $10,848 to be paid off with monthly $40 minimum payments? How much interest will the credit card debt cost?arrow_forwardA loan of 15700 was charged a simple discount rate of 4.2%. If the proceeds received were 15463.72, find the amount of bank discount. Hence, find the discount period in days.arrow_forwardThe First Bank of Lending lists the following APR for loans. Determine the APY, or effective interest rate, for a loan amount that is less than $20,000. Express your answer as a percentage rounded to the nearest hundredth of a percent, if necessary. First Bank of Lending Loan APR Loan Amount APR* <$20,000 12.25% $20,000–$99,999 9.99% >$99,999 6.75%arrow_forward

- Hi there, I'm not sure how to write this journal entryarrow_forwardA non-traditional lending source offers Megan a loan for $5,400. They require the loan to be repaid in 3 end-of-year payments of $2,100 each at the end of years 1, 2, and 3. What interest rate is this non-traditional lending source charging Megan? Click here to access the TVM Factor Table calculator. % Round entry to 1 decimal place. The tolerance is ±0.5.arrow_forwardZenith Bank charges an interest rate of 16.9% per annum on a loan to Samson Ltd. The bank requires borrowers to keep compensating balance (b) on loans of 3% and there is 7% reserve requirement (RR). The bank also charges administration fees of 2.9% of the loan amount per annum. What is the contractually promised rate of return to the bank from the loan? (Instructions: Please round your answer to four decimal places. Please also keep your answer in decimals not percentage terms. e.g. if the answer is 8.157%, enter 0.0816) Answer:arrow_forward

- Bank A offers you a loan at 8.52% compounded 5 times a year. Bank B offers to loan you the same amount at 0.10% less than the rate offered by Bank A but compounded twice as often as the Bank A rate is. Which bank's loan should you accept? As your answer, enter the effective rate (in percent, to two decimal places at least) offered by the bank whose loan you should accept.arrow_forwardwhich of the following banks would you choose for a savings account based on the following rates offered? 1. 6% APR compounded annually 2. 5% APR compounded annually 3. 5% APR compounded semi-annually 4. 4% APR compounded weekly 5. 6% APR compounded quarterly.arrow_forwardYou have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.) LoanPayment PaymentPeriod Term ofLoan (years) NominalRate (%) Present Value(Amount of Loan) $ every month 1 3 4 6 $40,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education