Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Question 4. Was incorrect the first time. Attached is a similar question with answer. Please answer in the same format. For the first part please round to the nearest 3 decimal places

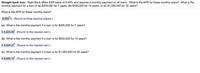

Transcribed Image Text:Straight bank loan. Right Bank offers EAR loans of 9.44% and requires a monthly payment on all loans. What is the APR for these monthly loans? What is the

monthly payment for a loan of (a) $200,000 for 7 years, (b) $430,000 for 14 years, or (c) $1,050,000 for 30 years?

What is the APR for these monthly loans?

9.055 % (Round to three decimal places.)

(a) What is the monthly payment if a loan is for $200,000 for 7 years?

$ 3,223.40 (Round to the nearest cent.)

(b) What is the monthly payment if a loan is for $430,000 for 14 years?

$ 4,524.27 (Round to the nearest cent.)

(c) What is the monthly payment if a loan is for $1,050,000 for 30 years?

$ 8,490.12 (Round to the nearest cent.)

Transcribed Image Text:Straight bank loan. Right Bank offers EAR loans of 8.74% and requires a monthly payment on all loans. What is the APR for these monthly loans? What is the

monthly payment for a loan of (a) $225,000 for 6 years, (b) S470,000 for 14 years, or (c) $1,300,000 for 32 years?

What is the APR for these monthly loans?

% (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hello, can you please help me with questions 10,11, and 12, thanks!arrow_forwardMultiple choice: 1. Correction in accounts should NOT be A. Traceable B. Initialed C. Ruled D. Covered completely 2. To find an error, you should do all of the following except A. Double check every entry B. Find the difference between debits and credits C. Erase questionable entries D. Retrace any math computationarrow_forwardEntries for Stock Investments, Dividends, and Sale of Stock Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24 Acquired 400 shares of Tett Co.'s stock for $105 per share plus a $148 brokerage commission. May 16 Acquired 1,600 shares of Issacson Co.'s stock for $26 per share plus a $80 commission. July 14 Sold 200 shares of Tett Co. stock for $117 per share less a $76 brokerage commission. Aug. 12 Sold 600 shares of Issacson Co. stock for $21 per share less a $65 brokerage commission. Oct. 31 Received dividends of $0.24 per share on Tett Co, stock. Dec. 31 At the end of the accounting period, the fair value of the remaining 200 shares of Tett Co.'s stock was $105.57 per share. The fair value of the remaining 1,000 shares of Isaacson Co.'s stock was equal to its cost of $26.05 per share. Journalize the entries for these transactions. In your computations, round per share…arrow_forward

- While posting an entry in a ledger, the Post. Ref. column in the ledger account is filled with the number 96. It indicates that: a.the entry is related to account number 96. b.the entry came from page number 96 of the journal. c.this entry came from a source document numbered 96. d.the entry is the 96th entry in the ledger.arrow_forwardHello can you answer questions 4, 5, and 6 please. I want to make sure I have it right, thanks!arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Please do not give image formatarrow_forwardWhat is the present value of $3,000 to be received 2 years from now, if the discount rate is: (a) 9%, (b) 13%, and (c) 25%? 1. Use the appropriate table (Appendix C: Table 1) to answer the above questions. 2. Use the formula shown at the bottom of Appendix C, Table 1, to answer the above questions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the appropriate table (Appendix C: Table 1) to answer the above questions. (Round your answers to the nearest whole dollar amount.) (a) (b) (c) Discount Rate 9% 13% 25% $ GAGA $ X Answer is complete but not entirely correct. $ Present Values 1 x 1 x 1 xarrow_forwardUsing Excel, create a table that shows the relationship between the interestearned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education