Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

14) Can i get help with this question please

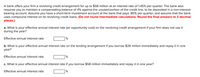

Transcribed Image Text:A bank offers your firm a revolving credit arrangement for up to $58 million at an interest rate of 1.45% per quarter. The bank also

requires you to maintain a compensating balance of 4% against the unused portion of the credit line, to be deposited in a non-interest-

bearing account. Assume you have a short-term investment account at the bank that pays .80% per quarter, and assume that the bank

uses compound interest on its revolving credit loans. (Do not round intermediate calculations. Round the final answers to 2 decimal

places.)

a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use it

during the year?

Effective annual interest rate

%

b. What is your effective annual interest rate on the lending arrangement if you borrow $26 million immediately and repay it in one

year?

Effective annual interest rate

%

c. What is your effective annual interest rate if you borrow $58 million immediately and repay it in one year?

Effective annual interest rate

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need help with questions 1 and 2arrow_forwardi did ask for a certain question to be resolved question 2barrow_forwarda) The Home Design Enterprises is considering a new project which will require RM325,000 for new fixed assets. In the initial year, the project will also require RM160,000 for additional inventory and RM35,000 for additional accounts receivable. Short-term debt is expected to increase by RM100,000 and long-term debt is expected to increase by RM300,000. The project has a 5-year life. The fixed assets will be depreciated straight-line to a zero-book value over the life of the project. At the end of the project, the fixed assets can be sold for 25% of their original cost. The net of balor expected to generate annual sales of RM554,000 and costs of RM430,000. The tax working capital returns to its original level at the end of the project. project is Hoota rate is 35% and the required rate of return is 15%. Calculate: The (exham S) i. the initial cost of this project? eriT bricii vib 16 iii. Set civ. (ex the after-tax operating cash flow for year 1 to year 4? 100 serk the cash flow for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education