FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

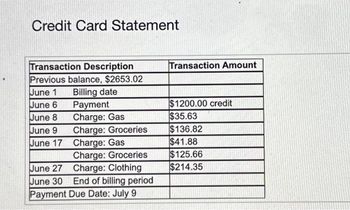

The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.2% of the average daily balance. Calculate parts a-d using the statement in the popup.

a. Find the average daily balance for the billing period. Round to the nearest cent.

Transcribed Image Text:The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.2% of the average daily balance.

Calculate parts a-d using the statement in the popup.

Click the icon to view the credit card statement.

a. Find the average daily balance for the billing period. Round to the nearest cent

The average daily balance for the billing period is $

(Round to the nearest cent as needed.)

Transcribed Image Text:Credit Card Statement

Transaction Description

Previous balance, $2653.02

June 1 Billing date

June 6

June 8

June 9

June 17

June 27

June 30

Payment

Charge: Gas

Charge: Groceries

Charge: Gas

Charge: Groceries

Charge: Clothing

End of billing period

Payment Due Date: July 9

Transaction Amount

$1200.00 credit

$35.63

$136.82

$41.88

$125.66

$214.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Alexis Monroe, a biologist from Dyersburg, Tennessee, is curious about the accuracy of the interest charges shown on her most recent credit card billing statement. Interest Charged Interest Charge on Purchases $6.40 Interest Charge on Cash Advances $4.65 TOTAL INTEREST FOR THIS MONTH $11.05 Use the average daily balances provided to recalculate the interest charges, and compare the result with the amount shown on the statement. Round your answers to the nearest cent. Annual Percentage Balances Subject to Type of Balance Rate (APR) Interest Rate Interest Charge Purchases 15.14% (V) $513.39 $ Cash Advances 22.43% (V) $252.98 $ Balance Transfers 0.00% $637.50 $ Penalty APR 28.99% $ 0.00 $arrow_forwardH5.arrow_forwardA credit card balance at the beginning of November is $4,000. On Nov. 3 a $300 charge is made. On Nov. 8 a $1000 charge is made. On Nov. 15 a $900 payment is made. On Nov. 17 a $200 charge is made. On Nov. 21 a $800 charge is made. using the average daily balance method, Caculate the interest charged if the account has a 17.5% rate and the billing period is 30 days.arrow_forward

- On august 10, a credit card account had a balance of $345. A purchase of $64 was made on august 15, and $165 was charged on august 27. A payment of $71 was made on august 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on September 10 bill. (Round your answer to two decimal places)arrow_forwardA credit card bill for $657 was due on April 14. Purchases of $155.56 were made on April 19. The amount $24.45 was charged on April 21 and $207.36 was charged on April 28. A payment of $500 was made on April 25. Find the average daily balance (in dollars) if the next due date is May 14. (Round your answer to the nearest cent.) $arrow_forwardOn August 10, a credit card account had a balance of $345. A purchase of $52 was made on August 15, and $161 was charged on August 27. A payment of $71 was made on August 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on the September 10 bill. (Round your answer to two decimal places.)arrow_forward

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Step 1 In the credit account statement below, the values of the annual percentage rate (APR), finance charge, and the new balance must be calculated. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Recall that the annual percentage rate (APR) is tied to the monthly periodic rate by the following formula. monthly periodic rate = APR 12 By solving this equation for the APR, the known value for the monthly periodic rate can be substituted to calculate the APR. APR = monthly periodic rate ✕ 12 The…arrow_forwardVishuarrow_forwardMN.3.arrow_forward

- Find the cash discount and the net price on an invoice for RM580 dated April 17 with terms of 3/10, n/30 if the bill was paid April 26. Draw the “timeline” stated the initial date, the due date, and the day receives cash discount.arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $120 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $10.00 October 25 Purchase $121.60 average daily balance = $arrow_forwardA credit card had a previous balance of P 9 500 on June 10. A purchase of P 5 000 was made on June 15, and a payment of P 2 500 was made on June 23. Find the average daily balance, if the billing date is July 5 and the interest rate is 3.5% per month. Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education