Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Only typing answer

Please explain step by step without table and graph thankyou.

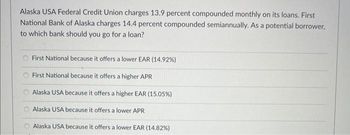

Transcribed Image Text:Alaska USA Federal Credit Union charges 13.9 percent compounded monthly on its loans. First

National Bank of Alaska charges 14.4 percent compounded semiannually. As a potential borrower,

to which bank should you go for a loan?

First National because it offers a lower EAR (14.92%)

First National because it offers a higher APR

Alaska USA because it offers a higher EAR (15.05%)

Alaska USA because it offers a lower APR

Alaska USA because it offers a lower EAR (14.82%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Please avoid answers in image format thank youarrow_forwardJasmine Thompson AutoSave Document4 Word O Search B Share Comment File Insert Draw Design Layout References Mailings Review View Help Home O Find X Cut Calibri (Body) A A Aa A EE v E EE T AaBbCcDd AaBbCcDd AaBbC AABBCCC AaB AaBbCcD AaBbCcDd AaBbCcDd v 12 S Replace Dictate Editor Copy Paste Emphasis BIU ab x, x' A ~ A EEEE E - 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select V Format Painter Styles Editing Voice Editor Clipboard Font Paragraph 3 4 5. 6. 1 2. In Year 2, Chalon Company records the payment of $450 cash for an expense accrued in Year 1 and records the accrual of $425 for another expense. Additionally, Chalon Company pays $475 for supplies that were purchased in Year 1 on account. The impact of these three entries on Year 2 total expenses and total liabilities is: Total Expenses Liabilities a. increase by $425 decrease by $500 b. increase by $450 decrease by $25 c. increase by $425 increase by $25 d. increase by $900 decrease by $500 e. increase…arrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardCan you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forwardTyping clearly urjentarrow_forward

- How do I fill out the chart?arrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Create a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardPlease answer questions correctlyarrow_forwardHi can you show how to input in excel using the pmt formula thank you so mucharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education