ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

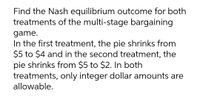

Transcribed Image Text:Find the Nash equilibrium outcome for both

treatments of the multi-stage bargaining

game.

In the first treatment, the pie shrinks from

$5 to $4 and in the second treatment, the

pie shrinks from $5 to $2. In both

treatments, only integer dollar amounts are

allowable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For various values of X(for player1 and player 2), find all Nash equilibria of the following game with von Neumann-Morgenstern preferences:arrow_forwardConsider the following situation: five individuals are participating in an auction for an old bicycle used by a famous cyclist. The table below provides the bidders' valuations of the cycle. The auctioneer starts the bid at an offer price far above the bidders' values and lowers the price in increments until one of the bidders accepts the offer. Bidder Value ($) Roberto 750 Claudia 700 Mario 650 Bradley 600 Michelle 550 What is the optimal strategy of each player in this case? Who will win the auction if each bidder places his or her optimal bid? If Claudia wins the auction, how much surplus will she earn?arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 2 in the equilibrium?arrow_forward

- Consider a Stackelberg game of quantity competition between two firms. Firm 1 is the leader and firm 2 is the follower. Market demand is described by the inverse demand function P=1000-4Q. Each firm has a constant unit cost of production equal to 20. Suppose firm 2's unit cost of production is c<20. What value would c have so that in the Nash Equilibrium, the two firms, the leader and the follower, had the same market share?arrow_forwardJane is interested in buying a car from a used car dealer. Her maximum willingness to pay for thecar is 12 ($12,000). Bo, the dealer, is willing to sell the car as long as he receives at least 9($9,000). What is the Nash bargaining solution to this game?arrow_forwardProblem 2. Consider the partnership-game we discussed in Lecture 3 (pages 81-87 of the textbook). Now change the setup of the game so that player 1 chooses x = [0, 4], and after observing the choice of x, player 2 chooses y ≤ [0, 4]. The payoffs are the same as before. (a) Find all SPNE (subgame perfect Nash equilibria) in pure strategies. (b) Can you find a Nash equilibrium, with player 1 choosing x = 1, that is not subgame perfect? Explain.arrow_forward

- PLEASE HOW TO THINK ABOUT IT AND SOLVEarrow_forwardWhile game theory predicts non-cooperative behavior for a one-shot Prisoner's dilemma. By repeating the game, say 20 rounds, it becomes possible to adopt more complex strategies that allow cooperative play as a Nash Equilibrium in at least some rounds of the game. True Falsearrow_forwardA Nash Equilibrium is the equilibrium of a game in which; Both players get the largest payoff amount Both players get the best payoff independent of what the other players choices are Both player, with the knowledge of what the other players possible moves are, do not have incentive to deviate from their strategy There is incomplete information of the game and each player makes the move that is best for them and their payoff outcomearrow_forward

- The inverse market demand for fax paper is given by P=100-Q. There are two firms who produce fax paper. Firm 1 has a cost of production of C1= 15*Q1 and firm 2 has a cost of production of C2=20*Q2 a) Suppose that firm play a Stackelberg game. First firm 1 sets the quantity in t=1, then, knowing which quantityfirm 1 has set, firm 2 chooses the quantity in t=2. What are the Stackelberg quantities and prices? What arethe profits od firm 1 and 2? Compared to part a) which firm benefits and which firm loses?arrow_forwardThere is a city, which looks like chopped isosceles triangle, as shown below. Citizens live uniformly distributed all over the city. Two ice-cream vendors, A and B, must independently set up stores in the city. Each citizen buys from the vendor closest to their location and when equidistant from both vendors they choose by coin toss. Each vendor’s aim is to maximize the expected number of customers. A choice of location by the two vendors is a Nash equilibrium if no vendor can do better by deviating unilaterally. Does this game have a Nash equilibrium? If so, describe it. If not, explain why notarrow_forwardSuppose a $1 bill is to be divided between two players according to a simultaneous-move, one-shot bargaining game. Is there a Nash equilibrium to the bargaining game if the smallest unit in which the money can be divided is $0.01? Assume that if the players ask for more in total than is available, they go home empty-handed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education