ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

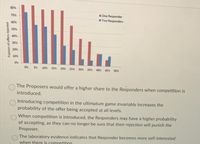

Transcribed Image Text:S0%

One Responder

Two Responders

70%

60%

50%

40%

30%

20%

10%

0%

o% 5% 10% 15% 20% 25% 30% 35% 40% 45% s0%

The Proposers would offer a higher share to the Responders when competition is

introduced.

Introducing competition in the ultimatum game invariably increases the

probability of the offer being accepted at all levels.

When competition is introduced, the Responders may have a higher probability

of accepting, as they can no longer be sure that their rejection will punish the

Proposer.

The laboratory evidence indicates that Responder becomes more self-interested

when there is competition

Fraction of offers rejected

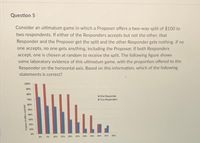

Transcribed Image Text:Question 5

Consider an ultimatum game in which a Proposer offers a two-way split of $100 to

two respondents. If either of the Responders accepts but not the other, that

Responder and the Proposer get the split and the other Responder gets nothing. If no

one accepts, no one gets anything, including the Proposer. If both Responders

accept, one is chosen at random to receive the split. The following figure shows

some laboratory evidence of this ultimatum game, with the proportion offered to the

Responder on the horizontal axis. Based on this information, which of the following

statements is correct?

100%

One Responder

70%

Two Responders

50%

10%

20%

10%

ON

ON SN 10% ASN 20%

as 40 45s sos

Fraction of offers rejected

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following situation: five individuals are participating in an auction for an old bicycle used by a famous cyclist. The table below provides the bidders' valuations of the cycle. The auctioneer starts the bid at an offer price far above the bidders' values and lowers the price in increments until one of the bidders accepts the offer. Bidder Value ($) Roberto 750 Claudia 700 Mario 650 Bradley 600 Michelle 550 What is the optimal strategy of each player in this case? Who will win the auction if each bidder places his or her optimal bid? If Claudia wins the auction, how much surplus will she earn?arrow_forwardType out the correct answer ASAP with proper explanation of it In the Ultimatum Game, player 1 is given some money (e.g. $10; this is public knowledge), and may give some or all of this to player 2. In turn, player 2 may accept player 1’s offer, in which case the game is over; or player 2 may reject player 1’s offer, in which case neither player gets any money, and the game is over. a. If you are player 2 and strictly rational, explain why you would accept any positive offer from player 1. b. In reality, many players reject offers from player 1 that are significantly below 50%. Whyarrow_forwardP-TV and QRS-TV are planning their fall line-up. Suppose that sit-coms are more popular than reality shows, and so generate more advertising revenue than do reality shows, but they are more expensive to produce since real actors must be hired. In the following decision tree, QRS-TV announces its decision first and P-TV observes that choice before it decides whether to air a sit- com in the same time slot or a reality show. Both stations know all of the information shown in this diagram when they make their decisions. QRS-TV Sit-com Reality P-TV- P-TV Sit-com Reality Sit-com -QRS-TV eams -$5 million; P-TV earns -$5 million QRS-TV earns +$5 million; P-TV eams +$20 million Reality QRS-TV earns +$20 million, P-TV earns +$5 million QRS-TV earns +$10 million; P-TV cams +$10 million Given the information in this decision tree, this season programming in this time slot on QRS-TV and P-TV will be: Select one: O a. a sit-com on QRS-TV and a reality show on P-TV. O b. only sit-coms. O c. only…arrow_forward

- When a famous painting becomes available for sale, it is often known which museum or collector will be the likely winner. Yet, the auctioneer actively woos representatives of other museums that have no chance of winning to attend anyway. Suppose a piece of art has recently become available for sale and will be auctioned off to the highest bidder, with the winner paying an amount equal to the second highest bid. Assume that most collectors know that Valerie places a value of $15,000 on the art piece and that she values this art piece more than any other collector. Suppose that if no one else shows up, Valerie simply bids $15,000/2=$7,500 and wins the piece of art. The expected price paid by Valerie, with no other bidders present, is $________.. Suppose the owner of the artwork manages to recruit another bidder, Antonio, to the auction. Antonio is known to value the art piece at $12,000. The expected price paid by Valerie, given the presence of the second bidder Antonio, is $_______. .arrow_forwardA buyer and seller trade with each other for an infinite number of periods. Both parties have a discount factor of d, where 0 < d < 1. In each period both parties can play trust (T) or to play selfish (S). If both the buyer and seller play T the payoffs are 4 to each player. If both parties plays the payoffs are 3 to each player. If one player plays S and the other T, the payoffs are 6 to the player who opted for 5 and 1 to the party that opted for T. Consider the following trigger strategy. In the first period play T. In any subsequent period, play T if in every previous period the outcome was (T, T), if not play S. What is the minimum d required for this trigger strategy to be subgame perfect equilibrium? O None of the other answers are correct. O 1/4 O 1/3 O 3/4arrow_forwardWhy is the multiplicity of equilibria in the standart Nash demand game in Nash (1953, ECMA) a problem for Nash’s purposes? How does he deal with this problem in Nash (1953)? Explain.arrow_forward

- Analyze the following game. Create payoff bimatrices consistent with the information given. Explain your choices. Then find the maximin moves, all dominated strategies for all players. Game: Adam, Bill, and Cindy are registering for a foreign language class independently and simultaneously. The available classes are ITA100 and FRE100. They d not care much which, but they care with whom they share the class. Bill and Cindy want to be in the same class, but want to avoid Adam. Adam wants to be in the same class as Bill or Cindy, or even better, both.arrow_forwardPLEASE CHECK THIS HOW TO SOLVEarrow_forwardJane is interested in buying a car from a used car dealer. Her maximum willingness to pay for thecar is 12 ($12,000). Bo, the dealer, is willing to sell the car as long as he receives at least 9($9,000). What is the Nash bargaining solution to this game?arrow_forward

- Within a voluntary contribution game, the Nash equilibrium level of contribution is zero, but in experiments, it is often possible to sustain positive levels of contribution for a long period. How might we best explain this? A) Participants are altruistic, and so value the payoff which other participants receive, benefiting (indirectly) from making a contribution. B) Participants believe that if they make a contribution, then other participants will be more likely to make a contribution. C) Participants in experiments believe that they have to make contributions in order to receive any payoff from their participation. D) Participants have experience of working in situations in which cooperation can be sustained for mutual benefit and so have internalised a social norm of cooperationarrow_forwardThere are three bidders participating in a first-price auction for a painting. Each bidder has a private, independent value vi for such a painting that is drawn uniformly from [0,1] Assume that each bidder i has a linear bidding function bi=avi, where a>0. What is the bidding strategy of bidder i , namely bi in the Bayesian equilibrium?arrow_forwardThe ultimatum game is a game in economic experiments. The first player (the proposer) receives a sum of money and proposes a fair proposal (F - 5;5) or unfair proposal (U - 8;2). The second player (the responder) chooses to either accept (A) or reject (R) this proposal. If the second player accepts, the money is split according to the proposal. If the second player rejects, neither player receives any money. 1 A 5:5 2 F R 0:0 U A 8:2 2 1. Find the subgame perfect Nash Equilibrium using backward induction. R 0;0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education