FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

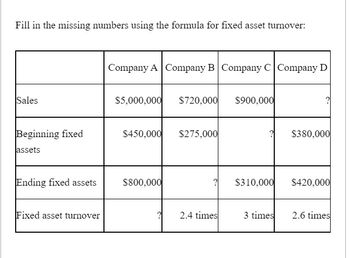

Transcribed Image Text:Fill in the missing numbers using the formula for fixed asset turnover:

Sales

Beginning fixed

assets

Ending fixed assets

Fixed asset turnover

Company A Company B Company C Company D

$5,000,000 $720,000 $900,000

$450,000 $275,000

$800,000

?

? $310,000

2.4 times

3 times

$380,000

$420,000

2.6 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Asset turnover Three major segments of the transportation industry are motor carriers such as Atlantic Worldwide, railroads such as Pacific, and transportation logistics services such as Mediterranean. Recent financial statement information for these three companies follows (in thousands): Atlantic Pacific Mediterranean Sales $1,868,060 $830,160 $1,984,500 Average total assets 812,200 1,383,600 441,000 a. Determine the asset turnover for all three comnpanies. Round to one decimal place. Atlantic Pacific Mediterranean b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned for every dollar of assets, the efficient a firm is in using assets. Check My Work 3 more Check My Work uses remaining. Previous Next 2. . 12:1 853535arrow_forwardNet Sales = $88,122 Total Assets = $189,100 Calculate Asset Turnover ( Round to nearest hundredth of a cent)arrow_forwardThe following information is available for Coulibaly Company: Total sales Total assets: Beginning of year End of year Year 1 Year 2 Asset Compute the asset turnover ratio for Coulibaly Company for Year 1 and Year 2. Round your answers to two decimal places. Turnover Ratio 3,600 Year 2 12500 $16,700 3,600 12,500 Year 1 $12,800 2,700 3,600arrow_forward

- Show the computation. Thank youarrow_forwardProvide the missing data in the following table: (Round "Turnover" answers to 1 decimal place.) Sales Operating income Average operating assets Margin Turnover Return on investment Fab $800,000 $ 72,000 9% 18 % Division Consulting $ 130,000 4% 5.0 % IT $ 40,000 8% 20 %arrow_forwardThe asset turnover from the following is: (Round to the nearest tenth) Gross Sales $60,000 //// Sales discount $3,000 II Sales returns and allowances $7,000 //// Total Assets $38,000 O a. 1.4 O b. 1.6 Oc. 1.5 O d. 1.3 A Moving to another question will save this response. «< Question 12 of 23 Sh Informative Top...docx の)arrow_forward

- Problem 6Four, Inc. provided the following balances at the end of the current year:Wasting asset, at cost P20,000,000Accumulated depletion 2,500,000Share capital 50,000,000Capital liquidated 1,800,000Retained earnings 1,500,000Depletion based on 50,000 units at P20 per unit 1,000,000Inventory of resource deposit 100,000Required:a. Compute the maximum dividend that can be declared.b. Prepare the journal entry to record the declaration of P2,000,000 dividend.arrow_forwardD1. Accountarrow_forwardPresented below is information related to Anderson Company for 2022. Sales revenue 25,000,000Cost of goods sold 16,000,000Interest expense 70,000Selling and administrative expenses 4,700,000Loss from write-off of goodwill. 820,000Gain on the sale of investments 110,000Loss due to flood damage 390,000Loss on the disposition of the wholesale division 8 00,000Loss on operations of the wholesale division 150,000Dividends declared on ordinary shares 250,000Dividends declared on…arrow_forward

- Subject:arrow_forwardBauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.3% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars): 1. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would…arrow_forwardPls complete required 1 and 2. Thanks!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education