FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

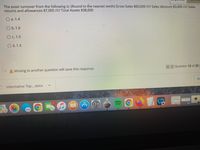

Transcribed Image Text:The asset turnover from the following is: (Round to the nearest tenth) Gross Sales $60,000 //// Sales discount $3,000 II Sales

returns and allowances $7,000 //// Total Assets $38,000

O a. 1.4

O b. 1.6

Oc. 1.5

O d. 1.3

A Moving to another question will save this response.

«< Question 12 of 23

Sh

Informative Top...docx

の)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Use the following information Year 0 1 2 3 Cash flow -$1000 $300 $500 $700 WACC= 8.0% Calculate: a) NPV b) IRR c) Payback d) MIRR e) EAAarrow_forwardSolve it using formulas, no tables correct answers: i) i^2 0.059126 > 0.0341 iii) P(wd) £73.34 per £100 nominal iv) using i* > 6% pa --> NPV(6%)= 2.78020 and NPV(6.5%) = 1.59578 therefore i= 6.32% pa and f=2.5% --> i'= 3.72% pa A fixed interest security pays coupons of 5% per annum convertible half-yearly in arrears. The security is redeemable at 110% at the option of the borrower on any anniversary date between 15 and 25 years after the date of issue. An investor, who is liable to tax on income at a rate of 25% and on capital gains at a rate of 30%, intends to buy the product exactly two months after issue for a price that gives a net effective yield of at least 6% per annum. (i) Determine whether the investor would make a capital gain if the bond is held until redemption. (ii) In what way does your answer to part (i) affect the assumptions made for calculating the issue price? Explain in general terms the reasoning behind your chosen pricing approach. (iii) Calculate the maximum…arrow_forward75. If a business has an asset turnover (Sales/Assets) of 5, plans to continue its current strategy, and wants to increase sales by $1,000,000, in general, then assets will need to be increased by: O A. $5,000,000. O B. $ 200,000.arrow_forward

- Cashbalance,beginning.....................P9 P ? P ? P? P?Add collectionsfromcustomers..... ? ? 125 ? 391Totalcash available................... 85 ? ? ? ?Less disbursements:Purchaseofinventory..................... 40 58 ? 32 ?Operatingexpenses............... ? 42 54 ? 180Equipmentpurchases................... 10 8 8 ? 36Dividends.......................... 2 2 2 2 ?Totaldisbursement.................... ? 110 ? ? ?Excess (deficiency) of cash availableOrdisbursements... ...................... (3) ? 30 ? ? Financing:Borrowings......................... ? 20 - - ?Repayments (including interest)*.. - - (?) (7) (?)Total financing......................... ? ? (?) (?) ?Cash balance, ending................... P ? P ? P ? P ? P ? *Interest will total P4, 000 for the year.arrow_forwardFill in the blanks in the schedule below for two separate investment centers A and B. Note: Round your final answers to 1 decimal place. Investment Center Sales Income Average assets Profit margin Investment turnover Return on investment A + $ 240,000 $ 1,200,000 8.0% B $ 10,400,000 2.0 12.0%arrow_forwardIf the profit margin is 0.1142, asset turnover is 0.5619 and financial leverage is 1.2937, what is the return on asset? Multiple Choice 0.1142 0.7269 0.0830 0.0642arrow_forward

- Given the following items , compute the required ones. REQUIRED COST OF SALES GIVEN Asset Turnover : Gross Margin: 1,2 0,3 NET SALES TOTAL SALES CURRENT ASSETS Fin.Goods InventoryTurnover Av. Finished Goods Inventory 120.000 Working.Capital Cycle Trade Receivables Turnover CURRENT RATIO 200 days 4 AV.TRADE RECEIVABLES TOTAL DEBT Long Term Debt Total Debt / Equity 250.000 TOT.DEBT/ TOTAL SOURCESarrow_forwardCash Flow Asset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 By using cell references to the given datea and the function PV, Calculate the value of asset D.arrow_forwardAnswer section A please.arrow_forward

- A4 Please solve branch B by hand on a piece of paper, pleasearrow_forwardA firm has projected the following financials for a possible project: YEAR Sales Cost of Goods S&A Depreciation Investment in NWC Investment in Gross PPE 0 1,130.00 105,468.00 1 132,716.00 Submit 549.00 2 62,780.00 62,780.00 30,000.00 30,000.00 30,000.00 21,093.60 21,093.60 21,093.60 Answer format: Currency: Round to: 2 decimal places. 3 132,716.00 132,716.00 132,716.00 549.00 What is the NPV of the project? (Hint: Be careful about rounding the WACC here!) 4 62,780,00 62,780.00 62,780.00 30,000.00 549.00 21,093.60 549.00 5 132,716.00 The firm has a capital structure of 37.00% debt and 63.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 15.00%. The tax rate facing the firm is 38.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year) 30,000.00 21,093.60 549.00arrow_forwardM7 Q5 Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education