FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

8

The records of Milwakee sprinkler systems report net sales of 520,000 net income of 130,000 and average total assets of 360,000. Using DuPont analysis. Calculate the two ratios used for return on assets.

SEE BELOW

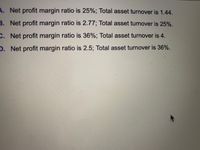

Transcribed Image Text:### Financial Ratios Analysis

In this section, we explore different scenarios of net profit margin ratios and total asset turnover rates. These metrics are crucial for evaluating a company's profitability and efficiency in using its assets.

1. **Scenario A:**

- **Net Profit Margin Ratio:** 25%

- **Total Asset Turnover:** 1.44

2. **Scenario B:**

- **Net Profit Margin Ratio:** 2.77%

- **Total Asset Turnover:** 25%

3. **Scenario C:**

- **Net Profit Margin Ratio:** 36%

- **Total Asset Turnover:** 4

4. **Scenario D:**

- **Net Profit Margin Ratio:** 2.5%

- **Total Asset Turnover:** 36%

#### Explanation:

- **Net Profit Margin Ratio** indicates how much profit a company makes for every dollar of sales.

- **Total Asset Turnover** measures the efficiency of a company's use of its assets in generating sales revenue.

These scenarios help in understanding different financial positions and strategic implications for business decision-making.

Expert Solution

arrow_forward

Explanation -

Ratio Analysis -

The ratio is the technique used by the prospective investor or an individual or strategist to read the company information in more detailed end accurate ways.

Ratio immediately recognizes the Liquidity, Profitability, and Solvency of the company.

By using ratio analysis comparison between two companies can also be done very easily and accurately.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- During the current year, Sokowski Manufacturing earned income of $270,000 from total sales of $4,500,000 and average capital assets of $12,100,000. What is the sales margin? If required, round your answer to one decimal place.arrow_forwardwant answerarrow_forwardBottlebrush Company has operating income of $150,720, invested assets of $314,000, and sales of $1,004,800. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place.arrow_forward

- Given the above information, calculate the net income. Enter the value in 2 decimal places, Sales 54,700 Cost of Goods Sold 51,650 Depreciation $700 Times Interest earned ratio 10 Tax rate 34%arrow_forwardBelow is financial information ($ values are in millions) in a model. Net income during the year for this company would be: Revenues SG&A Expenses Interest Expense Select one: OA. $4.5 million OB. $3.6 million O C. $16.6 million OD. $0.9 million $67.30 $4.70 $8.10 Cost of Goods Sold Depreciation Tax Rate $43.20 $6.80 20%arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $206,500 from total sales of $3,500,000 and average capital assets of $10,000,000. A. Based on this information, calculate asset turnover. If required, round your answer to two decimal places. B. Assume sales margin is 5.9%, what is the total ROI for the company during the current year?. If required, round your answer to one decimal place.arrow_forward

- Bottlebrush Company has operating income of $49,749, invested assets of $309,000, and sales of $710,700. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardIn its income statement for the year ended December 31, 2022, Pharoah Company reported the following condensed data. Operating expenses Cost of goods sold Interest expense (a) (b) Prepare a single-step income statement. Revenues $776,000 1,236,000 72,000 Net Sales Interest revenue Loss on disposal of plant assets Net sales Pharoah Company Income Statement For the Year Ended December 31, 2022 69 $ 29,000 17,000 2,218,000 KNUTarrow_forward8A. During the current year, Sokowski Manufacturing earned income of $342,385 from total sales of $6,375,343 and average capital assets of $10,106,928. What is the asset turnover? Round to the nearest to the hundredth, two decimal places and submit the answer in a percentage.arrow_forward

- The following are financial data taken from the annual report of Foundotos Company: Year 2 $134,448 51,981 37,154 57,504 Net sales Gross property, plant and equipment Accumulated depreciation Intangible assets (net) A. Calculate the following ratios for Year 1 and Year 2: 1. Fixed asset turnover 2. Accumulated depreciation divided-by-gross fixed assets B. What do the trends in these ratios reveal about Foundotos? Year 1 $130,060 47,744 34,180 36,276arrow_forwardThe following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company. Atlanta* $ 32,400 (15,500) 16,900 Boston* $ 87,500 (64,030) 23,470 Net sales Cost of goods sold Gross margin Less: Operating expenses Selling and administrative expenses Net income *All figures are reported in thousands of dollars. Required a-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. a-2. Ascertain which of the companies is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $17,800 and $20,200, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Req A1 Req A2 (12,740) (19,026) $ 4,160 $ 4,444 Req B Gross margin percentages Return-on-sales ratios Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) Atlanta % % Bostonarrow_forwardLechon Company provided the following data for the current year: Sales Cost of goods sold Expenses Depreciation Income tax expense The entity has two major reportable segments, A and B. An analysis revealed that P1,000,000 of the total depreciation expense and P2,000,000 of the expenses are related to general corporate activities. The remaining expenses and sales are directly allocable to segment activities according to the following percentages: Sales Cost of goods sold Expenses Depreciation P60,000,000 28,000,000 14,000,000 4,000,000 4,000,000 Segment A 40% 35 40 40 Segment B 45% Others 15% 15 20 15 50 40 45 What amount should be reported as net income of Segment A?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education