FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Pls complete required 1 and 2.

Thanks!

Transcribed Image Text:Homework i

Required 1 Required 2

Complete this question by entering your answers in the tabs below.

Year

external_browser=0&launchUrl=https%253A%252F%252Flms.mheducati... A

to

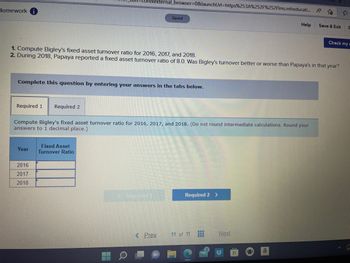

1. Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018.

2. During 2018, Papaya reported a fixed asset turnover ratio of 8.0. Was Bigley's turnover better or worse than Papaya's in that year?

2016

2017

2018

Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your

answers to 1 decimal place.)

Fixed Asset

Turnover Ratio

Saved

Repaired

< Prev.

Required 2 >

11 of 11

www

‒‒‒

Help

Next

a

Save & Exit S

Check my w

![nework

Saved

The following data were included in a recent Bigley.organization annual report (in millions):

2016

$164,910

16,600

E9-15 (Algo) Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts

Perspective [LO 9-7]

Required 1 Required 2

2015

$ 161,500

15,610

Complete this question by entering your answers in the tabs below.

< Prev

Net revenue

Net property, plant, and equipment

Required:

1. Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018.

2. During 2018, Papaya reported a fixed asset turnover ratio of 8.0. Was Bigley's turnover better or worse than Papaya's in that year?

11 of 11

Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your

answers to 1 decimal place.)

www

#

2017

$ 81,225

4,950

Next

F

Help

2018

$119, 119

9,280

a

Save & Exit

Check my](https://content.bartleby.com/qna-images/question/1506ec02-adda-4113-8c13-92d681b7a885/bb2e2e93-58c7-4ef5-acea-87a68e3be407/zswjvh5_thumbnail.jpeg)

Transcribed Image Text:nework

Saved

The following data were included in a recent Bigley.organization annual report (in millions):

2016

$164,910

16,600

E9-15 (Algo) Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts

Perspective [LO 9-7]

Required 1 Required 2

2015

$ 161,500

15,610

Complete this question by entering your answers in the tabs below.

< Prev

Net revenue

Net property, plant, and equipment

Required:

1. Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018.

2. During 2018, Papaya reported a fixed asset turnover ratio of 8.0. Was Bigley's turnover better or worse than Papaya's in that year?

11 of 11

Compute Bigley's fixed asset turnover ratio for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your

answers to 1 decimal place.)

www

#

2017

$ 81,225

4,950

Next

F

Help

2018

$119, 119

9,280

a

Save & Exit

Check my

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Settings - Password Manager X mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddlewar... AF Prin X M Question 4 - Chapter 7, Assign X Maps O Porter's Five Forc... Assignment 2 i [The following information applies to the questions displayed below.j Leach Incorporated experienced the following events for the first two years of its operations. Year 1: 1. Issued $16,000 of common stock for cash. 2. Provided $84,600 of services on account. 3. Provided $42,000 of services and received cash. 4. Collected $75,000 cash from accounts receivable. 5. Paid $44,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2: 1. Wrote off an uncollectible account for $950. 2. Provided $94,000 of…arrow_forwardO PowerPoint O from Towards a O Mail - Edjouline X E Content - ACG: X * CengageNOWv. x D (58) YouTube v2 cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < * * C WouTube O Maps ANKSHEET Entries for Notes Receivable Spring Designs & Decorators issued a 120-day, 4% note for $60,000, dated April 13 to Jaffe Furniture Company on account. Assume a 360-day year when calculating LANKSHEET interest. LGO a. Determine the due date of the note. LGO b. Determine the maturity value of the note. cl. Journalize the entry to record the receipt of the note by Jaffe Furniture. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank. 24 068 s: 912 items Previous Next 回习 9 O 11:49arrow_forwardNo chatgpt used i will give 5 upvotes typing pleasearrow_forward

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardu Online C (78) Wha X M Uh-oh! T X Accounti X M Inbox (2, x O SP2021 Answere x E3 My Hom x * Cengage x Bartleby x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10.. M Gmail D YouTube Fourth Homework O eBook 9. MC.12.09 Research and Development 10. MC.12.10 Instructions Chart Of Accounts General Journal 11. RE.12.01.BLANKSHEET Instructions 12. RE.12.02 Notting Hill Company incurred the following costs for R&D activities: 13. RE.12.03.BLANKSHEET Material used from inventory $15,000 14. RE.12.04.BLANKSHEET Equipment purchased (with cash) for R&D with no other use 85,000 Depreciation on building housing multiple R&D activities 10,000 15. RE.12.05.BLANKSHEET Wages and salaries paid to R&D employees 38,500 16. RE.12.06.BLANKSHEET Required: 17. RE.12.07.BLANKSHEET Prepare Notting Hill's journal entry(ies) to record its R&D. 18. RE.12.08 19. RE.12.09.BLANKSHEET 20. RE.12.10.BLANKSHEET 21. EX.12.01 22. EX.12.02.BLANKSHEET O…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education