FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

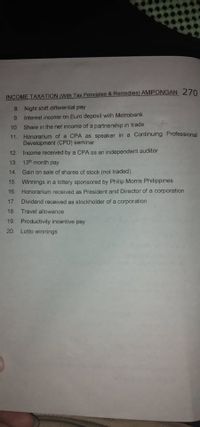

Transcribed Image Text:INCOME TAXATION (With Tax Principles & Remedies) AMPONGAN 270

8. Night shift differential pay

9.

Interest income on Euro deposit with Metrobank

10. Share in the net income of a partnership in trade

11.

Honorarium of a CPA as speaker in a Continuing Professional

Development (CPD) seminar

Income received by a CPA as an independent auditor

13. 13th month pay

12

14. Gain on sale of shares of stock (not traded)

15. Winnings in a lottery sponsored by Philip Morris Philippines

16. Honorarium received as President and Director of a corporation

17. Dividend received as stockholder of a corporation

18

Travel allowance

19. Productivity incentive pay

20. Lotto winnings

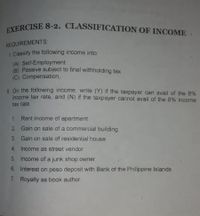

Transcribed Image Text:EXERCISE 8-2. CLASSIFICATION OF INCOME.

REQUIREMENTS:

I Classify the following income into

(A) Self-Employment

B) Passive subject to final withholding tax

(C) Compensation,

IL On the following income, write (Y) if the taxpayer can avail of the 8%

income tax rate, and (N) if the taxpayer cannot avail of the 8% income

tax rate

1.

Rent income of apartment

2 Gain on sale of a commercial building

3 Gain on sale of residential house

4. Income as street vendor

5 Income of a junk shop owner

6. Interest on peso deposit with Bank of the Philippine Islands

7. Royalty as book author

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haresharrow_forwardront Peragraph Styies Edting Senitty Now let's do a problem where we know the person's taxes and want to find their taxable income, and their AGI You may find the functions you determined in the question above helpha 6. Suppose someone paid $17,500 in taxes What could this person's adjusted gross income be? 1040 Linels) Description Amount 1 and Sb Wagen, salanes, and Sps Adjusted gross income (AGI) Standard deduction and exemption (singie. nondependent) Subtract line 5 trom line 4 Taxable income Total Tax (hom schedule) Elfective tax rate (tax asacentage of all income) 11a $12 200 11b $17.500 2019 Tax Schedule (NOT ued for HW- separate Tax Schedules previded wm Single Taxable Income Tax Brackets and Rates, 2019 If taxxable income is over- but not oer the tax i $0,700 $0,700 $39,475 584 200 $160,725 $204, 100 $30 475 $94.200 $160,725 $204.100 $610,300 10% of the amount over $0 $970 plus 12% of the amount over $0,700 $4,543 plus 22s of the amount over $39475 $14,382 plus 24 of the amount…arrow_forwardnkj.4arrow_forward

- Problem 1-42 (LO 1-4) Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $38,812, and Petra has W-2 income of $46,627. Use the appropriate Tax Tables and Tax Rate Schedules. Required: a. What is their tax liability using the Tax Tables? b. What is their tax liability using the Tax Rate Schedule? Note: Round your intermediate computations and final answers to 2 decimal places. a. Tax liability using Tax Tables b. Tax liability using Tax Rate Schedulearrow_forwardShow detailed solutionarrow_forwardDetermine the Income Taxes Responsibility for this taxpayers, remember to present procedure in any taxpayer. Taxpayer(s) Filing Status Income Itemized Deductions income Taxes LiabilityArturo Single $29,239 $2,000 ___________Belize HOH $53,129 $14,500 ___________Carmine Qualifying Widow 89,000 $12,490 ___________Family Rivas MFJ $139,000 $23,000 ___________arrow_forward

- Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee.arrow_forwardThe self-employment tax base is 100% of self-employment income (Schedule C net income). True or False True Falsearrow_forwardProblem 1-34 (LO 1-3) (Algo) Chuck, a single taxpayer, earns $77,100 in taxable income and $12,400 in interest from on investment in City of Heflin bonds. (Use the US tax.rate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Reg B Req C Req D What is his average tax rate? (Do not round intermediate calculations. Round total tax to nearest whole dollar amount.) Choose Numerator Choose Denominator Average Tax Rate Taxable income Total expense Total profit Total tax Total incomearrow_forward

- Taxpayers report taxable rental income and all deductible rental expenses on schedule c (form 1040) profit or loss from business. True or Falsearrow_forwardComputing Federal Income Tax Using the table (Refer to Figure 8-4 in the text.), determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: Marital Status Total Weekly Earnings Number of Allowances Amount of Withholding (a) S $364.80 2 (b) S 445.80 1 (c) M 493.40 3 (d) S 493.60 0 (e) M 702.70 5arrow_forwardWhich taxes are major taxes on income? That is, which taxes are normally paid in the form of deductions from a worker's paycheck? Major Tax Sc property tax Medicare tax income tax 1 Not a Major Tax Q A 2 ZI option WS # 3 X H command c E D S4 JAR 19 CRF +++ % 5 sales tax Search or type URL Social Security tax VT 6 GY B tv 7 H SHIVA UN* CO 8 J1 M 9 K(+ OH comarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education