FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

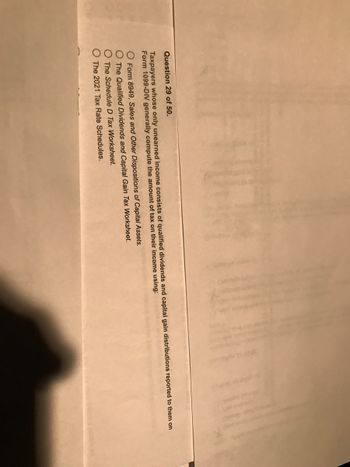

Transcribed Image Text:**Question 29 of 50**

Taxpayers whose only unearned income consists of qualified dividends and capital gain distributions reported to them on Form 1099-DIV generally compute the amount of tax on their income using:

- O Form 8949, Sales and Other Dispositions of Capital Assets.

- O The Qualified Dividends and Capital Gain Tax Worksheet.

- O The Schedule D Tax Worksheet.

- O The 2021 Tax Rate Schedules.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8-Which one of the following represents the tax payable? a. Tax payable is the balance of the total income still to be settled in cash b. Tax payable is the balance of the net income still to be settled in cash c. Tax payable is the balance of the tax liability still to be settled in cash d. Tax payable is the balance of the taxable income still to be settled in casharrow_forward1continue.. Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes. (f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes. (g)…arrow_forward1arrow_forward

- True or false: Income tax expense may be disclosed either on the income statement or in the notes to the financial statements.arrow_forwardProper tax planning for capital gains often involves controlling the _____ of the gain. Choose the correct answer. Question 28 options: income classification taxable amount timing carry forwardarrow_forward0 How are deferred tax assets and deferred tax liabilities reported in a classified balance sheet?arrow_forward

- Which of the following categories represent Deductions for AGIarrow_forward1.Explain the intake process to completing a tax return. using the form 13614-c, w2's, form 1099-R, Form SSA-1099, form 1099-c, Form W-2G, Form 1098-T Just explain for to process this thing all together.arrow_forwardThe tax law refers to gross income, yet the term gross income is not found on Form 1040. Explain.arrow_forward

- QUESTION 4 Which of the following allow a tax filer to legally reduce the amount of tax owed? Select all that apply. O A. The standard deduction. B. Tax returns. C. Tax evasion. D. Tax exemption. E. FICA taxes paid. F. Tax credits. G. Itemized deductions. QUESTION 5 Which of the following best describes taxable income? O A. The sum of your adjusted gross income and earned income tax credit. B. The sum of your wage income, unemployment benefits, and interest. C. The amount of income on which taxes were withheld by your employer. D. The amount of income you have after subtracting allowable deductions and exemptions.arrow_forwardA capital gains tax is levied on the sale of which of the following items? Choose all that apply. A. real estate B. income C. stocks D. gasolinearrow_forward! Required information Problem 12-45 (LO 12-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $191,000 salary working full time for Angels Corporation. Angels Corporation reported $444,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $191,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 12-45 Part a (Algo) a. Assuming the income allocated to Mason is qualified business income, what is Mason's deduction for qualified business income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education