FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

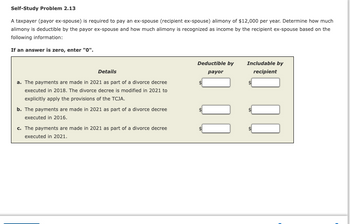

Transcribed Image Text:Self-Study Problem 2.13

A taxpayer (payor ex-spouse) is required to pay an ex-spouse (recipient ex-spouse) alimony of $12,000 per year. Determine how much

alimony is deductible by the payor ex-spouse and how much alimony is recognized as income by the recipient ex-spouse based on the

following information:

If an answer is zero, enter "0".

Details

a. The payments are made in 2021 as part of a divorce decree

executed in 2018. The divorce decree is modified in 2021 to

explicitly apply the provisions of the TCJA.

b. The payments are made in 2021 as part of a divorce decree

executed in 2016.

c. The payments are made in 2021 as part of a divorce decree

executed in 2021.

Deductible by

payor

Includable by

recipient

00

00

Expert Solution

arrow_forward

Step 1

| Serial no. | Deductible by payer | Includable by recipient |

| a | $0 | $0 |

| b | $12,000 | $12,000 |

| c | $0 | $0 |

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dora Burch files her 2020 income tax return on March 2, 2021. She receives a nil assessment on June 3, 2021. However, on December 28, 2021, she receives a reassessment indicating that she owes a substantial amount of additional tax. She would like to object to this reassessment. What is the latest date for her to file a notice of objection? (Ignore the effect of leap year if applicable.) Select one: O A. April 30, 2022. O B. March 2, 2022. O C. December 28, 2022. O D. March 28, 2022.arrow_forwardDetermine the amount of taxable income that should be reported by a cash-basis taxpayer in 2022 in each of the following independent cases: Required: a. A taxpayer completes $700 of accounting services in December 2022 for a client who pays for the accounting work in January 2023. b. A taxpayer is in the business of renting computers on a short-term basis. On December 1, 2022, she rents a computer for a $260 rental fee and receives a $650 deposit. The customer returns the computer and is refunded the deposit on December 20, 2022. c. Same facts as (b) except that the computer is returned on January 5, 2023. d. On December 18, 2022, a landlord rents an apartment for $625 per month and collects the first and last months' rent up front. It is customary that tenants apply the security deposit to their last month's rent upon moving out. e. An accountant agrees to perform $395 of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The…arrow_forwardA taxpayer who is married with $200,000 of joint income in 2024 and claiming the standard deduction of $29,200 owe $ 27,726 of total federal income taxes. True Falsearrow_forward

- Jackson and Ashley Turner (both 45 years old) are married and want to contribute to a Roth IRA for Ashley. In 2022, their AGI is $209,000. Jackson and Ashley each earned half of the income. Note: Leave no answers blank. Enter zero if applicable. a. How much can Ashley contribute to her Roth IRA if they file a joint return? (answer is not 6000)arrow_forwardWhich of the following payments may be considered alimony? A. cash payment B. Child support 500 month C. Property settlement D. Payment on former spouces estatearrow_forwardIdentify in which situation income was constructively received in 2022. Situation A taxpayer received a check on December 31, 2022. Deposited the check to their bank account on January 1, 2023. A taxpayer sold their home on December 20, 2022. Payment was received from the escrow company on January 5, 2023. A taxpayer's employer offers the taxpayer the option to receive their year-end bonus on either December 15, 2022 or January 15, 2023. The taxpayer chooses to defer it to January 15, 2023. A taxpayer who performs consulting services was informed by a client that a check for services they had performed was ready to be picked up on December 15, 2022. However, the taxpayer was on vacation and unable to pick it up until January 3, 2023. Was income constructively received? (Yes/No)arrow_forward

- Taxpayer started a calendar-year business on 1 August 2020. On that date, Taxpayer paid $9,600 in rent for the period 1 August 2020 through 31 July 2021. Determine the maximum amount that Taxpayer may deduct in 2020 under both the cash and accrual methods of accounting.arrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2022). In 2022, her net Schedule C income was $304,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part b (Algo) b. She sets up an individual 401(k).arrow_forwardLewis and Laurie are married and jointly own a home valued at $262,000. They recently paid off the mortgage on their home. The couple borrowed money from the local credit union in January of 2022. How much interest may the couple deduct in each of the following alternative situations? (Assume they itemize deductions no matter the amount of interest.) Note: Leave no answer blank. Enter zero if applicable. Required: The couple borrows $62,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds for purposes unrelated to the home. The couple pays $3,800 interest on the loan during the year, and the couple files a joint return. The couple borrows $154,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds to add a room to their home. The couple pays $6,300 interest on the loan during the year, and the couple files a joint…arrow_forward

- Faith, a single taxpayer, age 81, forgot to take her 2021 required minimum distribution (RMD) from her traditional IRA. Her account balance on December 31, 2020, was $240,000. What is her excess accumulations penalty? $24,000 $13,408 $6,704 $0arrow_forwardRequired information [The following information applies to the questions displayed below.] Hope is a self-employed taxpayer who turns 54 years old at the end of the year (2022). In 2022, her net Schedule C income was $130,000. This was her only source of income. This year, Hope is considering setting up a retirement plan. What is the maximum amount Hope may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. a. She sets up a SEP IRA. Maximum contributionarrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $314,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part a (Algo) a. She sets up a SEP IRA. Maximum contributionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education