FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

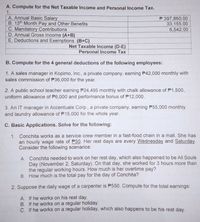

Transcribed Image Text:A. Compute for the Net Taxable Income and Personal Income Tax.

1.

A. Annual Basic Salary

B. 13th Month Pay and Other Benefits

C. Mandatory Contributions

D. Annual Gross Income (A+B)

E. Deductions and Exemptions (B+C)

P 397,860.00

33,155.00

6,542.00

Net Taxable income (D-E)

Personal Income Tax

B. Compute for the 4 general deductions of the following employees:

1. A sales manager in Kopimo, Inc., a private company, earning P42,000 monthly with

sales commission of P36,000 for the year.

2. A public school teacher earning P24,495 monthly with chalk allowance of P1,500,

uniform allowance of P6,000 and performance bonus of P12,000.

3. An IT manager in Accentuate Corp., a private company, earning P55,000 monthly

and laundry allowance of P15,000 for the whole year.

C. Basic Applications. Solve for the following:

1. Conchita works as a service crew member in a fast-food chain in a mall. She has

an hourly wage rate of P50. Her rest days are every Wednesday and Saturday.

Consider the following scenarios:

A. Conchita needed to work on her rest day, which also happened to be All Souls

Day (November 2, Saturday). On that day, she worked for 3 hours more than

the regular working hours. How much is her overtime pay?

B. How much is the total pay for the day of Conchita?

2. Suppose the daily wage of a carpenter is P550. Compute for the total earnings:

A. If he works on his rest day.

B. If he works on a regular holiday.

C. If he works on a regular holiday, which also happens to be his rest day.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haresharrow_forwardQuestion 21: For an employee who is paid monthly, completed the pre-2020 Form W-4, and claims 3 federal withholding allowances, $ subtracted from gross pay for withholding allowances prior to calculating the federal income tax withholding under the percentage method. would bearrow_forwardAmounts to Be Reported on Wage and Tax Statements (Form W-2) Gross Federal Income Social Security Medicare Employee Earnings Tax Withheld Tax Withheld Tax Withheld Arnett $ 8,250.00 $ 1,416.00 $ 495.00 $ 123.75 Cruz 57,600.00 9,996.00 3,456.00 864.00 Edwards 24,000.00 4,776.00 1,440.00 360.00 Harvin 6,000.00 1,070.00 360.00 90.00 Nicks 110,000.00 25,850.00 6,600.00 1,650.00 Shiancoe 116,000.00 26,000.00 6,960.00 1,740.00 Ward 7,830.00 1,314.00 469.80 117.45 Totals $ 329,680.00 $ 19,780.80 $ 4,945.20 Employer Payroll Taxes a. Social security…arrow_forward

- 1) The effect on the FICA Taxes Payable Account when a payment is made is called: a. Increase with a, CRb. Increase with a, DRc. Decrease with a DRd. Decrease with a, CR 2) From the options below, which of the following statements is true? a. Payroll Tax Expense increases on the credit side of the accountb. FICA Medicare Payable increases with a creditc. Federal Income Tax Withholding Payable decreases with a creditd. Employee Payroll Taxes withheld are recorded in Payroll Tax Expense 3) From the options below, identify the one that is NOT an example of internal control proceduresthat help prevent payroll fraud. a. Require mandatory vacations.b. Outsource Payroll Administration.c. Conduct periodic unannounced audits.d. Make sure only one person handles payroll functions. 4) Sally Carson has cumulative earnings of $89,900 and earns $6,500 during the current payperiod. If the FICA rate is 4.2% for Social Security, with a limit of $106,800, and 1.45% forMedicare, applied to all earnings,…arrow_forwardThe self-employment tax base is 100% of self-employment income (Schedule C net income). True or False True Falsearrow_forwardhow to figure out net pay ?arrow_forward

- Taxpayers report taxable rental income and all deductible rental expenses on schedule c (form 1040) profit or loss from business. True or Falsearrow_forwardsarrow_forwardComputing Federal Income Tax Using the table (Refer to Figure 8-4 in the text.), determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: Marital Status Total Weekly Earnings Number of Allowances Amount of Withholding (a) S $364.80 2 (b) S 445.80 1 (c) M 493.40 3 (d) S 493.60 0 (e) M 702.70 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education