FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

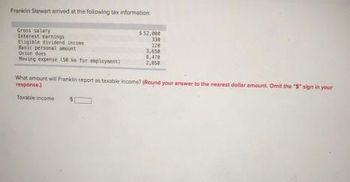

Transcribed Image Text:Franklin Stewart arrived at the following tax information:

Gross salary

Interest earnings

Eligible dividend income

Basic personal amount

Union dues

Moving expense (58 km for employment)

$ 52,00€

330

128

3,650

8,470

2,950

What amount will Franklin report as taxable income? (Round your answer to the nearest dollar amount. Omit the "S" sign in your

response)

Taxable income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manabhaiarrow_forwardUse the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability for the following taxpayers. Name Filing Status Taxable Income Tax Liability 10. Rua Head of Household $175,800 $36,554 11. Dylewski Married, Jointly $52,500 ANSWER$5,919 12. Williams Single $61,300 blank 2 13. Cabral Married, Separately $185,188 ANSWER$40,949.66arrow_forwardDogarrow_forward

- Single person (including head of household) If amount of wages (after subtracting withholding allowance) is: The amount of income tax withholding is: Not over $43 $0 Over– But not over– of excess over– $43 –$222.......$0.00 plus 10% –$43 $222 –$767.......$17.90 plus 15% –$222 $767 –$1,796....$99.65 plus 25% –$767 $1,796 –$3,700....$356.90 plus 28% –$1,796 $3,700 –$7,992....$890.02 plus 33% –$3,700 $7,992 –$8,025....$2,306.38 plus 35% –$7,992 $8,025 .................$2,317.93 plus 39.6% –$8,025 Using an $80 value for each exemption and the tax rate schedule above, what is Woods' federal income tax withholding? Round your answer to two decimal places.arrow_forwardComputing Federal Income Tax Using the table (Refer to Figure 8-4 in the text.), determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: Marital Status Total Weekly Earnings Number of Allowances Amount of Withholding (a) S $364.80 2 (b) S 445.80 1 (c) M 493.40 3 (d) S 493.60 0 (e) M 702.70 5arrow_forward1. Who assigns the SUTA tax rate to an employer? Answer: A. The Internal Revenue Service B. The state in which the employer is located C. The Social Security Administration D. The American Payroll Association 2. What is the due date for the first quarter FUTA tax? Answer: A. April 30 B. March 30 C. April 15 D. None of these options 3. Match each tax with its associated feature. SUTA Self-employment Social Security and Medicare The employer presently matches the amount employees pay. If net SE income is below $400, no tax is due. The number of laid-off employees may affect it.arrow_forward

- Question 2: Based on the wage-bracket method, the federal income tax withholding for an employee who files as Single, is paid weekly, completed the current Form W-4, has one job, and whose adjusted wage amount is $713 is $arrow_forwardNeed helparrow_forward13. Pat generated self-employment income in 2019 of $76,000. The self-employment tax is: a. b. C. d. $0. $5,369.23. $10,738.46. $11,628.00.arrow_forward

- Complete the following table with the information provided. Employee, with your deductions allowed Gross income Social Security Tax (6.20%) Medical care contribution (1.45%) Income tax Other deductions Net income 8 Stream (0) $ 735 (12%) $ 25 9 Bravo (1) $ 675 (11%) $ 12 10 Colon (2) $ 895 (10%) -0- eleven Diaz (3) $ 580 (9%) $ 5 12 Figueroa (4) $ 610 (7%) -0- Determine: Social Security Contribution (FICA) Medical care contribution (Medicare - FICA) Income tax Net incomearrow_forwardAll the listed benefits paid by an employer are required to be included in an employee's income for a tax year except one. Which one? Question 4 options: a) Tuition fees for training that relates to employer's work b) Medical expenses of an employee c) Forgiveness of employee debt d) Cost of life insurancearrow_forwardSee picture for details.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education