EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Solve this problem

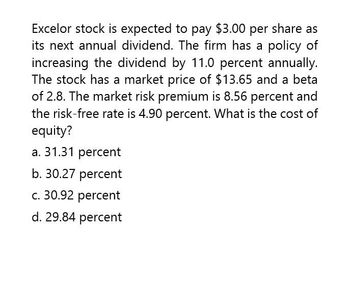

Transcribed Image Text:Excelor stock is expected to pay $3.00 per share as

its next annual dividend. The firm has a policy of

increasing the dividend by 11.0 percent annually.

The stock has a market price of $13.65 and a beta

of 2.8. The market risk premium is 8.56 percent and

the risk-free rate is 4.90 percent. What is the cost of

equity?

a. 31.31 percent

b. 30.27 percent

c. 30.92 percent

d. 29.84 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock is trading at $80 per share. The stock is expected to have a yearend dividend of $4 per share (D1 = $4), and it is expected to grow at some constant rate, g, throughout time. The stock’s required rate of return is 14% (assume the market is in equilibrium with the required return equal to the expected return). What is your forecast of gL?arrow_forwardWhat is the cost of equity?arrow_forwardBarton Industries estimates its cost of common equity by using three approaches: the CAPM, the band - yield - plus - nisk - premium approach, and the DCF model. Burton expects next year's annual dividend, D₁, to be $1.70 and it expects dividends to grow at a constant rate g = 5,4% The firm's current common stock price, Po, is $20.00. The current risk-free rate, FRF, = 4.9% the market risk premium, RPM = 6.3%, and the firm's stuck has a current beta, b, = 1.40. Assume that the firm's cast of debt, rd is 10.78%. The firm uses a 3.3% risk premium when arriving at a ballpark estimate of its cost of equity using the bund-vield-risk-premium approach. What is the firm's cost of equity using each of these three approaches? CAPM cost of equity. Band yield plus visle premium: DCF cost of equity: % 1. %arrow_forward

- Barton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.10 and it expects dividends to grow at a constant rate g = 4.4%. The firm's current common stock price, P0, is $25.00. The current risk-free rate, rRF, = 4.7%; the market risk premium, RPM, = 6.0%, and the firm's stock has a current beta, b, = 1.15. Assume that the firm's cost of debt, rd, is 11.00%. The firm uses a 3.0% risk premium when arriving at a ballpark estimate of its cost of equity using the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: % What is your best estimate of the firm's cost of equity?arrow_forwardBarton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.40 and it expects dividends to grow at a constant rate gL = 5.8%. The firm's current common stock price, P0, is $21.00. The current risk-free rate, rRF, = 4.8%; the market risk premium, RPM, = 6.1%, and the firm's stock has a current beta, b, = 1.2. Assume that the firm's cost of debt, rd, is 10.57%. The firm uses a 4.1% risk premium when arriving at a ballpark estimate of its cost of equity using the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Do not round intermediate calculations. Round your answers to two decimal places. CAPM cost of equity: % Bond-Yield-Plus-Risk-Premium: % DCF cost of equity: % If you are equally confident of all three methods, then what is the best estimate of the firm’s cost of…arrow_forwardDyer Furniture is expected to pay a dividend of D1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.85, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is Dyer's current stock price? Select the correct answer. a. $16.23 b. $16.70 c. $17.17 d. $15.29arrow_forward

- Dyer Furniture is expected to pay a dividend of D1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 2.00, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is Dyer's current stock price? Select the correct answer. a. $13.89 b. $12.83 c. $13.36 d. $11.77 e. $12.30 just give me the logic behind this dont give me the answer directlyarrow_forwardSuppose the risk-free rate is 2.10% and an analyst assumes a market risk premium of 5.90%. Firm A just paid a dividend of $1.26 per share. The analyst estimates the ẞ of Firm A to be 1.23 and estimates the dividend growth rate to be 4.57% forever. Firm A has 292.00 million shares outstanding. Firm B just paid a dividend of $1.53 per share. The analyst estimates the ẞ of Firm B to be 0.87 and believes that dividends will grow at 2.06% forever. Firm B has 197.00 million shares outstanding. What is the value of Firm B? Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forwardCrisp Cookware's common stock is expected to pay a dividend of $2.5 a share at the end of this year (D1 = $2.50); its beta is 0.6. The risk-free rate is 2.8% and the market risk premium is 6%. The dividend is expected to grow at some constant rate, gL, and the stock currently sells for $50 a share. Assuming the market is in equilibrium, what does the market believe will be the stock's price at the end of 3 years (i.e., what is )? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Company Z is expected to pay a dividend of D1 = $2.20 per share at the end of the year, and that dividend is expected to grow at a constant rate of 4.00% per year in the future. The company's beta is 1.3, the Market Risk Premium is 6.00%, and the risk-free rate is 3.00%. What is the company's current stock price? Group of answer choices 32.35 35.59 27.50 36.67 55.00arrow_forwardAssume that a firm can issue preferred stock that has a $70 par value and pays a 15.0% annual dividend each year. The firm's investment bankers believe that investors will be willing to pay $84.00 per share and that flotation costs will be equal to $9.97 per share. Given this information, determine the difference between the investor's required rate of return, and the firm's cost of preferred stock. 2.541% O 2.224% O 1.963% 1.398% 1.683%arrow_forwardSuppose the risk-free rate (RF) is 3.64% and an analyst assumes a market risk premium (Rm - Rf) of 7.50% . Firm A just paid a dividend of $1.05 per share (i.e. 1.05). The analyst estimates the beta of Firm A to be 1.49 and estimates the dividend growth rate to be 4.13% forever. Firm A has 2.2 million shares outstanding . What is the market value of the equity of Firm A?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning