Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please do fast

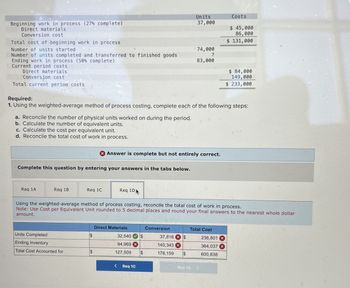

Transcribed Image Text:Beginning work in process (27% complete)

Direct materials

Conversion cost

Units

37,000

Total cost of beginning work in process

Number of units started

74,000

Number of units completed and transferred to finished goods

Ending work in process (50% complete)

?

83,000

Current period costs

Direct materials

Conversion cost

Total current period costs

Costs

$ 45,000

86,000

$ 131,000

$ 84,000

149,000

$233,000

Required:

1. Using the weighted-average method of process costing, complete each of the following steps:

a. Reconcile the number of physical units worked on during the period.

b. Calculate the number of equivalent units.

c. Calculate the cost per equivalent unit.

d. Reconcile the total cost of work in process.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Req 1C

Req 1D

Using the weighted-average method of process costing, reconcile the total cost of work in process.

Note: Use Cost per Equivalent Unit rounded to 5 decimal places and round your final answers to the nearest whole dollar

amount.

Direct Materials

Conversion

Total Cost

Units Completed

$

32,540

$

Ending Inventory

Total Cost Accounted for

$

94,969

127,509 $

37,816 $

140,343

236,801

364,037 X

178,159 $

600,838

<

Req 1C

Req 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Similar questions

- ssume the following information: Milling Department Materials Conversion Total Cost of beginning work in process inventory $ 10,000 $ 15,000 $ 25,000 Costs added during the period 291,600 394,500 686,100 Total cost $ 301,600 $ 409,500 $ 711,100 Assume the equivalent units of production for materials and conversion, when using the weighted-average method, are 5,200 units and 5,000 units, respectively. If the equivalent units in ending work in process inventory for materials and conversion are 400 units and 200 units, respectively, then what is the total cost of ending work in process for the Milling Department?arrow_forwardHelp5arrow_forwardGiven the following information, assuming all materials are added at the beginning of the process, calculate the total cost to be assigned to ending work in process for the period. Direct Material Conversion Total Cost per equivalent unit $3.00 $2.50 Units completed and transferred out 48,000 Units in work in process, ending, 70% complete 20,000 Multiple choice question. $95,000 $359,000 $144,000 $264,000arrow_forward

- Assume the following information: Milling Department Units Percent Complete Materials Conversion Beginning work in process inventory 200 40% 30% Units started into production during March 6,200 Units completed during the period and transferred to the next department 5,800 100% 100% Ending work in process inventory 600 70% 60% Milling Department Materials Conversion Cost of beginning work in process inventory $ 10,000 $ 15,000 Costs added during the period 292,000 385,000 Total cost $ 302,000 $ 400,000 Using the weighted-average method, the total cost of the units completed during the period and transferred out to the next department with respect to materials is closest to:arrow_forwardAssume the following information: Milling Department Units Percent Complete Materials Conversion Beginning work in process inventory 200 40% 30% Units started into production during March 6,200 Units completed during the period and transferred to the next department 5,800 100% 100% Ending work in process inventory 600 70% 60% Milling Department Materials Conversion Cost of beginning work in process inventory $ 10,000 $ 15,000 Costs added during the period 292,000 385,000 Total cost $ 302,000 $ 400,000 Using the weighted-average method, the total cost of the ending work in process inventory with respect to materials is closestarrow_forwardAssume the following information: Milling Department Units Percent Complete Materials Conversion Beginning work in process inventory 200 40% 30% Units started into production during March 6,200 Units completed during the period and transferred to the next department 5,800 100% 100% Ending work in process inventory 600 70% 60% Milling Department Materials Conversion Cost of beginning work in process inventory $ 10,000 $ 15,000 Costs added during the period 284,000 385,000 Total cost $ 294,000 $ 400,000 Using the weighted-average method, the cost per equivalent unit for materials is closest toarrow_forward

- Assume the following information: Percent Complete Milling Department Units Materials Conversion Beginning work in process inventory Units started into production during March 200 40% 30% 6,200 Units completed during the period and transferred to the next department 5,800 100% 100% Ending work in process inventory 600 70% 60% Milling Department Materials Conversion Cost of beginning work in process inventory $ 10,000 $ 15,000 Costs added during the period 287,000 385,000 Total cost $ 297,000 $ 400,e00 Using the weighted-average method, the total cost of the units completed during the period and transferred out to the next department with respect to materials is closest to: Multiple Cholce $276,950. $275,536. $276,386. $274.285.arrow_forwardAssume the following information: Materials $ 10,000 291,600 $301,600 Conversion $15,000 387,000 $ 402,000 Milling Department Total Cost of beginning work in process inventory Costs added during the period $ 25,000 678,600 $703,600 Total cost ts 00:13:14 Assume the equivalent units of production for materials and conversion, when using the weighted-average method, are 5,200 units and 5,000 units, respectively. If the equivalent units in ending work in process inventory for materials and conversion are 400 units and 200 units, respectively, then what is the total cost of ending work in process for the Milling Department? Multiple Choice $29,280 $59,280 $49.280arrow_forwardGiven the following information, calculate the direct materials equivalent units for the period (assume all materials are added at the beginning of the process): % Complete as to Conversion costs Beginning work in process 15,000 units 25% Ending work in process 20,000 units 70% Units started during the period 53,000 units Units completed and transferred out 48,000 units Multiple choice question. A. 62,000 B. 50,000 C. 68,000 D. 42,000arrow_forward

- Complete this production cost report: Enter all amount as positive values. If required round "Cost per unit" answers to two decimal place. Production Cost Report Beginning inventory 20,000 Started during the month 74,000 Total units to account for Completed and transferred out 70,000 Ending work in process Total units to account for Work in process completion percent 100% 20% Materials Units Conversion Units Total Units Completed and transferred out 70,000 70,000 70,000 Ending work in process Total units to account for Materials Conversion Total Costs to account for $4,000 $17,000 $21,000 Beginning work in process Transferred in 35,360 59,560 24,200 Incurred during the period $4 $4 Total costs to account for Equivalent units Previous Next %24arrow_forwardTransferred-In Cost Golding's finishing department had the following data for July: Line Item Description Transferred-In Materials Conversion Units transferred out 60,000 60,000 60,000 Units in EWIP 15,000 15,000 9,000 Equivalent units 75,000 75,000 69,000 Costs: Work in process, July 1: Transferred-in from fabricating $2,100 Materials 1,500 Conversion costs 3,000 Total $6,600 Current costs: Transferred-in from fabricating $30,900 Materials 22,500 Conversion costs 45,300 Total $98,700 Required: 1. Calculate unit costs for the following categories: transferred-in, materials, and conversion. Round your answers to the nearest cent. Line Item Description Cost Unit transferred-in cost $fill in the blank 1 Unit materials cost $fill in the blank 2 Unit conversion cost $fill in the blank 3 2. Calculate total unit…arrow_forwardAssume the following information pertaining to Star Company: Prime costs $ 198,500 Conversion costs 228,000 Direct materials used 87,450 Beginning work in process 101,150 Ending work in process 82,400 Direct labor used is calculated to be:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College