Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

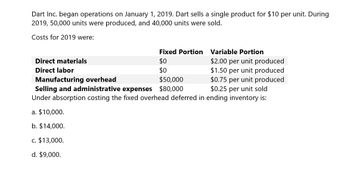

Transcribed Image Text:Dart Inc. began operations on January 1, 2019. Dart sells a single product for $10 per unit. During

2019, 50,000 units were produced, and 40,000 units were sold.

Costs for 2019 were:

Direct materials

Direct labor

Manufacturing overhead

Fixed Portion

Variable Portion

$0

$2.00 per unit produced

$0

$1.50 per unit produced

$50,000

$0.75 per unit produced

$0.25 per unit sold

Selling and administrative expenses $80,000

Under absorption costing the fixed overhead deferred in ending inventory is:

a. $10,000.

b. $14,000.

c. $13,000.

d. $9,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardWana ansarrow_forward

- Dart Inc. began operations on January 1, 2019. Dart sells a single product for $10 per unit. During 2019, 50,000 units were produced, and 40,000 units were sold. Costs for 2019 were: Direct materials Direct labor Manufacturing overhead Fixed Portion Variable Portion $0 $2.00 per unit produced $0 $1.50 per unit produced $50,000 Selling and administrative expenses $80,000 Under absorption costing, the total period costs are: a. $90,000. b. $50,000. $0.75 per unit produced $0.25 per unit sold c. $80,000. d. $130,000.arrow_forwardUnder absorption costingarrow_forwardEnding Inventotyarrow_forward

- TikTokElectronics manufactures an aluminium fibre tripod model“TRI-X” which sells for $1,600.The production cost computed per unit under traditional costing for each model in 2019was as follows: Traditional Costing TRIX Direct Materials $700 Direct Labour($20/hour) $120 Manufacturing overhead($38 per DLH) $228 Total per unit cost $1,048 In 2019, TikTokElectronics manufactured 26,000units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTokElectronics management accountant to prepare an analysis using activity-based costing (ABC). The management accountant accumulates the following information…arrow_forwardX Co. Ltd. produces three types of products A, B and C and keeps accounts for Process I, Process II and Process III. Following statements show the relative importance of each type of product in each process : Process I Points Process II Points Process III Points Product A Product B 2 4 2 4 2 1 Product C 8 3 2 Costs for each process for March, 2019 are as follows : Process I Process II $ 9,000 3,000 5,100 Process III $ 9,000 1,800 2,400 Total Materials Labour Overheads 12,000 4,200 3,000 $ 30,000 9,000 10,500 19,200 17,100 13,200 49,500 Production during the period : Product A 600 units ; Product B 300 units ; Product C 900 units. You are required to- (a) prepare a statement showing weighted average production for each process and (b) compute the cost for each type of product.arrow_forwardManagerial Accountingarrow_forward

- Broha Company manufactured 1,500 units of its only product during 2019. The inputs for this production are as follows: 450 pounds of Material A at a cost of $1.50 per pound 300 pounds of Material H at a cost of $2.75 per pound 300 direct labor hours at $20 per hour The firm manufactured 1,800 units of the same product in 2018 with the following inputs: 500 pounds of Material A at a cost of $1.20 per pound 360 pounds of Material H at a cost of $2.50 per pound 400 direct labor hours at $18 per hour Round all calculations to 2 significant digits. The total productivity ratio in 2018 is:arrow_forwardNuvoview Manufacturing uses a normal cost system and had the following data available for 2019: Direct materials purchased on account $145,000 Direct materials requisitioned 88,000 Direct labor cost incurred 127,000 Factory overhead incurred 148,000 Cost of goods completed 299,000 Cost of goods sold 250,000 Beginning direct materials inventory 34,000 Beginning WIP inventory 70,000 Beginning finished goods inventory 55,000 Overhead application rate (% DL costs $) 130% Which of the following Answers below best fits in each black space? The ending balance of works in process inventory is________ A: Beginning direct materials inventory B: Beginning works in process inventory C: Cost of goods complete D: Cost of goods sold E: Direct labor incurred F: Direct materials purchased…arrow_forwardMr. Mohammed furnishes the following data relating to the manufacture of a standard product during the month of April 2019. Raw materials consumed OMR 296000 Direct labour charges OMR 67800 Machine hour worked 21000 Machine hour rate OMR 3.5 Administrative overheads 25% on works cost Selling and distribution expenses OMR 0.60 per unit Units Produced 18500 Units Units Sold 16000 at OMR 6.4 per unit You are required to prepare a cost sheet from the above, showing: (a)The cost of production per unit. (b) Profit per unit sold and (c) Profit for the period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning