Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

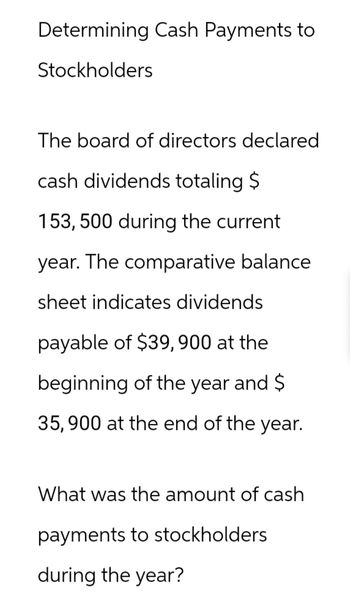

Transcribed Image Text:Determining Cash Payments to

Stockholders

The board of directors declared

cash dividends totaling $

153, 500 during the current

year. The comparative balance

sheet indicates dividends

payable of $39,900 at the

beginning of the year and $

35,900 at the end of the year.

What was the amount of cash

payments to stockholders

during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The board of directors declared cash dividends total $336,000 during the year. The comparative balance sheet indicated dividends payable of $92,000 at the beginning of the year. What was the amount of cash payments to stockholders during the year?arrow_forwardThe board of directors declared cash dividends total $168,000 during the year. The comparative balance sheet indicated dividends payable of $46,000 at the beginning of the year and $42,000 at the end of the year. What was the amount of cash payments to stockholders during the year?arrow_forwardThe board of directors declared cash dividends totaling $223,700 during the current year. The comparative balance sheet indicates dividends payable of $53,700 at the beginning of the year and $48,300 at the end of the year. What was the amount of cash payments to stockholders during the year?fill in the blank 1 of 1$arrow_forward

- The board of directors of Rinetti Spagettie Co. declared cash dividends totaling $375,000 and a stock dividend valued at $155,000 during the current year. The comparative balance sheet indicates dividends payable of $56,000 at the beginning of the year and $74,000 at the end of the year. What was the amount of cash payments the company made to stockholders during the year?arrow_forwardCash dividends of $79,384 were declared during the year. Cash dividends payable were $10,045 at the beginning of the year and $15,078 at the end of the year. The amount of cash for the payment of dividends during the year isarrow_forwardComparative statements of shareholders' equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2021, 2022, and 2023. ANACONDA INTERNATIONAL CORPORATION Statements of Shareholders' Equity For the Years Ended Dec. 31, 2021, 2022, and 2023 ($ in millions) Preferred Balance at January 1, 2021 Sale of preferred shares Sale of common shares Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 Retirement of shares Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a dividend Net income Balance at December 31, 2022 Common stock dividend Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2023 Required: Stock $10 par Common Stock $1 par Additional Paid-In Retained Total Shareholders' Capital Earnings Equity 85 680 1,750 2,515 20 980 8 64 1,000 72 (2) (2) (19) (19) 290 290 20 93 1,724 2,019 3,856 (7) (56) (15) (78) (2) (2) (23) (23) 10 (10)…arrow_forward

- The following information was taken from the accounting records of ATLANTA Company for the year ended December 31, 2021: Net income during the year, P2,250,000Proceeds from the issuance of preference shares, P4,000,000Dividends paid on preference shares, P400,000Bonds payable converted to ordinary shares, P2,000,000Payment for purchase of machinery, P500,000Proceeds from sale of plant building, P1,200,000Retirement of bonds payable at face value, P2,500,0002% bonus issue on ordinary shares, P300,000Purchase of ordinary treasury shares, P120,000Payment for the purchase of debt securities at amortized cost, P450,000Gain on sale of plant building, P200,000Depreciation expense, P188,000Doubtful accounts expense, P87,000Increase in accounts receivable, P325,000Decrease in merchandise inventory, P129,000Increase in investments in equity securities at FVTPL, P440,000Increase in accounts payable, P90,000Decrease in accrued expenses, P225,000Increase in income tax payable, P117,000 How much is…arrow_forwardVishuarrow_forwardA summary of the transactions affecting the stockholders’ equity of Strait Corporation during thecurrent year follows: Prior period adjustment (net of income tax benefit) . . . . . . . . . . . . . . . . . . . . . . . . $ (80,000)Issuance of common stock: 10,000 shares of $10 par valuecapital stock at $34 per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 340,000Declaration and distribution of 5% stock dividend (6,000 shares,market price $36 per share) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (216,000)Purchased 1,000 shares of treasury stock at $35 . . . . . . . . . . . . . . . . . . . . . . . . . (35,000)Reissued 500 shares of treasury stock at a price of $36 per share . . . . . . . . . . . 18,000Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 845,000Cash dividends declared . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .…arrow_forward

- Shown as follows are the amounts from the stockholders' equity section of the balance sheets of Wasson Corporation for the years ended December 31, 2020 and 2021. Stockholders' equity: Capital Stock Retained Earnings Total stockholders' equity a. b. 2021 2020 $50,000 $30,000 200,000 180,000 $250,000 $210,000 Calculate the amount of additional investment that the stockholders made during 2021. Assuming that the corporation declared and paid $15,000 in dividends during 2021, calculate the amount of net income earned by the corporation during 2021. c. Explain the significance of the $200,000 balance of retained earnings at December 31, 2021.arrow_forwardCc. 215.arrow_forwardMarkus Company's common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 1,095,000 $ 635,100 $ 459,900 $ 313,875 $ 15,500 $ 208,862 Accounts receivable turnover Average collection period Answer is complete but not entirely correct. 13.62 26.76 days Ending Balance $ 49,000 $ 92,000 $ 76,300 $ 217,300 $ 801,000 $ 85,500 $ 206,000 $ 165,000 $ 595,000 $ 801,000 Beginning Balance $ 44,200 $ 68,700 $ 92,000 $ 204,900 $ 875,400 Foundational 14-9 (Algo) 9. What is the accounts receivable turnover and the average collection…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,