FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

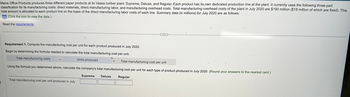

Transcribed Image Text:Maine Office Products produces three different paper products at its Vaasa lumber plant: Supreme, Deluxe, and Regular. Each product has its own dedicated production line at the plant. It currently uses the following three-part

classification for its manufacturing costs: direct materials, direct manufacturing labor, and manufacturing overhead costs. Total manufacturing overhead costs of the plant in July 2020 are $190 million ($18 million of which are fixed). This

total amount is allocated to each product line on the basis of the direct manufacturing labor costs of each line. Summary data (in millions) for July 2020 are as follows:

(Click the icon to view the data.)

Read the requirements.

Requirement 1. Compute the manufacturing cost per unit for each product produced in July 2020.

Begin by determining the formula needed to calculate the total manufacturing cost per unit.

Total manufacturing costs

Units produced

= Total manufacturing cost per unit

Using the formula you determined above, calculate the company's total manufacturing cost per unit for each type of product produced in July 2020. (Round your answers to the nearest cent.)

Total manufacturing cost per unit produced in July

Supreme

Deluxe

Regular

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2) Minnesota Office Products (MOP) produces three different paper products at its Vaasa lumber plant: Supreme, Deluxe, and Regular. Each product has its own dedicated production line at the plant. It currently uses the following three-part classification for its manufacturing costs: direct materials, direct manufacturing labor, and manufacturing overhead costs. Total manufacturing overhead costs of the plant in July 2011 are $150 million ($15 million of which are fixed). This total amount is allocated to each product line on the basis of the direct manufacturing labor costs of each line. Summary data (in millions) for July 2011 are as follows: Supreme Deluxe Regular Direct material costs $ 89 $ 57 $ 60 Direct manufacturing labor costs $ 16 $ 26 $ 8 Manufacturing overhead costs $ 48 $ 78 $ 24 Units produced 125 150 140 a. Compute the manufacturing cost per unit for each product produced in July 2011. b. Suppose that in August 2011, production was 150 million units of Supreme, 190…arrow_forwardCarica Company is a manufacturer with two production departments (Machining andAssembly) as well as two support departments (Materials Requisitions and Utility Services).For the last quarter of 2020, Carica’s cost records indicate the following: Required:1. Allocate the two support departments’ costs to the two operating departments using thefollowing methods: a. Direct method b. Step-down method (allocate MR first) c. Step-down method (allocate US first) d. The Algebraic method. 2. Compare and explain differences in the support-department costs allocated to eachproduction department. 3. What approaches might be used to decide the sequence in which to allocate supportdepartments when using the step-down method?arrow_forwardCarica Company is a manufacturer with two production departments (Machining andAssembly) as well as two support departments (Materials Requisitions and Utility Services).For the last quarter of 2020, Carica’s cost records indicate the following: Required:1. Allocate the two support departments’ costs to the two operating departments using thefollowing methods:a. Direct method b. Step-down method (allocate MR first) c. Step-down method (allocate US first) d. The Algebraic method.arrow_forward

- Compute for the total Factory overhead rate of G Department, if the company uses the step method in allocating service department costs and distributes the cost of Department U first, Department V second and finally Department W. The producing departments uses the following bases: Department H, 100,000 direct labor hours; and Department G, 195,000 direct labor hours. The Madalilangko Ink Company prepared the following table for the year 2019: Production Service Departments Departments H G U V W Rent 250,000 770,000 15,000 14,500 7,000 Repairs 100,000 120,500 23,000 30,000…arrow_forwardRakotan Co establishes the following standards for the costs of 1 unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Table 1 attached During December 2020, Rakotan Co purchased 30,000 kg of direct material at a total cost of $246,000. The total wages for December were $260,000, 75% of which were for direct labor. Wesley Co manufactured 9,500 units of product during December 2020, using 28,400 kg of the direct material purchased in December and 18,900 direct-labor hours. Actual variable and fixed overhead cost were $200,000 and $150,000, respectively. The scheduled production for the month was 10,000 units. Table 2 attached Assume that the rest of the variances had been calculated and remarked correctly. For each of the variances on the list above : 1. Provide a brief explanation of the causes of variance 2. State who is responsible for the variancearrow_forwardMichael Scott Paper Co. uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required.At the beginning of 2020, the company expected to incur the following:Michael Scott Paper Co.Beginning of 2020 Manufacturing overhead costs $1,001,910 Direct labor costs $1,512,800 Number of Machine hours to be used 73,400 At the end of 2020, the company had actually incurred:Michael Scott Paper Co.End of 2020 Direct labor costs $1,219,700 Depreciation on manufacturing plant equipment $596,400 Property taxes on plant $39,600 Sales Salaries $28,400 Delivery drivers wages $25,600 Plant janitor's wages $17,100 Number of Machine hours actually used 65,700 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rate. Total estimated overhead cost ? Total estimated quantity of the overhead allocation base =…arrow_forward

- Aaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $760,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 16,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) OA. $1.52 per labor hour OB. $100.00 per machine hour OC. $152.00 per machine hour O D. $31.25 per labor hourarrow_forwardHammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: The Deluxe and the Regular. At the beginning of the year 2019, the following data were prepared for this plant: Deluxe Regular Quantity 20 000 80 000 Selling price $90 $75 Unit direct cost $53 $48 In addition, the following information was provided so that overhead costs could be assigned to each product: Activity name Activity Cost Activity driver Deluxe Regular Set-up $200,000 Number of set-up 3 000 5 000 Machining 800,000 Machine hours 10 000 30 000 Engineering 600,000 Engineering hours 100 000 50 000 Packing 100,000 Packing orders 1 000 4 000 Total overhead costs $1,700,000 Required: Calculate the production overhead cost allocated to each product in 2019 using machine-hours as the cost driver (traditional costing system). Calculate the…arrow_forwardHill Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine hours in the Machining Department and on the basis of direct labor hours in the Assembly Department. At the beginning of 2020, the following estimates were provided for the coming year: Direct labor hours Machine hours Direct labor cost Manufacturing overhead costs Machining Direct labor hours Machine hours Direct material cost Direct labor cost 10,000 DLH 100,000 MH $80,000 $250,000 The accounting records of the company show the following data for Job # 846: Machining 50 DLH 170 MH Assembly 90,000 DLH 5,000 MH $2,700 $400 $720,000 $360,000 Assembly 120 DLH 10 MH $1,600 $900 4 Required: 1. Compute the manufacturing overhead allocation rate for each department. 2. Compute the total cost of Job #846. 3. Provide possible reasons why Hill Manufacturing uses two different cost allocation rates.arrow_forward

- XYZ Motors Corporation has identified activity centers to which overhead costs are assigned. The cost pool amounts for these centers and their selected cost drivers for 2018 are as follows: Activity Center - Utilities: Cost - P600,000 Cost Driver - 30,000 machine hours Activity Center - Scheduling sand setups Cost - P546,000 Cost Driver - 390 setups Activity Center - Material handling Cost - P1,280,000 Cost Driver - 800,000 kilos of materials The company's products and other operating statistics are as follows: Product A: Direct costs - P40,000 Machine hours - 15,000 Number of setups - 65 Kilos of material - 250,000 Number of units produced - 20,000 Direct labor hours - 16,000 Product B: Direct costs - P40,000 Machine hours - 5,000 Number of setups - 190 Kilos of material - 150,000 Number of units produced - 10,000 Direct labor hours - 9,000 Product C: Direct costs - P45,000 Machine hours - 10,000 Number of setups - 135 Kilos of material - 400,000 Number of units produced -…arrow_forwardAssign the total 2020 manufacturing overhead costs to the two products using activity based costing and determine the overhead cost per unit. (round to 2 decimal places, e.g.12.25)arrow_forwardSuperior Fender uses a standard cost system and provide the following informationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education