Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Determine the correct inventory amount to be reported in Kwok's 2018 balance sheet.

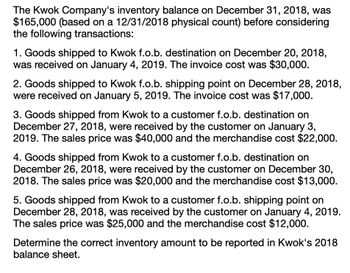

Transcribed Image Text:The Kwok Company's inventory balance on December 31, 2018, was

$165,000 (based on a 12/31/2018 physical count) before considering

the following transactions:

1. Goods shipped to Kwok f.o.b. destination on December 20, 2018,

was received on January 4, 2019. The invoice cost was $30,000.

2. Goods shipped to Kwok f.o.b. shipping point on December 28, 2018,

were received on January 5, 2019. The invoice cost was $17,000.

3. Goods shipped from Kwok to a customer f.o.b. destination on

December 27, 2018, were received by the customer on January 3,

2019. The sales price was $40,000 and the merchandise cost $22,000.

4. Goods shipped from Kwok to a customer f.o.b. destination on

December 26, 2018, were received by the customer on December 30,

2018. The sales price was $20,000 and the merchandise cost $13,000.

5. Goods shipped from Kwok to a customer f.o.b. shipping point on

December 28, 2018, was received by the customer on January 4, 2019.

The sales price was $25,000 and the merchandise cost $12,000.

Determine the correct inventory amount to be reported in Kwok's 2018

balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardAt December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forwardThe following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forward

- Goods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?arrow_forwardThe following items were included in Venicio Corporations inventory account on December 31, 2019: What amount should Venicio report as inventory at December 31, 2019? a. 21,000 b. 20,400 c. 26,000 d. 35,000arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forward

- Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of the merchandise sold on October 29, and (c) the inventory on October 31.arrow_forwardBeginning inventory, purchases, and sales for Item Foxtrot are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on March 27 and (b) the inventory on March 31.arrow_forward

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forwardBeginning inventory, purchases, and sales for Item Gidget are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub