FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

account inventry

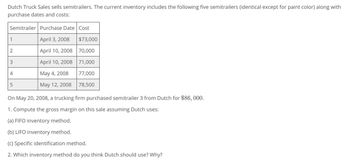

Transcribed Image Text:Dutch Truck Sales sells semitrailers. The current inventory includes the following five semitrailers (identical except for paint color) along with

purchase dates and costs:

Semitrailer Purchase Date Cost

1

April 3, 2008

$73,000

2

April 10, 2008 70,000

3

April 10, 2008 71,000

4

May 4, 2008

77,000

5

(л

May 12, 2008

78,500

On May 20, 2008, a trucking firm purchased semitrailer 3 from Dutch for $86,000.

1. Compute the gross margin on this sale assuming Dutch uses:

(a) FIFO inventory method.

(b) LIFO inventory method.

(c) Specific identification method.

2. Which inventory method do you think Dutch should use? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the year, Wright Company sells 435 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Date Transaction Number of Units Unit Cost Total Cost Jan. 1 Beginning inventory 40 $ 80 $ 3,200 May. 5 Purchase 240 83 19,920 Nov. 3 Purchase 180 88 15,840 460 $ 38,960 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Available for Sale # of units Cost per unit Cost of Goods Sold # of units Cost per unit Ending Inventory Beginning Inventory not attempted not attempted $0 not attempted $0 $0 not attempted Purchases: May 5 not attempted not attempted 0 not attempted $0 0 not attempted Nov. 3 not attempted not attempted 0 not attempted $0 0 not attempted Total 0…arrow_forwardVishalarrow_forwardOn January 15, 2018, Walmart sold 1,700 fishing reels to Costco. Immediately prior to this sale, Walmart perpetual inventory records for reels included the following cost layers: Prepare a separate journal entry to record the cost of goods sold relating to the January 15 sale of 1,700 reels, assuming that Walmart uses: LIFOarrow_forward

- On January 15, 2018, Walmart sold 1,700 fishing reels to Costco. Immediately prior to this sale, Walmart perpetual inventory records for reels included the following cost layers: Prepare a separate journal entry to record the cost of goods sold relating to the January 15 sale of 1,700 reels, assuming that Walmart uses: FIFOarrow_forwardOn January 15, 2018, Walmart sold 1,700 fishing reels to Costco. Immediately prior to this sale, Walmart perpetual inventory records for reels included the following cost layers: Prepare a separate journal entry to record the cost of goods sold relating to the January 15 sale of 1,700 reels, assuming that Walmart uses: AVERAGE COSTarrow_forwardDuring the year, Wright Company sells 510 remote-control airplanes for $100 each. The company has the following inventory purchase transactions for the year. Number of Unit Total Date January 1 Transaction, Beginning inventory Units Cost Cost 50 $64 $3,200 May 5 Purchase 290 67 19,430 240 580 72 17,280 $39,910 November 3 Purchase Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. Cost of Goods Available for Sale Number Cost per FIFO Cost of Goods Number of units unit Available for Sale of units Cost of Goods Sold Cost per unit Cost of Goods Number Sold of units Ending Inventory Cost per unit Ending Inventory Beginning Inventory 50 $ 64 $ 3,200 $ 이 Purchases May 5 290 67 19,430 0 November 3 240 72 17.280 0 Total 580 $ 39,910 ° $ о $ 0arrow_forward

- Indigo Corporation sells a snowboard, EZslide, that is popular with snowboard enthusiasts. Below is information relating to Indigo Corporation’s purchases of EZslide snowboards during September. During the same month, 109 EZslide snowboards were sold. Indigo Corporation uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 12 $ 105 $ 1,260 Sept. 12 Purchases 50 108 5,400 Sept. 19 Purchases 57 109 6,213 Sept. 26 Purchases 21 110 2,310 Totals 140 $ 15,183 (a) Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory at September 30 $ Enter a dollar amount $ Enter a dollar amount $ Enter a dollar amount…arrow_forwardCompute for the cost of inventory on consignment in the hand of Urban Furniture Co.arrow_forwardDuring the year, Wright Company sells 460 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Number Date Transaction of Units Unit Cost Total Cost $80 $ 3,200 19,920 Jan. 1 Beginning inventory Purchase 40 May 5 Nov. 3 240 83 Purchase 190 88 16,720 470 $ 39,840 Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Average # of units Cost per Cost of Average # of units Cost per Average Cost Ending Inventory Goods Goods # of units Available unit unit Sold per unit for Sale Beginning Inventory 40 $ 80 3,200 40 $ 80 3,200 Purchases: May 5 240 $ 83 19,920 240 83 19,920 Nov. 3 190 $ 88 16,720 $ 88 Total 470 $ 39,840||arrow_forward

- louie company sells Astro's photocards for P30 each. the following was taken from the inventory records during march: date photocard units cost march 03 purchase 500 P15 march10 sale 300 17 purchase 1000 P17 20 sale 600 23 sale 300 30 purchase 1000 P20 1. Determine the cost of sales and cost of ending inventory using First-in-First-out Method (Periodic) 2.Determine the cost of sales and cost of ending inventory using Weighted Average Method 3. Determine the cost of sales and cost of ending inventory using Moving Average Methodarrow_forwardDuring the year, Wright Company sells 490 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Number of Units 40 270 220 Unit Cost $68 71 76 Total Cost $2,720 19,170 16,720 Date Transaction Beginning inventory Purchase Jan. 1 May. 5 Nov. 3 Purchase 530 $38,610 Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Goods Available for Sale 2.720 Cost of Goods Sold Ending Inventory # of units Cost per unit # of units Cost per unit #of units Cost per unit Beginning Inventory 40 68 40 $4 68 2.720 Purchases: May 5 270 $ 71 19,170 270 71 19.170 Nov. 3 220 76 16,720 220 76 16,720 Total 530 38,610 530 38.610 $4 %24 %24 %24 9. %24arrow_forwardDuring the year. Wright Company sells 370 remote control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase FIFO Beginning Inventory Purchases May 5 Nov 3 Number of Units 40 210 160 410 Total Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. Unit Cost $74 77 82 # of units Cost per unit Cost of Goods Available for Sale Total Cost $ 2,960 16,170 13,120 $32,250 Cost of Goods Available for Sale #of units Cost of Goods Sold Cost per unit Cost of Goods Sold # of units Ending Inventory Cost per unit Ending Inventoryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education