FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

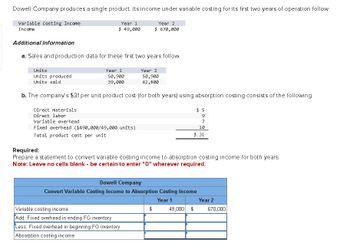

Transcribed Image Text:Dowell Company produces a single product. Its income under variable costing for its first two years of operation follow.

Variable Costing Income

Income

Year 1

$ 49,000

Year 2

$ 670,000

Additional Information

a. Sales and production data for these first two years follow.

Units

Units produced

Units sold

Year 1

50,900

39,000

Year 2

50,900

62,800

b. The company's $31 per unit product cost (for both years) using absorption costing consists of the following.

Direct materials

Direct labor

Variable overhead

Fixed overhead ($490,000/49,000 units)

$ 5

9

7

10

$ 31

Total product cost per unit

Required:

Prepare a statement to convert variable costing income to absorption costing income for both years.

Note: Leave no cells blank - be certain to enter "0" wherever required.

Dowell Company

Convert Variable Costing Income to Absorption Costing Income

Variable costing income

Add: Fixed overhead in ending FG inventory

Less: Fixed overhead in beginning FG inventory

Absorption costing income

Year 1

Year 2

$

49,000 $

670,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A company has a net income of $918,000 based on variable costing method. Beginning and ending inventories were 56,800 units and 55,600 units. Assume the fixed overhead per unit was $2.15 for both the beginning and ending inventory. What will be the net income under absorption costing?arrow_forwardMunabhaiarrow_forwardPlease do not give image formatarrow_forward

- Assume the following information for a company that produced 10,000 units and sold 9,000 units during its first year of operations: Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 72 $ 50 $ 10 $8 Multiple Choice $ 287,000 Which of the following choices explains the relationship between the absorption costing net operating income and the variable costing net operating income? The absorption costing net operating income will be lower than the variable costing net operating income by $28,700. The absorption costing net operating income will be lower than the variable costing net operating income by $100,700. Per Year The absorption costing net operating income will be higher than the variable costing net operating income by $28,700.arrow_forwardDomesticarrow_forwardDuring Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales (@ $62 per unit) Year 1 $ 1,178,000 Gross margin 513,000 Selling and administrative 303,000 expenses* Net operating $ income Cost of goods sold (@$35 665,000 1,015,000 per unit) Year 2 210,000 $ 1,798,000 783,000 333,000 $ 450,000 *$3 per unit variable; $246,000 fixed each year. The company's $35 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($360,000 ÷ 24,000 units) Absorption costing unit product cost $9 9 2 15 $ 35arrow_forward

- Dowell Company produces a single product. Its Income under variable costing for its first two years of operation follow. Variable Costing Income Income Units Units produced Units sold Additional Information a. Sales and production data for these first two years follow. Year 1 $ 43,000 Year 1 44,300 33,000 Direct materials Direct labor Variable overhead Fixed overhead ($430,000/43,000 units) Total product cost per unit Variable costing income Year 2 b. The company's $32 per unit product cost (for both years) using absorption costing consists of the following. Absorption costing income 44,300 55,600 Year 2 $ 610,000 Required: Prepare a statement to convert variable costing income to absorption costing income for both years. (Leave no cells blank - be certain to enter "0" wherever required.) $6 Dowell Company Convert Variable Costing Income to Absorption Costing Income Year 1 $ 9 7 10 $32 43,000 $ Year 2 610,000arrow_forward1. Assume that the company uses absorption costing A) compute the unit product cost B) prepare an income statement for a year(do not leave empty spaces;input a 0 whatever it is required) 2. Assume the company uses variable costing A) compute the unit product cost B) prepare an income statmement(input 0 on empty spaces)arrow_forwardDowell Company produces a single product. Its income under variable costing for its first two years of operation follow. Variable Costing Income Year 1 Year 2 Income $ 50,000 $ 680,000 Additional Information Sales and production data for these first two years follow. Units Year 1 Year 2 Units produced 52,000 52,000 Units sold 40,000 64,000 The company’s $33 per unit product cost (for both years) using absorption costing consists of the following. Direct materials $ 6 Direct labor 9 Variable overhead 8 Fixed overhead ($500,000/50,000 units) 10 Total product cost per unit $ 33 Required:Prepare a statement to convert variable costing income to absorption costing income for both years. (Leave no cells blank - be certain to enter "0" wherever required.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education