FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:k

ces

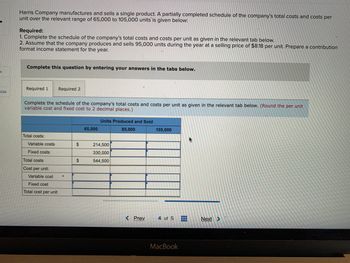

Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per

unit over the relevant range of 65,000 to 105,000 units is given below:

Required:

1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below.

2. Assume that the company produces and sells 95,000 units during the year at a selling price of $8.18 per unit. Prepare a contribution

format income statement for the year.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit

variable cost and fixed cost to 2 decimal places.)

Total costs:

Variable costs

Fixed costs

Total costs

Cost per unit:

Variable cost

Fixed cost

Total cost per unit

.

$

$

65,000

Units Produced and Sold

85,000

214,500

330,000

544,500

< Prev

105,000

4 of 5

MacBook

ww

A

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Betty DeRose, Inc. manufactures and sells a single product. Information related to the cost of producing this product for the past six months is provided below: Units Produced 5,360 4,840 7,580 4,930 6,110 7,620 Month June July August September October November Total Cost Incurred $126,017 $118,831 $155,833 $119,246 $136,932 $157, 195 Betty DeRose, Inc. expects to produce 6,495 units of this product during December. Using the high-low method, calculate Betty DeRose, Inc's expected total cost incurred for December.arrow_forwardSheddon Industries produces two products. The products' identified costs are as follows: Product A Product B Direct materials $20,000 $15,000 Direct labor $12,000 $24,000 The company's overhead costs of $108,000 are allocated based on direct labor cost. Assume 4,000 units of product A and 5,000 units of Product B are produced. What is the cost per unit for product B? (Do not round your intermediate calculations.)arrow_forward! Required information [The following information applies to the questions displayed below.] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. During its first year of operations, O'Brien produced 98,000 units and sold 74,000 units. During its second year of operations, it produced 80,000 units and sold 99,000 units. In its third year, O'Brien produced 90,000 units and sold 85,000 units. The selling price of the company's product is $78 per unit. Req 4A 4. Assume the company uses absorption costing and a LIFO inventory flow assumption (LIFO…arrow_forward

- Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 14 Direct labor $ 8 Variable manufacturing overhead $ 2 Variable selling and administrative $2 Fixed costs per year: Fixed manufacturing overhead $ 250,000 Fixed selling and administrative $ 160,000 During the year, the company produced 25,000 units and sold 21,000 units. The selling price of the company's product is $47 per unit. Required: Assume the company uses absorption costing: Compute the unit product cost. Prepare an income statement for the year. Assume the company uses variable costing: Compute the unit product cost. Prepare an income statement for the year.arrow_forwardam.103.arrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company’s first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 12 Direct labor $ 7 Variable manufacturing overhead $ 2 Variable selling and administrative $ 2 Fixed costs per year: Fixed manufacturing overhead $ 248,000 Fixed selling and administrative $ 158,000 During the year, the company produced 31,000 units and sold 21,000 units. The selling price of the company’s product is $44 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year.arrow_forward

- Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 53,000 to 93,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 83,000 units during the year at a selling price of $9.29 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 1 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost Variable cost Fixed cost Total cost Cost por unit: Required 2 Variable cost Fixed cost Total cost per unit 53,000 Units Produced and Sold $ S $ Required 1 Required 2 73,000 Units Produced and Sold 185,500 350,000…arrow_forwardCalculate the expected costs when production is 5100 units. Sheridan Corporation manufactures a single product. Monthly production costs incurred in the manufacturing process are shown below for the production of 3,200 units. The utilities and maintenance costs are mixed costs. The fixed portions of these costs are $390 and $290, respectively. Production in Units Production Costs Direct materials. Direct labour Utilities Property taxes Indirect labour Supervisory salaries Maintenance Depreciation 3,200 $7,936 15,264 1,798 1,000 4,512 1,900 1,602 2,550arrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company’s first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 12 Direct labor $ 6 Variable manufacturing overhead $ 3 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 276,000 Fixed selling and administrative $ 186,000 During the year, the company produced 23,000 units and sold 19,000 units. The selling price of the company’s product is $50 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education