FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

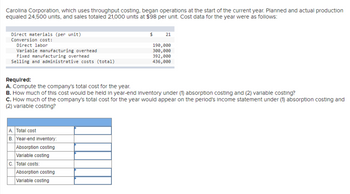

Transcribed Image Text:Carolina Corporation, which uses throughput costing, began operations at the start of the current year. Planned and actual production

equaled 24,500 units, and sales totaled 21,000 units at $98 per unit. Cost data for the year were as follows:

Direct materials (per unit)

Conversion cost:

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Selling and administrative costs (total)

A. Total cost

B. Year-end inventory:

Absorption costing

Variable costing

C. Total costs:

$

Absorption costing

Variable costing

21

Required:

A. Compute the company's total cost for the year.

B. How much of this cost would be held in year-end Inventory under (1) absorption costing and (2) variable costing?

C. How much of the company's total cost for the year would appear on the period's income statement under (1) absorption costing and

(2) variable costing?

190,000

300,000

392,000

436,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare an absorption-costing income statement for last year. Round to nearest whole number.arrow_forwardInformation taken from Kombucha Cooperative's records for the most recent year is as follows: Direct material used Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs Required: 215,000 79,600 41,000 68,000 35,200 20,000 1. Assuming Kombucha Cooperative's uses absorption costing, compute the inventoriable costs for the year. 2. Compute the year's inventoriable costs using variable costing. 1. Absorption costing 2. Variable costing Inventoriable costsarrow_forwardCalculate and Use Ovrehead Rate During the coming accounting year, Baker Manufacturing, Inc. anticipates the following costs, expenses, and operating data: Direct material (16,000 lb) $80,000 Direct labor (@10/hr) 200,000 Indirect materials 12,000 Indirect labor 22,000 Sales Commissions 34,000 Factory administration 16,000 Nonfactory administrative expenses 20,000 Other manufacturing overhead 80,000 a. Calculate the predetermined manufacturing overhead rate for the coming year for each of the following application bases: (1) direct labor hours, (2) direct labor costs, and (3) machine hours. b. For each item in requirement in requirement a, determine the proper application of manufacuring overhead to Job 63, to which 16 direct labor hours, $150 of direct labor cost, and 40 machine…arrow_forward

- The Dorset Corporation produces and sells a single product. The following data refer to the year just completed: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit 0 30,300 24,700 $ 465 $ 25 Fixed per year $ 469,300 Manufacturing costs: Direct materials cost per unit $ 211 Direct labor cost per unit $ 53 Variable manufacturing overhead cost per unit $ 36 $ 454,500 Fixed manufacturing overhead per year Assume that direct labor is a variable cost. Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing. d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare an…arrow_forwardI want the correct answer with questionarrow_forwardTrio Company reports the following information for its first year of operations. Direct materials $ 13 per unit Direct labor $ 17 per unit Variable overhead $ 7 per unit Fixed overhead $ 220,950 per year Units produced 24,550 units Units sold 18,000 units Ending finished goods inventory 6,550 units Assume instead that Trio Company uses variable costing.1. Compute the product cost per unit using variable costing.2. Determine the cost of ending finished goods inventory using variable costing.3. Determine the cost of goods sold using variable costing.arrow_forward

- devratarrow_forwardPlease Complete the last subpartarrow_forwardTrez Company began operations this year. During this year, the company produced 100,000 units and sold 80,000 units. The absorption costing income statement for this year follows. Income Statement (Absorption Costing) Sales (80,000 units x $45 per unit) Cost of goods sold Gross profit Selling and administrative expenses Income Additional Information $ 3,600,000 2,000,000 1,600,000 490,000 $ 1,110,000 a. Selling and administrative expenses consist of $350,000 in annual fixed expenses and $1.75 per unit in variable selling and administrative expenses. b. The company's product cost of $25 per unit consists of the following. Direct materials Direct labor Variable overhead Fixed overhead ($700,000 / 100,000 units) Required: $ 5 per unit $ 10 per unit $ 3 per unit $ 7 per unit Prepare an income statement for the company under variable costing. TREZ Companyarrow_forward

- Trio Company reports the following information for its first year of operations. Direct materials $ 18 per unit Direct labor $ 19 per unit Variable overhead $ 7 per unit Fixed overhead $ 221,650 per year Units produced 20,150 units Units sold 15,500 units Ending finished goods inventory 4,650 units Assume instead that Trio Company uses variable costing.1. Compute the product cost per unit using variable costing.2. Determine the cost of ending finished goods inventory using variable costing.3. Determine the cost of goods sold using variable costing.arrow_forward! Required information [The following information applies to the questions displayed below.] Cool Sky reports the following for its first year of operations. The company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Income Statement (Absorption Costing) 1b. Assume the company uses absorption costing. Prepare its income statement for the year under absorption costing. Sales Cost of goods sold Gross profit Income Income $ $ $ $ 5,040,000 3,240,000 1,800,000 1,404,000 396,000 $ 60 per unit $ 22 per unit $ 8 per unit 528,000 per year $ 11 per unit 105,000 per yeararrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense 154 2,560 2,230 330 51 24 $. 15 16 $92,160 $11,150 The tegross margin for the month under absorption costing is: Multiple Chotce $62.440 S15.610, K Prev 4: of 10 Next > ere to searcharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education