Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand raiting and don't use Ai solution

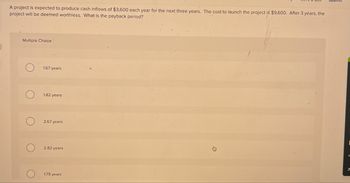

Transcribed Image Text:A project is expected to produce cash inflows of $3,600 each year for the next three years. The cost to launch the project is $9,600. After 3 years, the

project will be deemed worthless. What is the payback period?

Multiple Choice

1.67 years

1.82 years

о

2.67 years

2.82 years

1.79 years

ㄱ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forwardCompute the payback statistic for Project B if the appropriate cost of capital is 10 percent and the maximum allowable payback period is three years. (Round your answer to 2 decimal places. If the project never pays back, then enter a "0" (zero).) Project B Time: Cash flow 0 1 2 3 4 -$12,900 $3,540 $4,560 $1,900 $0 Payback years Should the project be accepted or rejected? Accepted O Rejected 5 $1,380 LOarrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$2,300 $870 $870 $780 $560 $360 Should the project be accepted or rejected?multiple choice accepted rejectedarrow_forward

- An investment project provides cash inflows of $735 per year for eight years. a. What is the project payback period if the initial cost is $1,950? (Enter 0 if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the project payback period if the initial cost is $3,800? (Enter 0 if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the project payback period if the initial cost is $5,900? (Enter 0 if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 8 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 4 5 Cash flow: $1,600 $590 $660 $640 $420 $220 Payback years Should the project be accepted or rejected? O accepted O rejected MacBook Airarrow_forwardCompute the payback statistic for Project B if the appropriate cost of capital is 11 percent and the maximum allowable payback period is three years. (If the project never pays back, then enter a "0" (zero).) Project B Time: 2 3 4 5 Cash flow: -$12,000 $3,450 $4,380 $1,720 $0 $1,200 Payback years Should the project be accepted or rejected? O accepted O rejectedarrow_forward

- Your company is considering to choose one of the two projects: Project Gold and Project Diamond. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of two projects are provided below. Gold Diamond Cost $485 000 $520 000 Future Cash Flow Year 1 105 850 117 050 Year 2 153 250 162 400 Year 3 225 650 275 500 Year 4 245 000 255 000 Year 5 250 350 260 000 Required: a. Identify which project should your company accept based on Net Present Value method? b. Identify which project should your company accept based on Discounted Payback Period method if the payback criterion is maximum 2.5 years?arrow_forwardA project that provides annual cash flows of $17,800 for eight years costs $84,000 today. What is the NPV for the project if the required return is 7 percent? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) At a required return of 7 percent, should the firm accept this project? multiple choice 1 Accept Reject What is the NPV for the project if the required return is 19 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) At a required return of 19 percent, should the firm accept this project? multiple choice 2 Accept Reject At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: –$1,700 $630 $690 $660 $440 $240 Should the project be accepted or rejected? multiple choice accepted rejectedarrow_forward

- The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? 5.77 years 4.25 years 3.33 years 2.66 yearsarrow_forwardWhich of the following values comes closest to the payback of a project that requires an initial investment of $34, produces cash flows of $12 for 5 consecutive years beginning at the end of year 1, and provides a final cash flow at the end of year 6 of $100? The project's required rate of return is 13%. Select one: a. 3 years b. 4 years c. Undefined-there is no payback for this project. d. 6 years e. 5 yearsarrow_forwardNeed help throughout this problem pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT