Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

??

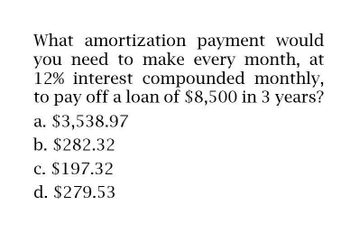

Transcribed Image Text:What amortization payment would

you need to make every month, at

12% interest compounded monthly,

to pay off a loan of $8,500 in 3 years?

a. $3,538.97

b. $282.32

c. $197.32

d. $279.53

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If you borrow $18,000 today with a loan term of 2 years and semiannual repayments of $4,500, how much will your third interest payment be with an annual interest rate of 4%? O a. $270 O b. $180 Oc. $380 O d. $360arrow_forwardVijayarrow_forwardIf you borrow $100,000 at an annual interest rate of 10% for six years, what is the annual payment (prior to maturity) on a fully amortized loan? 14 Your choice: 14/15 Qs A: $0.00 B: $10,000.00 C: $16,666.67 D: $22960.74arrow_forward

- A loan of P50,000 is to be amortized by paying quarterly in 1 year. If money is worth 10% compounded quarterly, how much is the monthly installment? a. P13,648.90 b. P11,589.57 c. P12.765.50 d. P13,290.89arrow_forwardSuppose you borrowed $20,000 at a rate of 9.2% and must repay it in 5 equal installments at the end of each of the next 5 years. How much would you still owe at the end of the first year, after you have made the first payment? O a. $16,000.00 O b. $17,106.89 Oc. $14,831.44 O d. $16,671.44 Oe. $15,266.89arrow_forwardQ5. Suppose you borrow $10,000. You are going to repay the loan by making equal annual payments for five years. The interest rate on the loan is 15 percent per year. Prepare an amortization schedule for the loan. How much interest will you pay over the life of the loan? Beginning Total Principal Ending Year Interest balance payment раyment раyment balance 1 $10,000 2 3 2,983.16 4 5 0.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning