Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

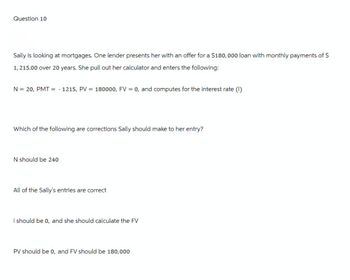

Transcribed Image Text:Question 10

Sally is looking at mortgages. One lender presents her with an offer for a $180,000 loan with monthly payments of S

1, 215.00 over 20 years. She pull out her calculator and enters the following:

N = 20, PMT =

==

-

1215, PV

=

180000, FV = 0, and computes for the interest rate (i)

Which of the following are corrections Sally should make to her entry?

N should be 240

All of the Sally's entries are correct

i should be 0, and she should calculate the FV

PV should be 0, and FV should be 180,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- You can afford a $1400 per month mortgage payment. You've found a 30 year loan at 8% interest. a) How big of a loan can you afford? Round your answer to the nearest dollar. b) How much total money will you pay the loan company? Round your answer to the nearest dollar. c) How much of that money is interest? Round your answer to the nearest dollar. Question Help: D Post to forum Submit Questionarrow_forwardGive typing answer with explanation and conclusionarrow_forwardTtme Value of of Money Tim wants to borrow $400,000 from Bank of America on a 30-year mortgage. a. What would Tim's monthly payments be on his motgage? b. Amortize the loan and determine: Interest expense for the first quarter of the loan. Cash flows for the first quarter of the loan. Loan balance at the end of the first quarter of the loan. Please show your calculations, part b is very important. If you are using the TVM chart, please state whether you used PVoA, FVoA, PVoSA, FVoSA.arrow_forward

- Mortgage, part 1 (The Loan)5 years ago you purchased a home for $215,000. You made a 10% down payment and paid for the rest with a 30 year mortgage with a rate of 4.65%. How much was the down payment? How much of the purchase price did you finance with the loan? What is your monthly payment? Use solver. Clearly write the formula you will use as well as all values used in the formula. How much of the loan is left to pay after the first 5 years? Use solver. Clearly write the formula you will use as well as all values used in the formula. How much did you pay to the lender (total) over the first 5 years? How much of what you paid to the lender in the first 5 years was interest? If you paid this loan for all 30 years, how much interest would you pay?arrow_forwardO CONSUMER MATHEMATICS Finding the monthly payment, total payment, and interest for a... When Laura bought her house, she got her mortgage through a bank. The mortgage was a personal, amortized loan for $99,500, at an interest rate of 3.75%, with monthly payments for a term of 40 years. For each part, do not round any intermediate computations and round your final answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) Find Laura's monthly payment. (b) If Laura pays the monthly payment each month for the full term, find her total amount to repay the loan. $0 (c) If Laura pays the monthly payment each month for the full term, find the total amount of interest she will pay. $0 X Monthly Payment Formula M= P r 12 r 1- ( 1 + 12 ) - 12tarrow_forwardGeneral Accounting Questionarrow_forward

- ques 1arrow_forwardhow do you do this on a finacial calculator?arrow_forwardI need the excel function typed out? Example =RATE???? G. Find the interest rate (APR) on a 27-year mortgage with a initial loan amount of $358,000, if the monthly payment is $2229.45 Let's use references for input values; and be sure to annualize the rate! INPUTS: OUTPUT: Period 27 Rate is APR Payment 2229.45 Loan amount 358000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning