SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

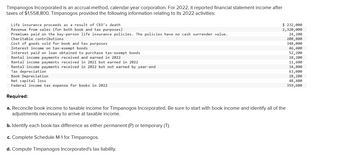

Transcribed Image Text:$ 232,000

2,320,000

24,200

208,800

348,000

46,400

52,200

18,200

11,600

34,800

63,000

28,200

48,400

359,600

Timpanogos Incorporated is an accrual-method, calendar-year corporation. For 2022, it reported financial statement income after

taxes of $1,558,800. Timpanogos provided the following information relating to its 2022 activities:

Life insurance proceeds as a result of CEO's death

Revenue from sales (for both book and tax purposes)

Premiums paid on the key-person life insurance policies. The policies have no cash surrender value.

Charitable contributions

Cost of goods sold for book and tax purposes

Interest income on tax-exempt bonds

Interest paid on loan obtained to purchase tax-exempt bonds

Rental income payments received and earned in 2022

Rental income payments received in 2021 but earned in 2022

Rental income payments received in 2022 but not earned by year-end

Tax depreciation

Book Depreciation

Net capital loss

Federal income tax expense for books in 2022

Required:

a. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the

adjustments necessary to arrive at taxable income.

b. Identify each book-tax difference as either permanent (P) or temporary (T).

c. Complete Schedule M-1 for Timpanogos.

d. Compute Timpanogos Incorporated's tax liability.

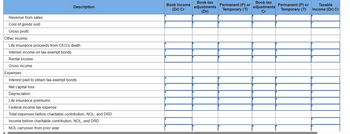

Transcribed Image Text:Description

Book Income

(Dr) Cr

Book-tax

adjustments

(Dr)

Permanent (P) or

Temporary (T)

Book-tax

adjustments

Cr

Permanent (P) or

Temporary (T)

Revenue from sales

Cost of goods sold

Gross profit

Other income:

Life insurance proceeds from CEO's death

Interest income on tax-exempt bonds

Rental income

Gross income

Expenses:

Interest paid to obtain tax-exempt bonds

Net capital loss

Depreciation

Life insurance premiums

Federal income tax expense

Total expenses before charitable contribution, NOL, and DRD

Income before charitable contribution, NOL, and DRD

NOL carryover from prior year

Taxable

Income (Dr) Cr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- XYZ is a calendar-year corporation that began business on January 1, 2020. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. XYZ corp. BookIncome Income statement For current year Revenue from sales $ 40,000,000 Cost of Goods Sold (27,000,000 ) Gross profit $ 13,000,000 Other income: Income from investment in corporate stock 300,000 1 Interest income 20,000 2 Capital gains (losses) (4,000 ) Gain or loss from disposition of fixed assets 3,000 3 Miscellaneous income 50,000 Gross Income $ 13,369,000 Expenses: Compensation (7,500,000 )4 Stock option compensation (200,000 )5 Advertising (1,350,000 ) Repairs and Maintenance (75,000 ) Rent (22,000 ) Bad Debt expense (41,000 )6 Depreciation (1,400,000 )7 Warranty expenses (70,000 )8 Charitable donations (500,000 )9 Meals (18,000 )…arrow_forwardWildhorse Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Wildhorse's fiscal year ends May 31. The following information is available. 1. 2. 3. 4. 5. 6. 7. 1. Income from operations before income tax for Wildhorse was $1,500,000 and $1,900,000, respectively, for the fiscal years ended May 31, 2021, and 2020. 2. Wildhorse experienced a loss from discontinued operations of $600,000 from a business segment disposed of on March 3, 2021. A 20% combined income tax rate applies to all of Wildhorse Corporation's profits, gains, and losses. Wildhorse's capital structure consists of preferred shares and common shares. The company has not issued any convertible securities or warrants and there are no outstanding stock options. Wildhorse issued 136,000 of $10 par value, 5% cumulative preferred shares in 2013. All of these shares are outstanding, and no preferred dividends are in arrears. Determine the…arrow_forwardTimpanogos Inc. is an accrual-method, calendar-year corporation. For 2020, it reported financial statement income after taxes of $1,342,000. Timpanogos provided the following information relating to its 2020 activities: Life insurance proceeds as a result of CEO’s death $200,000 Revenue from sales (for both book and tax purposes) $2,000,000 Premiums paid on the key-person life insurance policies. The policies have no cash surrender value. $21,000 Charitable contributions $180,000 Cost of goods sold for book and tax purposes $300,000 Interest income on tax-exempt bonds $40,000 Interest paid on loan obtained to purchase tax-exempt bonds $45,000 Rental income payments received and earned in 2020 $15,000 Rental income payments received in 2019 but earned in 2020 $10,000 Rental income payments received in 2019 but not earned by year-end $30,000 Tax Depreciation $55,000 Book Depreciation $25,000…arrow_forward

- b. Suppose that Matt sold half of his shares to Chris Coop on June 1st for $40,000. How much dividend income will Matt recognize this year? Dividend recognized Show Transcribed Text G o c. If Matt's basis in his Lone Star shares was $7,000 at the beginning of the year, how much capital gain will he recognize on the sale and distributions from Lone Star? Capital gain recognized on the sale and distributionarrow_forwardXYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. XYZ corporation Income statement For current year Book Income Revenue from sales $ 40,000,000 Cost of Goods Sold (27,000,000) Gross profit $ 13,000,000 Other income: Income from investment in corporate stock 300,0001 Interest income 20,0002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,0003 Miscellaneous income 50,000 Gross Income $ 13,369,000 Expenses: Compensation (7,500,000)4 Stock option compensation (200,000)5 Advertising (1,350,000) Repairs and Maintenance (75,000) Rent (22,000) Bad Debt expense (41,000)6 Depreciation (1,400,000)7 Warranty expenses (70,000)8 Charitable donations (500,000)9 Meals (all at restaurants) (18,000) Goodwill impairment (30,000)10…arrow_forwardAn entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $665,000 39,900 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 5,320,000 Trustee fees, deductible portion (19,950) Net rental losses, passive activity (133,000) Income Tax Rates-Estates and Trusts Tax Year 2021 Taxable Income The Tax Is: Of the But not Amount Over- Over- Over- $ 0 $ 2,650 10% $ 0 2,650 9,550 $ 265.00 +24% 2,650 9,550 13,050 1,921.00 + 35% 9,550 13,050 3,146.00 + 37% 13,050 Income Tax Rates-C Corporations, 2018 and after For all income levels, the tax rate is 21%. Question: The Federal income tax liability for the Valerio Trust isarrow_forward

- Timpanogos Incorporated is an accrual-method, calendar-year corporation. For 2021, it reported financial statement income after taxes of $1,529,880. Timpanogos provided the following information relating to its 2021 activities: $ 228,000 2,280,000 23,940 205,200 Life insurance proceeds as a result of CrO's death Revenue from sales (for both book and tax purposes) Premiums paid on the key-person life insurance policies. The policies have no cash surrender value. Qualified charitable contributions Cost of goods sold for book and tax purposes Interest income on tax-exempt bonds Interest paid on loan obtained to purchase tax-exempt bonds Rental income payments received and earned in 2021 Rental income payments received in 2020 but earned in 2021 Rental income payments received in 2021 but not earned by year-end Tax depreciation Book Depreciation Net capita1 loss Federal income tax expense for books in 2021 342,000 45,600 51,300 17,100 11,400 34,200 62,700 28,500 47,880 353,400 Required: a.…arrow_forwardSandhill Corporation is preparing the comparative financial statements for the annual report to its shareholders for fiscal years ended May 31, 2020, and May 31, 2021. The income from operations for the fiscal year ended May 31. 2020, was $1.793.000 and income from continuing operations for the fiscal year ended May 31. 2021, was $2.412,000. In both years, the company incurred a 10% interest expense on $2.393,000 of debt, an obligation that requires interest-only payments for 5 years. The company experienced a loss from discontinued operations of S614.000 an February 2021. The company uses a 20% effective tax rate for income taxes. The capital structure of Sandhill Corporation on June 1. 2019. consisted of 971.000 shares of common stock outstanding and 20,500 shares of $50 par value, 6%, cumulative preferred stock. There were no preferred dividends in arrears, and the company had not issued any convertible securities, options, or warrants. On October 1. 2019, Sandhill sold an…arrow_forwardPlease fulfil this account requirementsarrow_forward

- Hh2. Accountarrow_forwardTwo public corporations, First Engineering and Midwest Development, each show capitalization of $175 million in their annual reports. The balance sheet for First indicates total debt of $87 million, and that of Midwest indicates net worth of $62 million. Determine the D-E mix for each companyarrow_forwardNapier Co. provided the following information on selected transactions during 2021: Purchase of land by issuing bonds, P250,000; Proceeds from issuing bonds, P500,000; Purchases of inventory, P950,000; Purchases of treasury shares, P150,000; Loans made to affiliated corporations, P350,000; Dividends paid to preference shareholders, P100,000; Proceeds from issuing preference share, P400,000; Proceeds from sale of equipment, P50,000. The net cash provided by financing activities during 2021 is (A P650,000. (B) P800,000. P900,000. D P550,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you