FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Sandhill Corporation is preparing the comparative financial statements for the annual report to its shareholders for fiscal years

ended May 31, 2020, and May 31, 2021. The income from operations for the fiscal year ended May 31. 2020, was $1.793.000 and

income from continuing operations for the fiscal year ended May 31. 2021, was $2.412,000. In both years, the company incurred

a 10% interest expense on $2.393,000 of debt, an obligation that requires interest-only payments for 5 years. The company

experienced a loss from discontinued operations of S614.000 an February 2021. The company uses a 20% effective tax rate for

income taxes.

The capital structure of Sandhill Corporation on June 1. 2019. consisted of 971.000 shares of common stock outstanding

and 20,500 shares of $50 par value, 6%, cumulative preferred stock. There were no preferred dividends in arrears, and the company

had not issued any convertible securities, options, or warrants.

On October 1. 2019, Sandhill sold an additional 510.000 shares of the common stock at $20 per share. Sandhill distributed a 20%

stock dividend on the common shares outstanding on January 1.2020. On December 1. 2020, Sandhill was able to sell an

additional 764.000 shares of the common stock at $22 per share. These were the only common stock transactions that occurred

during the two fiscal years.

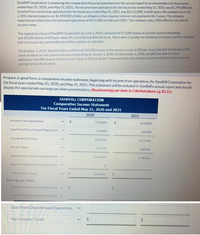

Prepare, in good form, a comparative income statement, beginning with income from operations, for Sandhill Corporation for

the fiscal years ended May 31, 2020, and May 31. 2021. This statement will be included in Sandhill's annual report and should

display the appropriate earnings per share presentations. (Round earnings per share to 2 decimal places, eg $1.55.)

SANDHILL CORPORATION

Comparative Income Statement

For Fiscal Years Ended May 31, 2020 and 2021

2020

2021

Income From Operations

1793000

2412000

Loss From Discontinued Operations

239300

239300

Income Before Taxes

1553700

2172700

Income Taxes

310740

434540

Income From Continuing Operations v

1242960

1738160

Loss From Discontinued Operations

Net Income/(Losa)

1242960

Earnings per share:

Income From Continuing Operations

Loss From Discontinued Operations

Loss From Discontinued Operations

Net Income/ (Loss)

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Obtain Target Corporation's annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com a. What was Target's gross margin percentage for the fiscal year ended February 2, 2019 (2018) and 2017? Use "Sales" for these computations b. What was Target's Return on Sales percentage for 2018 and 2017? Use "Total Revenue" for these computations. c. Target's return on ales percentage for 2017 was higher than it was in 2018. Ignoring taxes, how much higher would Target's 2018 net income have been if it's return on sales percentage in 2018 had been the same as for 2017?arrow_forwardShow all of your work for numerical problems. 1. Based on the following information for ABC Corporation, answer each question (calculate for year 2023). Assume that price per share is $13.33 and number of shares is 175. Sales Cost of goods sold/Expenses Depreciation b. EBIT Interest Taxable Income Taxes Net Income Dividends Cash Inventory Account Receivable Current assets Net fixed assets Current liabilities Long-term debt Common stock Retained Earning 2022 1,000 1,400 1,600 4,000 9,000 3,500 4,000 3,000 2,500 2023 8,000 4,900 600 ? 450 ? ? ? 1,370 1,200 1,600 1,800 4,600 9,200 3,700 4,300 3,050 2,750 a. What are the ABC's tax liabilities (tax payments)? Use a 21 percent (flat) tax rate. Calculate cash flow from assets (CF Generating), cash flow to creditors, and cash flow to stockholders. Check CF identityarrow_forwardFor this question, please refer to the Fact Pattern below (Same fact pattern as previous question). Given the set of transactions above, what was Adjusted EBITDA in 2021? O $1,107.2 O $1,082.2. O $1,068.2 $1,092.2 Activities during the year: Capital expenditures Cost of Goods Sold (excluding D&A) Dividend Payout Ratio (dividends/ net income to common shareholders) Income Tax Net Interest Expense Net Revenues Non-controlling Interest Expense (After-Tax) Litigation Expense Other Operating Expenses (excluding D&A) Purchases of intangible assets Preferred dividends Research And Development (excluding D&A) Proceeds from sale of land with book value of $15 Selling, General, & Administrative (excluding D&A) Write-down of PP&E 2021 580.0 3,256.0 40% 35% 45.6 5,800.0 25.0 97.0 16.5 45.0 5.0 56.3 20.0 1,488.0 7.0arrow_forward

- Below are the Income Statement and Balance Sheet for Palmer Corporation for the years ended 2020 and 2021. Calculate the liquidity ratios in the table to the right for the year ended 2021. Palmer Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $5,750,900 $4,894,800 Cost of goods sold 3,646,700 3,195,600 Gross profit 2,104,200 1,699,200 Selling expenses 775,500 688,700 Administrative expenses 863,900 815,200 Total operating expenses 1,639,400 1,503,900 Income from operations 464,800 195,300 Other income 102,500 84,600 Income before income tax 567,300 279,900 Income tax expense 200,600 101,200 Net income $366,700 $178,700 Palmer Corporation…arrow_forwardRequired information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ $ 467,052 357,800 281,165 223,625 185,887 134, 175 66,321 49,376 42,035 31,486 108,356 80,862 77,531 53,313 14,421 10,929 $ $ 63,110 42,384 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income KORBIN COMPANY Comparative Balance Sheets 2020 Assets Current assets Long-term investments Plant assets, net Total assets December 31 2021 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 2019 $…arrow_forwardUsing EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), find the annual report (10-K) for Target Corporation for the year ended February 3, 2024. Locate the "Consolidated Statements of Operations and Comprehensive Income" (income statement) and "Consolidated Balance Sheets." You may also find the annual report at the company's website.arrow_forward

- Prepare a retained earnings statement for the year ended December 31, 2021 in proper format: Ladila corporation has retained earnings of P725,825 at January 1, 2021. Net income during the year was P1,800,900, and cash dividends declared and paid during 2021 totaled P98,000.arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardUse the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forward

- Prepare a horizontal analysis of the following comparative income statement for the Buff Bodies Corporation. Round percentage changes to the nearest one-hundredth percent. Buff Bodies Corporation Comparative Income Statement for the Years Ended December 31, 2020 and 2019 2020 2019 Total revenue $1,450,000 $1,300,000 Expenses: Cost of goods sold $ 1,023,000 $ 930,000 Operating expenses 310,000 275,000 Interest expense 12,000 10,000 Income tax expense 48,300 38,000 Total expenses $1,393,300 $1,253,000 Net income $ 56,700 $ 47,000arrow_forwardPresented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021. 2021 2020 Sales $314,000 $272,000 Cost of sales 200,000 147,000 Gross profit 114,000 125,000 Еxpenses 94,500 52,700 Net income $19,500 $72,300 Retained earnings (Jan. 1) $116,900 $70,700 Net income 19,500 72,300 Dividends (27,000 ) (26,100 ) Retained earnings (Dec. 31) $109,400 $116,900 The follawing additional information is provided: In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2020 for $98,000 with an estimated useful life of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of 2020.) 1. In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for 2021 is correctly stated. 2. Prepare the revised…arrow_forward1. Calculate the cash operating cycle of Stone Limited for the year ended 30 April, 2018 and 2019.2. Calculate the comparative ratios for Stone limited for the year ended 30 April 2019. (to two decimal places where appropriate).3. Based on the result of the previous year end and the industry average. Draft a report addressed to the Board of Directors of Stone Limited analysing the performance of the company for the year 2019arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education