Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

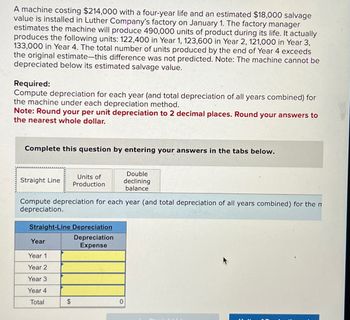

Transcribed Image Text:A machine costing $214,000 with a four-year life and an estimated $18,000 salvage

value is installed in Luther Company's factory on January 1. The factory manager

estimates the machine will produce 490,000 units of product during its life. It actually

produces the following units: 122,400 in Year 1, 123,600 in Year 2, 121,000 in Year 3,

133,000 in Year 4. The total number of units produced by the end of Year 4 exceeds

the original estimate-this difference was not predicted. Note: The machine cannot be

depreciated below its estimated salvage value.

Required:

Compute depreciation for each year (and total depreciation of all years combined) for

the machine under each depreciation method.

Note: Round your per unit depreciation to 2 decimal places. Round your answers to

the nearest whole dollar.

Complete this question by entering your answers in the tabs below.

Straight Line

Units of

Production

Double

declining

balance

Compute depreciation for each year (and total depreciation of all years combined) for the m

depreciation.

Straight-Line Depreciation

Depreciation

Year

Expense

Year 1

Year 2

Year 3

Year 4

Total

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- St. Johns Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMCs Cath Lab. Each technician is paid a salary of 36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for 250,000. It is expected to last five years. The equipments capacity is 25,000 procedures over its life. Depreciation is computed on a straight-line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is 120 per test. The technicians report with the outside physicians note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends 50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMCs business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging 850 for the procedureenough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services). At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be 550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporaryfor one year only. The HMO expects to have its own testing capabilities within one year. Required: 1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources. 2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning. 3. Assume that SJMC will accept the HMO offer if it reduces the hospitals operating costs. Should the HMO offer be accepted? 4. Jerold Bosserman, SJMCs hospital controller, argued against accepting the HMOs offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesnt even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for 550. Discuss the merits of Jerolds position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation. 5. Chandra Denton, SJMCs administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC wont need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of 2,000 per year. How does this outcome affect the analysis of the HMO offer? 6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activitys first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?arrow_forwardA machine that cost $475,500, with a four-year life and an estimated $48,000 residual value, was installed in Haley Company’s factory on September 1, 2020. The factory manager estimated that the machine would produce 475,000 units of product during its life. It actually produced the following units: 2020, 21,000; 2021, 128,500; 2022, 125,000; 2023, 108,300; and 2024, 102,200. The company’s year-end is December 31.Required:Show the depreciation for each year and the total depreciation for the machine under each depreciation method calculated to the nearest whole month. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.)arrow_forwardA construction company operates a bulldozer that initially costs $28,000. The first year maintenance is $600, the second year is $900, and $1200 the third year. The salvage value at the end of the third year is $15,000. If the company decides to keep the bulldozer beyond the third year, the maintenace costs are: $900 the fourth year, $1150 the fifth year, $1300 the sixth year. There is a $7000 cost at the end of the third year if the bulldozer is kept. The salvage value at the end of six years is $10,000. If the bulldozer is kept for two more years, another overhaul at the end of the sixth year will cost $14,000. Maintenance costs will be $9900 at the end of the seventh and eighth years. Compare the annual costs if the bulldozer is kept for three years, six years, or eight years. Assume the eight-year salvage value is zero. Use 10%arrow_forward

- Fleet Sports purchased a production machine with a cost of $180,000 at the beginning of 2019. Transportation costs to get the machine ready were $5,000. An additional $15,000 of labor costs were incurred to assemble the machine. The equipment has an estimated life of 10 years or 100,000 snowboards (units of product). The estimated residual value is $20,000. During 2019, 17,000 snowboards (units of product) were produced with this machinery. Determine the following, and show your work: 4.What is the book value of the equipment at the end of 2020 using straight-line depreciation? 5.What is depreciation expense for the equipment at the end of 2019 using double-declining balance depreciation? 6What journal entry is needed at the end of 2020 to record depreciation expense using double-declining balance depreciation?arrow_forwardThe Johnson Company pays $1700 a month to a trucker to haul wastepaper and cardboard to the city dump. The material could be recycled if the company were to buy a $48,000 hydraulic press baler and spend $21,000 a year for labor to operate the baler. The baler has an estimated useful life of 15 years and no salvage value. Strapping material would cost $1500 per year for the estimated 600 bales a year that would be produced. A wastepaper company will pick up the bales at the plant and pay Johnson $27 per bale for them. Use an annual cash flow analysis and an interest rate of 8% to recommend whether it is economical to install and operate the baler.arrow_forwardOn June 30, 2024, Prego Equipment purchased a precision laser - guided steel punch that has an expected capacity of 300,000 units and no residual value. The cost of the machine was $450,000 and is to be depreciated using the units - of - production method. During the six months of 2024, 24, 000 units of product were produced. At the beginning of 2025, engineers estimated that the machine can realistically be used to produce only another 230,000 units. During 2025, 70,000 units were produced. The company would report depreciation in 2024 of: 1)$21, 950 2) $18,000 3) $43, 900 4)$36,000arrow_forward

- To automate one of its production processes, Milwaukee Corporation bought three flexible manufacturing cells at a price of $400,000 each. When they were delivered, Milwaukee paid freight charges of $30,000 and handling fees of $15,000. Site preparation for these cells cost $50,000. Six employees, each earning $15 an hour, worked five 40-hour weeks to set up and test the manufacturing cells. Special wiring and other materials applicable to the new manufacturing cells cost $2,000. Determine the cost basis (the amount to be capitalized) for these cells.arrow_forwardBramble Inc. plans to purchase a new metal stamping machine for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor. The engineering department has determined that each vendor's stamping machine is substantially identical and each has a useful life of 30 years. In addition, engineering has estimated that required year-end maintenance costs will be $2,790 per year for the first 10 years, $4,790 per year for the next 10 years, and $11,790 per year for the last 10 years. Following is each vendor's sale package: Vendor A: $36,200 cash at time of delivery and 5 year-end payments of $50,300 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 30-year maintenance service contract, under which Vendor A will perform all year-end maintenance at a one-time initial cost of $47,300. Vendor B: Forty semiannual payments of $13,100 each, with the first…arrow_forwardBenson Moran manages the cutting department of Greene Campbell Company. He purchased a tree-cutting machine on January 1, year 2, for $380,000. The machine had an estimated useful life of 5 years and zero salvage value, and the cost to operate it is $86,000 per year. Technological developments resulted in the development of a more advanced machine available for purchase on January 1, year 3, that would allow a 30 percent reduction in operating costs. The new machine would cost $240,000 and have a 4- year useful life and zero salvage value. The current market value of the old machine on January 1, year 3, is $250,000, and its book value is $304,000 on that date. Straight-line depreciation is used for both machines. The company expects to generate $225,000 of revenue per year from the use of either machine. Required a. Recommend whether to replace the old machine on January 1, year 3. b. Prepare income statements for four years (year 3 through year 6) assuming that the old machine is…arrow_forward

- An engineer for a mining company is called upon to examine a mining property which is for sale and to advise his employer regarding its value. He estimates the “ore in sight” to be 440,000 tons and will base his value on this figure. The existing facilities will permit the removal of about 55,000 tons of ore per year. He estimates that the mining, transportation, and smelting cost will total about P5.75 per ton of ore and that the gross income per ton mined will be P11.75. Administrative expenses will be an addition of P30,000 per year. What will be the value of the mine to yield a 15% annual return on the investment throughout its life and to provide in addition for reinvestment of earnings at 4% so that the original capital investment will be intact at the end of the life of the mine? (depletion)arrow_forwardEV Box is a manufacturer of electric vehicle charging stations and charging software. The initial cost of one part of their manufacturing process was $130,000 with annual costs of $49,000. Revenues were $78,000 in year 1, increasing by $1000 per year. A salvage value of $23,000 was realized when the process was discontinued after 8 years. Determine the rate of return the company made on the process.arrow_forwardAllen International, Inc., manufactures chemicals. It needs to acquire a new piece of production equipment to work on production for a large order that Allen has received. The order is for a period of three years, and atthe end of that time the machine would be sold. Allen has received two supplier quotations, both of which will provide the required service. Quotation I has a first cost of $180,000 and an estimated salvage value of$50,000 at the end of three years. Its cost for operation and maintenance is estimated at $28,000 per year. Quotation II has a first cost of $200,000 and an estimated salvage value of $60,000 at the end of three years. Its cost for operation and maintenance is estimated at $17,000 per year. The company pays income tax at a rate of 40% on ordinary income and 28% on depreciation recovery. The machine will be depreciated using MACRS-GDS (asset class 28.0). Allen uses an after-tax MARR of 12% for economic analysis, and it plans to accept whichever of these two…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning