Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

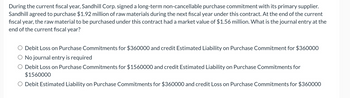

Transcribed Image Text:During the current fiscal year, Sandhill Corp. signed a long-term non-cancellable purchase commitment with its primary supplier.

Sandhill agreed to purchase $1.92 million of raw materials during the next fiscal year under this contract. At the end of the current

fiscal year, the raw material to be purchased under this contract had a market value of $1.56 million. What is the journal entry at the

end of the current fiscal year?

Debit Loss on Purchase Commitments for $360000 and credit Estimated Liability on Purchase Commitment for $360000

No journal entry is required

O Debit Loss on Purchase Commitments for $1560000 and credit Estimated Liability on Purchase Commitments for

$1560000

○ Debit Estimated Liability on Purchase Commitments for $360000 and credit Loss on Purchase Commitments for $360000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please do not give hand written answerarrow_forwardMN Plc's revenue as shown in its draft statement of profit or loss for the year ended 31 December 20X9 is GHS27m. This includes: (i) GHS8m for a consignment of goods sold on 31 December 20X9 on which MN Plc will incur ongoing service and support costs for two years after the sale. The cost of providing service and support is estimated at GHS800,000 per annum. MN Plc applies a 30% mark-up to all service costs. (ii) GHS4m collected on behalf of Aintree. MN Plc acts as an agent for Aintree and receives a 10% commission on all sales. At what amount should revenue be shown in the statement of profit or loss of MN Plc for the year ended 31 December 20X9? (Ignore the time value of money.) A. GHS22,920,000 B. GHS21,800,000 C. GHS20,520,000 D. GHS21,320,000arrow_forwardDuring 2019, the Mitt Co. signed a non-cancellable contract to purchase 2,000 units of a raw material at P 32 per pound. On December 31, 2019, the market price of the raw material is P 26 per unit, and the selling price of the finished product is expected to decline accordingly.The financial statement prepared for 2019 should report a. A loss of P 12,000 in the statement of comprehensive income. b. An appropriation of retained earnings for P 12,000. c. Nothing regarding this matter. d. A note describing the expected loss on the purchase commitment.arrow_forward

- Newmarket's revenue as shown in its draft statement of profit or loss for the year ended 31 December 20X9 is $27 million. This includes $8 million for a consignment of goods sold on 31 December 20X9 on which Newmarket will incur ongoing service and support costs for two years after the sale. The supply of the goods and the provision of service and support are separate performance obligations under the terms of IFRS 15 Revenue from contracts with customers. The cost of providing service and support is estimated at $800,000 per annum. Newmarket applies a 30% mark-up to all service costs. At what amount should revenue be shown in the statement of profit or loss of Newmarket for the year ended 31 December 20X9? (Ignore the time value of money.)arrow_forwardSubject: acountingarrow_forwardIn 2021, a merchandise was sold on instalment basis by ONB for P80, 000 at a gross profit of 25% on cost. During this year, a total of P42, 500, including interest of P12, 500 was collected on this contract. In 2021, no collection was made on this sale, and the merchandise was repossessed. The fair value of the merchandise is P34, 000. Reconditioning cost amounts to P4, 000. What is the gain (loss) on reposition? a. 10, 000 b. (6, 000) c. (14, 000) d. (10, 000)arrow_forward

- On October 31, Year 1, Trailer Homes Company (THC) determines that it will need to buy 175,000 lbs, of aluminum siding panels on April 30, Year 2. In order to hedge the risk that the price of the aluminum siding panels will increase in six months the Treasurer simultaneously takes a long position in an aluminum forward contract, where the company agrees to purchase 175,000 lbs, of aluminum for $3.756/lb. on April 30, Year 2. The prices for the aluminum siding panels and the aluminum forward are as follows. Aluminum Siding /lb. Aluminum Forward/Ib. October 31, Year 1 $5.390 $3,756 January 31, Year 1 $5.552 $3. 881 $5.768 $3.925 April 30, Year 2 inanols onarrow_forwardEye Deal Optometry leased vision-testing equipment from Insight Machines on January 1, 2021. Insight Machines manufactured the equipment at a cost of $290,000 and lists a cash selling price of $333,293. Appropriate adjusting entries are made quarterly. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly lease payments Economic life of asset Interest rate charged by the lessor Required: 1. Prepare appropriate entries for Eye Deal to record the arrangement at its beginning, January 1, 2021, and on March 31, 2021. 2. Prepare appropriate entries for Insight Machines to record the arrangement at its beginning, January 1, 2021, and on March 31, 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare appropriate entries for Eye Deal to record the arrangement at its beginning, January 1, 2021, and on March 31, 2021. (If no entry is…arrow_forwardKk.303.arrow_forward

- On June 30, 2021, Casio Sony Company sold a property carried in inventory at a cost of P1,894,200 for P2,800,000. A 20% down payment was made and the balance payable in 8 equal installments of P280,000, payable quarterly starting September 30 and December 31, 2021. The market rate of interest is 12%.Required:How much is the total realized gross profit in 2021?arrow_forwardBlossom Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures Ltd. The contract is a non-cancellable fixed price contract for $10.0 million. The following data pertain to the construction period (all figures in thousands). Costs for the year Estimated costs to complete Progress billings for the year (non-refundable) Cash collected for the year Gross profit/(loss) $ eTextbook and Media List of Accounts Account Titles and Explanation (To record cost of construction) The construction industry has experienced significant expansion, making construction materials and labour more costly than originally estimated. Blossom finds it extremely difficult to estimate the costs to complete construction and therefore difficult to estimate the percent complete. It must account for the construction project using the zero-profit method. (To record progress billings) Calculate the amount of the gross profit to be recognized each year of…arrow_forwardKoolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning