Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

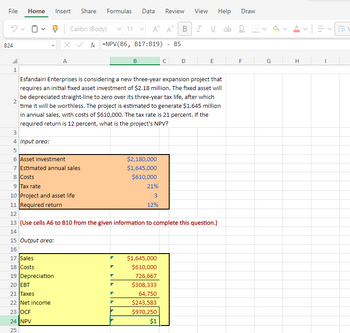

i need the correct excel input for the

Transcribed Image Text:File

Home

Insert Share Formulas

Data Review View Help Draw

B24

✓

Calibri (Body)

Xfx NPV(B6, B17:B19) - B5

11

✓

Α' Α' BIUab D

A

B

C

D

E

F

G

H

1

2

3

Esfandairi Enterprises is considering a new three-year expansion project that

requires an initial fixed asset investment of $2.18 million. The fixed asset will

be depreciated straight-line to zero over its three-year tax life, after which

time it will be worthless. The project is estimated to generate $1.645 million

in annual sales, with costs of $610,000. The tax rate is 21 percent. If the

required return is 12 percent, what is the project's NPV?

4 Input area:

56

6 Asset investment

$2,180,000

7 Estimated annual sales

$1,645,000

8 Costs

$610,000

9 Tax rate

21%

10 Project and asset life

3

12%

11 Required return

12

13 (Use cells A6 to B10 from the given information to complete this question.)

14

15 Output area:

16

17 Sales

$1,645,000

18 Costs

$610,000

19 Depreciation

726,667

20 EBT

$308,333

21 Taxes

64,750

22 Net income

$243,583

23 OCF

$970,250

24 NPV

25

$1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- You are given the following data for a project that is to be evaluated using the APV method. Year EBIT CAPEX 0 O $201.765 O $193,822 O $185,617 O $222,872 O $213,918 1 $127.000 $60,000 2 Depreciation Increase in NWC Year-end net debt $80,000 Cost of net debt = 8% Unlevered cost of capital = 11.8% Corporate tax rate = 30% Calculate the total value of the project at t = 0. using the APV method. $72,000 $50,000 $100,000 $133,000 $40,000 $80,000 $60,000 $140,000 3 $138.500 $10,000 $84,000 $30,000 $140,000arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease help me find the NPV using Excel. Esfandairi Ent. is considering a new three-year expansion project that requires an initial fixed asset...arrow_forward

- NCF practice a) What is the ncf from the sale of this asset - purchased for $250,000, 7-year property, sold at end of year 6 for $50,000, tax rate = 21%? basis = MACRS depreciation (as decimal) * sale price step 1: sales price - basis = gain/loss step 2: gain * loss tax rate = tax step 3: sales price - tax = ncfarrow_forwardBegin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbooks Web site. a. Using the financial statements shown here for Lan Chen Technologies, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for 2020. The federal-plus-state tax rate is 25%. b. Assume there were 15 million shares outstanding at the end of 2019, the year-end closing stock price was 65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2020. Lan Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars) Lan Chen Technologies: December 31 Balance Sheets (Thousands of Dollars)arrow_forwardEco Don't upload any image pleasearrow_forward

- Correct answer Pleasearrow_forwardent question Time Left : 01:39:30 Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0 -$290 -$400 1 -387 134 2 -193 134 3 -100 134 4 600 134 5 600 134 6 850 134 7 -180 134 What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A % Project B % Calculate the two projects' NPVs, if you were told that each project's cost of capital was 14%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A $ Project B $ Calculate the two projects' NPVs, if the cost of capital was 17%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A $ Project B $ What is each project's MIRR at a cost of capital of 14%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations.…arrow_forwardNEED the correct EXCEL INPUT, not just the number answer, please provide the excel code to get the answer from the imagearrow_forward

- 10. please answer part b thanksarrow_forwardA company is considering two (2) capital expenditure proposals, X and Y. Both options will generate the new line of product that the company will produce. Both are expected to operate for four (4) years. Only one (1) proposal will be accepted. The following information is provided to you: X Y Acquisition cost P46,000.00 P46,000.00 Life 4 4 Profits after depreciation Year 1 P6,500.00 P4,500.00 Year 2 3,500.00 2,500.00 Year 3 13,500.00 4,500.00 Year 4 -1,500.00 14,500.00 Scrap value 4,000.00 4,000.00 Depreciation is charged on a straight-line basis. Required: Calculate the Payback Period for both proposals. Which proposal fared better? Calculate the ARR for both Which proposal fared better? Which appraisal method will you use to decide on this product?arrow_forwardUSF x My Home CengageNOWv2 | Online teachir X agenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker =&takeAssignmentSessionLocator=&inpro... to 田 Sunrise Inc. is considering a capital investment proposal that costs $227,500 and has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows: Year Net Cash Flow 1 $97,500 2. 80,000 3 60,000 4 40,000 The minimum desired rate of return for net present value analysis is 10%. The factors for the present value of $1 at the compound interest rate of 10% for 1, 2, 3, and 4 years are 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Round interim answers to the nearest dollar. Enter a negative value as negative number.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning