Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Get The Solution with proper finance Subject mathod

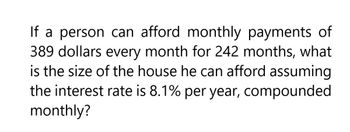

Transcribed Image Text:If a person can afford monthly payments of

389 dollars every month for 242 months, what

is the size of the house he can afford assuming

the interest rate is 8.1% per year, compounded

monthly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardSuppose that Jacob would like to invest at the end of each month for the next 15 years into an account paying 6.72% compounded monthly in order to accumulate $10,000 at the end of that time? How much money must Jacob deposit into the account each month? How much interest will he have earned?arrow_forwardYou borrow $364000 for the the purchase of a house at an APR of 7.52% for 15 years. Your monthly payment is $3378.46. How much money will you pay in interest for this loan?arrow_forward

- You can afford to pay $15,000 at the end of each of the next 30 years to repay a home loan. If the interest rate is 7.50%, what is the most you can borrow?arrow_forwardAfter making payments of $901.10 for 6 years on your 30-year loan at 8.9%, you decide to sell your home. What is the loan payoff?arrow_forwardSuppose that you would like to have $25,000 to use as a down payment for a home in five years by making regular deposits at the end of every three months in an annuity that pays 7.25% compounded quarterly. Determine the amount of each deposit. Round up to the nearest dollar. How much of the $25,000 comes from deposits and how much comes from interest?arrow_forward

- You would Ilike to have $59,000 in 5 years for the down payment on a new house following graduation by making deposits at the end of every three months in an annuity that pays 4.25% compounded quarterly. (a) How much should you deposit at the end of every three months? (b) How much of the $59,000 comes from deposits? (c) How much of the $59,000 comes from interest? (Round UP to the nearest dollar. For example, $247) OPensyrooo n 21 l 1e0 (6)' s 6Tei 0hcc doirdW (b)Saaviz wDi 26. 7 1 0 59.000 6 00arrow_forwardYou would like to save $250,000for retirement. If you are planning to retire 30 years from now, how much should you deposit each month into an account that pays 7.2% interest compounded monthly? What is the total interest earned?arrow_forwardHow much is your monthly payment?arrow_forward

- An individual needs $12,000 immediately as a down payment on a new home. Suppose that he can borrow this money from his insurance company. He must repay the loan in equal payments every six months over the next eight years. The nominal interest rate being charged is 7% compounded continuously. What is the amount of each payment?arrow_forwardSuppose you put $ 600 a month for retirement into an annuity earning 7.5% compounded monthly. If you need $ 550000 to retire, in how many years will you be able to retire?arrow_forwardSuppose you want to have $ 367733 for retirement in 31 years. Your account earns 4.4 % interest monthly. How much interest will you earn?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College