FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

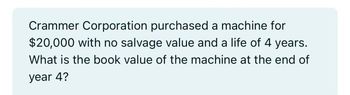

Transcribed Image Text:Crammer Corporation purchased a machine for

$20,000 with no salvage value and a life of 4 years.

What is the book value of the machine at the end of

year 4?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2000, Paradise Condo Inc. bought a new apartment building that was rented out to families on June 21st, 2000. The purchase cost was 697,798 dollars and in addition it had to spend 13,622 dollars remodeling the space. Paradise Condo estimated that in 2030 the building would have a net salvage value of $100,000. Using the US Straight Line Depreciation Schedule, compute the value of depreciation recorded in the accounting books in the year 2000. (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas) You Answered 20,380.67 Correct Answer 14,012.84 margin of error +/- 10arrow_forwardA personal computer that originally cost $5,000 has no estimated salvage value and was depreciated at the rate of 20% a year. At the end of the third year, the computer was sold for $1,500 cash. The transaction would result in a a. loss of $1,500. Ob. gain of $250. Oc. loss of $250. Od. gain of $1,500.arrow_forwardMartinez Corp. bought equipment on January 1, 2022. The equipment cost $380000 and had an expected salvage value of $65000. The life of the equipment was estimated to be 5 years. The depreciable cost of the equipment isarrow_forward

- 11. Gingerbread Corp had been depreciating a delivery truck for 3 years when it decided to sell the truck. The historical cost of the delivery truck was $40,000 with an estimated salvage value of $5,000 and a useful life of 7 years. The company had recorded $7,000 of depreciation expense every year for three years. The company sold the truck for $21,000. What is the gain or loss recorded on the sale of the truck. a.Loss of $4,000 b.Gain of $2,000 c.Gain of $4,000 d.Loss of $2,000arrow_forwardXYZ bought an asset that cost $200,000 at the beginning of the year. It has a salvage value of $30,000. The useful life of the asset is 10 years. How much will the company's total depreciation expense be over the asset's 10 year life? Group of answer choices $200,000 $170,000 $30,000 $20,000arrow_forwardThe Seliger Company has a building that it originally bought for $100,000. As of December 31, 2012, there is $10,000 of Accumulated Depreciation on the building (it was being straight-line depreciated over 10 years with no salvage value). On January 1, 2013, Seliger decides to change the remaining useful life to 5 years (starting now) with a $50,000 salvage value. What will be the depreciation on the building in 2013? $20,000 $10,000 $8,000 $12,500 $13,000 O O O O Oarrow_forward

- Sandhill Motor Corporation bought equipment on January 1, 2025. The equipment cost $340000 and had an expected salvage value of $65000. The life of the equipment was estimated to be 4 years. The depreciable cost of the equipment is O $275000. O $68750. O $65000 O $340000.arrow_forwardCarla Vista Products purchased a machine for $66400 on July 1, 2025. The company intends to depreciate it over 8 years using the double-declining balance method. The salvage value is $6700. Depreciation for 2026 to the closest dollar is $8300. O $33200. O $14525. $13200.arrow_forwardWarren Enterprises purchased a van for $21,510. The van has a salvage value of $3,800, and an estimated useful life of eight years. Warren plans to use the straight line method of depreciation. The accumulated depreciation at the end of year 3 would be $___ Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Lou Lou and Company purchased a piece of machinery 2 years ago for $50,000 and has depreciation to date of $15,000. The fair market value of the asset is $30,000, but the company believes it can achieve $34,000 in net future cash flows from the asset. Costs to dispose of the asset is $200. Assuming the asset is held for use, determine if the asset is impaired. If so, what is the amount of the write-off? The asset is impaired and Lou Lou should record a $1,000 loss on impairment. The asset is impaired and Lou Lou should record a $5,200 loss on impairment. The asset is NOT impaired. The asset is impaired and Lou Lou should record a $5,000 loss on impairment.arrow_forwardHampton Inc. purchased a machine to use in its business. The machine is estimated to have an economic life of 10 (ten) years before it becomes obsolete. The company expects to use the machine for 4 (four) years before it sells the machine to another company. Hampton uses the straight-line depreciation method. Question: How many years should Hampton depreciate this asset over? (4,7,10, or 14)arrow_forwardOn May 1, 2017 Merron Inc. sold a machine that it no longer had any use for. Merron sold the machine for $2,000 cash. The original cost of the machine was $32,000 and at December 31, 2016 the accumulated depreciation on the machine was $26,000. The machine had an original useful life of 10 years with zero estimated residual value. Merron uses the straight-line method to depreciate all of their machines. Required: Prepare the journal entries required for this transaction.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education