FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

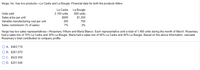

Transcribed Image Text:Verge, Inc. has two products-Le Cadre and La Bougie. Financial data for both the products follow:

Le Cadre

La Bougie

800 units

2,100 units

$600

Units sold

Sales price per unit

Variable manufacturing cost per unit

Sales commission (% of sales)

$1,200

300

700

7%

3%

Verge has two sales representatives-Rosemary Wilson and Maria Blanco. Each representative sold a total of 1,450 units during the month of March. Rosemary

had a sales mix of 70% Le Cadre and 30% La Bougie. Maria had a sales mix of 60% Le Cadre and 40% La Bougie. Based on the above information, calculate

Rosemary's total contribution to company profits.

O A. $463,710

O B. $261,870

OC. $522,000

O D. $201,840

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Jerry, Incorporated 6 Kate Company 60 3,000 460 4 50 15 3 190 4 es Number of sales calls Colleen sells its products at $230 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Deliveries Cost Driver and Rate $800 per visit 280 per order. 440 per order Order processing 240 per return and $3 per unit returned 83,000 per month. Sales returns Sales salary Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen…arrow_forwardVinubhaiarrow_forwardPathways Careers, Inc. has two products-Resume Reader and Cover Letter Cure. Financial data for both the products follow: Resume Cover Letter Reader Cure 2,600 units 1,300 units Units sold Sales price per unit Variable manufacturing cost per unit Sales commission (% of sales) $600 320 6% $1,000 650 4% Pathways has two sales representatives-Curtis Muller and Willow Brown. Each sales representative sold a total of 1,950 units during the month of March. Curtis had a sales mix of 60% Resume Reader and 40% Cover Letter Cure. Willow had a sales mix of 80% Resume Reader and 20% Cover Letter Cure. Based on the above information, calculate Willow's total contribution to company profits. OA. $380,640 O B. $120,900 OC. $501,540 OD. $573,300arrow_forward

- For February, sales revenue is $620,000, sales commissions are 6% of sales, the sales manager's salary is $80,300, advertising expenses are $80,200, shipping expenses total 2% of sale, and miscellaneous selling expenses are $2,700 plus 1/2 of 1% of sales. Total selling expenses for the month of February are O $212,800 O b. $200,400 O c. $215,900 Od $163,200arrow_forwardRamirez Corp. has two customers, C1 and C2. Ramirez Corp currently allocates indirect costs to customers at a rate of 5% of customer revenue. Data for C1 and C2 are as follows: C1 C2 Selling Price per Unit $20.00 $20.00 Units Sold 50,000 12,000 Manufacturing Cost per unit $15.00 $15.00 Number of Purchase Orders 112 27 Number of deliveries 105 68 Number of Inspection 77 50 Customer Visits 40 35 A. Using the current costing system to allocate support costs, calculate Operating Income for customers C1 and C2. Ramirez Corp.'s Management Accountant has gathered the following ABC rate information: ABC Cost Rate Number of purchase orders $40 per purchase order $85 per delivery $200 per expedited delivery Number of deliveries Number of inspections Number of customer visits $400 per customer visit b. Calculate the total support cost allocated to C1 & C2 using the Activity Based Costing (ABC) system. c. Comparing the indirect cost allocated in part a. to the indirect cost allocated in part b.…arrow_forwardPharoah Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 22% of sales. The income statement for the year ending December 31, 2025, is as follows. PHAROAH BEAUTY CORPORATION Income Statement For the Year Ended December 31, 2025 Sales | Cost of goods sold Variable Fixed Gross profit Selling and marketing expenses Commissions Fixed costs Operating income $30,760,000 8,580,000 $16,918,000 10,070,400 $76,900,000 39,340,000 $37,560,000 26,988,400 $10,571,600 (a) ✓ Your answer is correct. Under the current policy of using a network of sales agents, calculate the Pharoah Beauty Corporation's break-even point in sales dollars for the year 2025. (b) Break-even point $ eTextbook and Media Calculate the company's break-even point in sales dollars for the year 2025 if it hires its own sales force to replace the network of agents. Break-even point $ eTextbook and Media Save for Later Attempts: 1 of 2 used The…arrow_forward

- Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Jerry, Incorporated Kate Company 6 30 1,000 420 4 5 50 13 140 5 Colleen sells its products at $290 per unit. The firm's gross margin ratio is 20%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Cost Driver and Rate $800 per visit Order processing Deliveries Sales returns Sales salary Required: 180 per order 410 per order 270 per return and $3 per unit returned 107,000 per month 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company…arrow_forwardMienfoo Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume: Sales volume (units) 9,500 11,490 Cost of sales ₱ 731,500 ₱ 884,730 Selling and administrative costs ₱ 696,000 ₱ 739,780 The company sells the product for ₱134.00 per unit. The best estimate of the TOTAL CONTRIBUTION MARGIN when 10,070 units are sold is ₱_________________arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education