FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

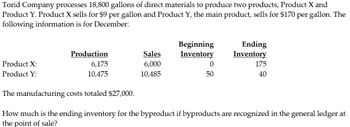

Transcribed Image Text:Torid Company processes 18,800 gallons of direct materials to produce two products, Product X and

Product Y. Product X sells for $9 per gallon and Product Y, the main product, sells for $170 per gallon. The

following information is for December:

Product X:

Product Y:

Production

6,175

10,475

Sales

6,000

10,485

Beginning

Inventory

0

50

Ending

Inventory

175

40

The manufacturing costs totaled $27,000.

How much is the ending inventory for the byproduct if byproducts are recognized in the general ledger at

the point of sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forwardCortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 230 units at $45 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 265-unit purchase at $50 per unit; the second was a 360-unit purchase at $52 per unit. During the period, it sold 535 chairs. RequiredDetermine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses FIFO. LIFO. Weighted average.arrow_forwardCortez Company sells chairs that are used at computer stations. Its beginning Inventory of chairs was 230 units at $44 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 295-unit purchase at $49 per unit; the second was a 355-unit purchase at $51 per unit. During the period, It sold 585 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending Inventory, assuming that Cortez uses a. FIFO b. LIFO c. Weighted average. (Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount.) Cost of goods sold Ending inventory FIFO 0.120 LIFO Weighted Averagearrow_forward

- harshalarrow_forwardFresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (192,000 units) during the first month, creating an ending inventory of 21,000 units. During February, the company produced 171,000 units during the month but sold 192,000 units at $560 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Number of Units Unit Cost TotalCost Manufacturing costs in February 1 beginning inventory: Variable 21,000 $280.00 $5,880,000 Fixed 21,000 24.00 504,000 Total $304.00 $6,384,000 Manufacturing costs in February: Variable 171,000 $280.00 $47,880,000 Fixed 171,000 27.70 4,736,700 Total $307.70 $52,616,700 Selling and administrative expenses in February: Variable 192,000 18.50 $3,552,000 Fixed 192,000 2.00 384,000 Total 20.50 $3,936,000 a. Prepare an income…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forward

- Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October: Trees processed: 280 trees Production: paper 160,000 sheets pencil casings 160,000 Sales: paper 147,000 at $0.10 per page pencil casings 158,500 at $0.13 per casing The cost of purchasing 280 trees and processing them up to the split-off point to yield 160,000 sheets of paper and 160,000 pencil casings is $13,000. Bismite's accounting department reported no beginning inventory. What is the total sales value at the split-off point for paper?arrow_forwardDuring March of the current year, Rolly Company purchased P3,500,000 raw materials. During the month, Reyes incurred P2,040,000 direct labor cost and applied 80% of direct labor cost. During the same month, there were changes in inventories as follows: Increase in raw materials P100,000; Decrease in work in process P150,000 and decrease in finished goods 75,000. If the goods available for sale is P7,500,000, what is the amount of finished goods at March 1? a.P203,000 b.P278,000 c.P 0 d.P 75,000arrow_forwardLens Junction sells lenses for $44 each and is estimating sales of 16,000 units in January and 19,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $22 per hour. Desired inventory levels are: Jan. 31 Feb. 28 Mar. 31 Beginning inventory Finished goods 4,500 5,100 5,200 Direct materials: silicon 8,600 9,000 9,300 Direct materials: solution 11,400 12,200 12,800 c). Prepare direct materials budget for silicon. d). Prepare a direct labor budget.arrow_forward

- 2. Lens Junction has required production of 15,400 units in January and 18,100 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound and 3 ounces of solution costing $3 per ounce. Desired inventory levels are: Jan. Feb. Mar. Beginning Inventory: Finished Goods (units) 4,500 4,900 5,000 DM - Silicon (pounds) 8,500 9,100 9,200 DM - Solution (ounces) 11,200 12,000 13,000 PLEASE NOTE: Units are rounded to whole numbers with commas as needed (i.e. 1,234) - no labels. All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345), except for any "per" amounts (units, pounds, ounces, or dollars), which are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56) - no labels. Cost per Pound Desired Ending Inventory DM per Unit Ounces Needed for Production Required DM Ounces Pounds Needed for Production Units to be Produced Total Cost of DM Purchase Required DM Pounds…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forwardSuperStar company operates 50 weeks per year, and its cost of goods sold last year was $2,000,000. The firm carries four items in inventory: two raw materials, two work-in-process items. The following table shows last year's average inventory levels for these items, along with their unit values. Part Number RM₁ RM₂ WIP₁ WIP₂ 7.175 4.175 6.175 Average 5.175 Inventory (units) Value ($/unit) 15,000 10,000 5,000 6,000 How many weeks of supply does the firm have? 3.00 5.00 8.00 12.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education