FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

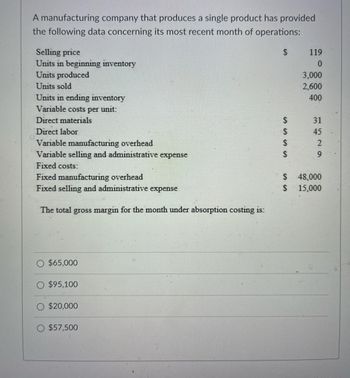

Transcribed Image Text:A manufacturing company that produces a single product has provided

the following data concerning its most recent month of operations:

Selling price

Units in beginning inventory

Units produced

Units sold

Units in ending inventory

Variable costs per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative expense

Fixed costs:

Fixed manufacturing overhead

Fixed selling and administrative expense

The total gross margin for the month under absorption costing is:

$65,000

$95,100

$20,000

$57,500

S

SSSS

S

S

119

0

3,000

2,600

400

31 45 29

48,000

15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the Total period cost for April under variable costing?A. P 55,200 B. P 82,500 C. P 123,900D. P 137,700arrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense 154 2,560 2,230 330 51 24 $. 15 16 $92,160 $11,150 The tegross margin for the month under absorption costing is: Multiple Chotce $62.440 S15.610, K Prev 4: of 10 Next > ere to searcharrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead $ 147 0 6,900 6,600 300 Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $ 24 $ 54 $ 18 $ 18 $ 186,300 $ 27,600 Multiple Choice $114 per unit $141 per unit $123 per unitarrow_forward

- need helparrow_forward1. COMPUTE THE UNIT PRODUCT COST UNDER ABSORPTION COSTING 2. COMPUTE THE UNIT PRODUCT COST UNDER VARIABLE COSTINGarrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (5,600 units) Cost of goods sold: Cost of goods manufactured (6,600 units) Inventory, April 30 (900 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Variable cost of goods sold: $138,600 (18,900) Fixed costs: $162,400 If the fixed manufacturing costs were $30,492 and the fixed selling and administrative expenses were $12,600, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 (119,700) $42,700 (25,720) $16,980arrow_forward

- Estimated Income Statements, using Absorption and Variable Costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: Sales (23,200 x $81) $1,879,200 Manufacturing costs (23,200 units): Direct materials 1,127,520 Direct labor 266,800 Variable factory overhead 125,280 Fixed factory overhead 148,480 Fixed selling and administrative expenses 40,400 Variable selling and administrative expenses 48,800 The company is evaluating a proposal to manufacture 25,600 units instead of 23,200 units, thus creating an ending inventory of 2,400 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, comparing operating results if 23,200 and 25,600 units are manufactured in the absorption costing format. If an amount box does not…arrow_forwardNonearrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead. Variable selling and administrative expense Multiple Choice Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $110 per unit $137 per unit $143 0 $120 per unit 6,850 6,550 300 $93 per unit $23 $53 $17 $17 $184,950 $ 27,300arrow_forward

- don't give answer in image formatarrow_forwardVariable costs per unit: Direct materials A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory $ 131 0 3,320 2,890 430 $ 45 Direct labor Variable manufacturing overhead $ 15 $ 7 Variable selling and administrative expense Fixed costs: $ 19 Fixed manufacturing overhead $92,960 Fixed selling and administrative expense $28,900 The total gross margin for the month under absorption costing is:arrow_forwardDowell Company produces a single product. Its Income under variable costing for its first two years of operation follow. Variable Costing Income Income Units Units produced Units sold Additional Information a. Sales and production data for these first two years follow. Year 1 $ 43,000 Year 1 44,300 33,000 Direct materials Direct labor Variable overhead Fixed overhead ($430,000/43,000 units) Total product cost per unit Variable costing income Year 2 b. The company's $32 per unit product cost (for both years) using absorption costing consists of the following. Absorption costing income 44,300 55,600 Year 2 $ 610,000 Required: Prepare a statement to convert variable costing income to absorption costing income for both years. (Leave no cells blank - be certain to enter "0" wherever required.) $6 Dowell Company Convert Variable Costing Income to Absorption Costing Income Year 1 $ 9 7 10 $32 43,000 $ Year 2 610,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education