Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

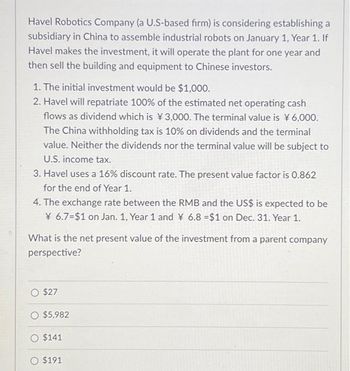

Transcribed Image Text:Havel Robotics Company (a U.S-based firm) is considering establishing a

subsidiary in China to assemble industrial robots on January 1, Year 1. If

Havel makes the investment, it will operate the plant for one year and

then sell the building and equipment to Chinese investors.

1. The initial investment would be $1,000.

2. Havel will repatriate 100% of the estimated net operating cash

flows as dividend which is ¥3,000. The terminal value is ¥6,000.

The China withholding tax is 10% on dividends and the terminal

value. Neither the dividends nor the terminal value will be subject to

U.S. income tax.

3. Havel uses a 16% discount rate. The present value factor is 0.862

for the end of Year 1.

4. The exchange rate between the RMB and the US$ is expected to be

¥6.7=$1 on Jan. 1, Year 1 and ¥ 6.8 =$1 on Dec. 31. Year 1.

What is the net present value of the investment from a parent company

perspective?

$27

O $5,982

O $141

$191

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow -$590,000 0 1 2 √34 3 220,000 163,000 228,000 207,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 7 percent. Assume Anderson uses a required return of 13 percent on this project. a. What is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR of the project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. X Answer is complete but not entirely correct. NPV IRR $ 17,315.59 x 14.40 × %arrow_forwardCompute the necessary calculations and advise Apple Limited if it is worth investing in neither, in one or both of these two opportunitiesarrow_forwardLeland Industries is a producer of bakery and snack goods in Western Canada and are considering expending into Eastern Canada. The expansion is estimated to cost $10,000,000 for a new production facility. This project is in the same line of business as the firm's current operations and is therefore not expected to alter the risk of the firm. The most recent balance sheet is provided below. Leland Industries Balance Sheet As at Dec 31, 2021 Assets Liabilities Accounts Payable Other Current Liabilities $ Cash & Marketable Securities 425,000 300,000 Accounts Receivable $ 400,000 425,000 Inventories 500,000 Total Current Liabilities 725,000 Total Current Assets $ 1,325,000 Net Fixed Assets 18,000,000 LT Debt * 6,500,000 Preferred Stock ** 2,500,000 Common Stock*** 3,000,000 Retained Earnings 6,600,000 Total Liabilities & Total Assets $ 19,325,000 Owners Equity $ 19,325,000 Notes to financial statements: * The 5% semi-annual coupon bonds have a face value of $1,000, were issued 5 years ago…arrow_forward

- Exhibit 30 (This relates to question below) Assume that Baps Corp. is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5 million. If the project is undertaken, Baps would terminate the project after four years. Baps's cost of capital is 13 percent, and the project has the same risk as Baps's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK): Year 1 NOK10,000,000 Year 1 Year 2 $.13 NOK15,000,000 Year 2 Year 3 The current exchange rate of the Norwegian kroner is $.135. Baps's exchange rate forecasts for the Norwegian kroner over the project's lifetime are listed below: $.14 NOK17,000,000 Year 3 Year 4 $.12 NOK20,000,000 Year 4 $.15 Refer to Exhibit 30. What is the net present value of the Norwegian project?arrow_forwardSelect- (increases/reduces) please show with steps thanks!arrow_forwarda) watax inc a mining outfit in phoenix intends to engage in mining operations in southern Africa after conducting comprehensive feasibility of the referenced country. Assume that the prevailing interest rate in South Africa is 9 percent. To meet its working capital needs, watax will borrow south African rands, convert them to us dollars, and repay the loan in one year. What will watax effective financing rate if the rand depreciates by 6 perfect or appreciates by 3 percent. Discuss your result. b) given the information and assuming a 50 % probability that either scenario would occur, determinate the expected value of the effective financing rate. c) Assume that the one tear prevailing interest in mexico is 5 percent while that in the US is 8%. What percentage change in the peso would cause a US firm borrowing peso to incur the same effective financing rate as it would it borrowed dollars. Discuss the resultarrow_forward

- JJ. 178.arrow_forwardAnderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow -$590,000 O 1 2 3 4 220,000 163,000 228,000 207,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 7 percent. Assume Anderson uses a required return of 13 percent on this project. a. What is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR of the project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardInvolves the purchase of a lumber mill operation located in Nova Scotia. You have estimated the initial investment as $1,000,000 and the annual pre-tax cash flow over the next 10 years as $200,000 at which point the operation will be obsolete. If GBEI decides to invest in the lumber mill operation, it will be financed using the same proportions of debt and equity that GWEI currently uses. You have collected information on a publicly-traded lumber products company whose primary line of business is similar to GBEI’s lumber mill operation – this has led you to recommend a discount rate of 11.27% for this investment. Assume straight line depreciation. 1. Calculate the NPV, Payback Period, and Profitability Index of the lumber mill operation.arrow_forward

- Nonearrow_forwardCullumber Inc. is planning to expand operations into South America in 8 years. The first three years, Cullumber will spend on feasibility and marketing studies. Once those studies are complete, Cullumber plans to invest $198000 per year for the remaining five years. What amount will Cullumber have at the end of the eight-year period for the expansion assuming a 11% interest rate? ○ $1431104 $990000 ○ $2348167 ○ $1233104arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education