Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

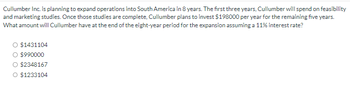

Transcribed Image Text:Cullumber Inc. is planning to expand operations into South America in 8 years. The first three years, Cullumber will spend on feasibility

and marketing studies. Once those studies are complete, Cullumber plans to invest $198000 per year for the remaining five years.

What amount will Cullumber have at the end of the eight-year period for the expansion assuming a 11% interest rate?

○ $1431104

$990000

○ $2348167

○ $1233104

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Carlson Inc. is evaluating a project in India that would require a $6.0 million after-tax investment today (t = 0). The after-tax cash flows would depend on whether India imposes a new property tax. There is a 50-50 chance that the tax will pass, in which case the project will produce after-tax cash flows of $1,100,000 at the end of each of the next 5 years. If the tax doesn't pass, the after-tax cash flows will be $2,100,000 for 5 years. The project has a WACC of 10.2%. The firm would have the option to abandon the project 1 year from now, and if it is abandoned, the firm would receive the expected $1.10 million cash flow at t = 1 and would also sell the property and receive $4.95 million after taxes at t = 1. If the project is abandoned, the company would receive no further cash inflows from it. What is the value (in thousands) of this abandonment option? Do not round intermediate calculations. a. $1,124 b. $739 c. $705 d. $671 e. $34arrow_forward4. Portland Ltd, an Australian firm, needs AUD10 million to finance a new project in USA. The company has the capacity to borrow either from an Australian bank which offers 7% (AUD loan) annual interest rate or from a USA bank which offers 6% (USD loan) annual interest rate. The loan expects to settle after one year period. You found following additional information: The current spot is USD1.0654/AUD One year forward rate is USD1.0455/AUD. Required: Recommend the loan which provides better off to the company.arrow_forwardCarlson Inc. is evaluating a project in India that would require a $5.5 million after-tax investment today (t = 0). The after-tax cash flows would depend on whether India imposes a new property tax. There is a 50-50 chance that the tax will pass, in which case the project will produce after-tax cash flows of $1,150,000 at the end of each of the next 5 years. If the tax doesn't pass, the after-tax cash flows will be $1,950,000 for 5 years. The project has a WACC of 12.0%. The firm would have the option to abandon the project 1 year from now, and if it is abandoned, the firm would receive the expected $1.15 million cash flow at t-1 and would also sell the property and receive $4.85 million after taxes at t-1. If the project is abandoned, the company would receive no further cash inflows from it. What is the value (in thousands) of this abandonment option? Do not round intermediate calculations. O a $87 b. 5781 c. $606 O d. 1963 Oe. $693arrow_forward

- Imperial Motors is considering producing its popular Rooster model in China. This will involve an initial investment of CNY 5.3 billion. The plant will start production after one year. It is expected to last for five years and have a salvage value at the end of this period of CNY 513 million in real terms. The plant will produce 100,000 cars a year. The firm anticipates that in the first year, it will be able to sell each car for CNY 78,000, and thereafter the price is expected to increase by 4% a year. Raw materials for each car are forecasted to cost CNY 31,000 in the first year, and these costs are predicted to increase by 3% annually. Total labor costs for the plant are expected to be CNY 2.4 billion in the first year and thereafter will increase by 7% a year. The land on which the plant is built can be rented for five years at a fixed cost of CNY 313 million a year payable at the beginning of each year. Imperial’s discount rate for this type of project is 10% (nominal). The…arrow_forwardAn MNC is considering establishing a two- year project in New Zealand with a USD$50 million initial investment. The required rate of return on this project is 11%. The project is expected to generate cash flows of NZ$15 million in Year 1 and NZ$35 million in Year 2, excluding the salvage value. Assume a stable exchange rate of USD$.70 per NZ$1 over the next two years. All cash flows are remitted to the parent. What is the break-even salvage value? about NZ$47 million about NZ$21 million about NZ$14 million about NZ$60 million about NZ$36 millionarrow_forwardSouthern Pole is developing a special vehicle for Antarctic exploration. The development requires investments of $100,000 today, $200,000 in 1 year from today and $300,000 in 2 years from today. Net returns for the project are expected to be $96,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project. (Chapter 16.2)arrow_forward

- ne Payback period The Ball Shoe Company is considering an investment project that requires an initial investment of $524,000 and returns after-tax cash inflows of $87,180 per year for 10 years. The firm has a maximum acceptable payback period of 8 years. a. Determine the payback period for this project. b. Should the company accept the project? ts a. The payback period for this project is years. (Round to two decimal places.) Text lia Libra Calculat Resource Enter vour answer in the answer box and then click Check Answer, = Study 1 part remaining Clear All Check. nication Tools > Question 9 (0/1) Question 10 (0/1) Question 11 (0/1) Ouestion 12 (0/1). Type here to searcharrow_forwardKara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) -$ 59,000 Cash Flow (B) 01234 24,000 31,400 26,000 12,000 -$ 104,000 26,000 31,000 28,000 236,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? a. Project A years Project B years b. Project acceptance Accept Project A and reject Project Barrow_forwardThe proposed expansion of CIV Electronics' plant facilities requires the immediate outlay of $102,000. Expected net returns are given in the following table. Calculate the internal rate of return (IRR) Year 1 Year 2 Year 3 $Nil $24,000 $30,000 Year 4 Year 5 Year 6 The internal rate of return is%. (Round to the nearest tenth as needed.) $53,000 $48,000 $17,000arrow_forward

- 113.arrow_forwarda) watax inc a mining outfit in phoenix intends to engage in mining operations in southern Africa after conducting comprehensive feasibility of the referenced country. Assume that the prevailing interest rate in South Africa is 9 percent. To meet its working capital needs, watax will borrow south African rands, convert them to us dollars, and repay the loan in one year. What will watax effective financing rate if the rand depreciates by 6 perfect or appreciates by 3 percent. Discuss your result. b) given the information and assuming a 50 % probability that either scenario would occur, determinate the expected value of the effective financing rate. c) Assume that the one tear prevailing interest in mexico is 5 percent while that in the US is 8%. What percentage change in the peso would cause a US firm borrowing peso to incur the same effective financing rate as it would it borrowed dollars. Discuss the resultarrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$10,000,000 (Singapore dollars). The required rate of return is expected to be 15.00% for all four years of the project. _____________________________ Year 0 Year 1 Year 2 Year 3 Year 4 Cash Flows to Parent, excluding Salvage Value $2,500,000 $2,500,000 $3,400,000 $3,800,000 Initial Investment $10,000,000 Which of the following most closely approximates the break-even salvage value? $2,938,788 $2,671,625 $2,137,300 $2,404,463arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education