Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please solve this financial accounting problem without use Ai

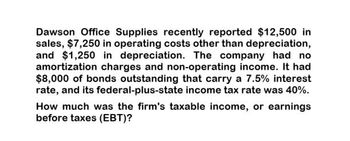

Transcribed Image Text:Dawson Office Supplies recently reported $12,500 in

sales, $7,250 in operating costs other than depreciation,

and $1,250 in depreciation. The company had no

amortization charges and non-operating income. It had

$8,000 of bonds outstanding that carry a 7.5% interest

rate, and its federal-plus-state income tax rate was 40%.

How much was the firm's taxable income, or earnings

before taxes (EBT)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Frederickson Office Supplies recently reported $10,000 of sales, $7,250 of operating costs other than depreciation and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes? a. $1,300 b. $1,100 c. $900 d. $1,200arrow_forwardA company recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? Show your answer using the income statement structure.arrow_forwardEdwards Electronics recently reported $11,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? a. $3,375.00 b. $3,045.94 c. $3,206.25 d. $2,748.96 e. $2,893.64arrow_forward

- Meric Mining Inc. recently reported $14,700 of sales, $7,600 of operating costs other than depreciation, and $1,100 of depreciation. The company had no amortization charges, it had outstanding $6,700 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 30%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes. Group of answer choices $3,320.84 $3,711.53 $3,906.88 $3,995.53 $4,102.22arrow_forwardEdwards Electronics recently reported $15,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Select the correct answer. a. $6,324.00 b. $6,349.50 Oc$6,273.00 O d. $6,298.50 e. $6,375.00arrow_forwardPluto Minerals recently reported $15,800 of sales, $10,600 of operating costs other than depreciation, and $1,100 of depreciation. The company had no amortization charges, no interest expense, and non-operating interest income from $8,000 of bonds carrying a 7.0% interest rate. Its federal-plus-state income tax rate was 25%. How much was the company's EBIT? $4,100 O $3,540 $3,495 O $3,075 O $4,660arrow_forward

- Infrared Vision Inc. recently reported $15,500 of sales, $13,700 of operating costs other than depreciation, and $1,800 of depreciation. The company had no amortization charges, it had outstanding $10,000 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 30%. How much was the firm's net income after taxes? The company uses the same depreciation expense for tax and stockholder reporting purposes.arrow_forwardLast year Tiemann Technologies reported $10,300 of sales, $6,450 of operating costs other than depreciation, and $1,400 of depreciation. The company had no amortization charges, it had $4,800 of bonds that carry a 6.0% interest rate, and its federal-plus-state income tax rate was 35%. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $700. By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes. Group of answer choices -455.00 -432.25 -500.50 -477.75 -409.50arrow_forwardGreen Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's earnings before taxes (EBT) * $4,627 $5,638 $5,114 $5,369 $4,870 Mori Company's net income last year was $25,000 and cash dividends declared and paid to the company's stockholders totaled $10,000. Changes in selected balance sheet accounts for the year appear below: Increases (Decreases) Debit balances: Accounts receivable $(6,000) Inventory $2,000 Prepaid expenses $(1,000) Long term investments $20,000 Credit balances: Accumulated depreciation $12,000 Accounts payable $9,000 Taxes payable $(5,000) Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be: * $46,000 $36,000 $37,000 $4,000arrow_forward

- abc corp recently reported 13000 of sales 5000 of operating costs other than depreciation and 4000 of depreciation. the company has no amortization charges and no non operating income it had issued 4000 of bonds that carry a 10% interest rate and its federal plus state income tax rate was 40%. what was the firms taxable or pre - tax income?arrow_forwardansarrow_forwardEmery Mining Inc. recently reported $125,000 of sales, $75,500 of operating costs other than depreciation, and $10,200 of depreciation. The company had $16,500 of outstanding bonds that carry a 7.25% interest rate, and its federal-plus-state income tax rate was 35%. How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT