Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need Correct solution in this financial account problems

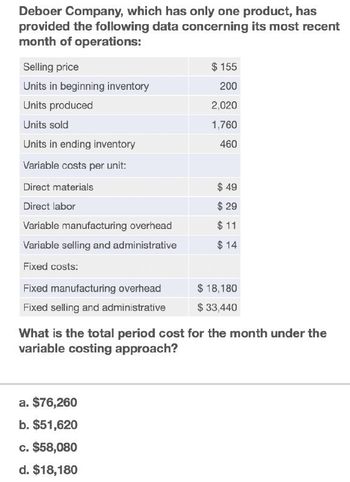

Transcribed Image Text:Deboer Company, which has only one product, has

provided the following data concerning its most recent

month of operations:

Selling price

Units in beginning inventory

Units produced

Units sold

Units in ending inventory

Variable costs per unit:

$ 155

200

2,020

1,760

460

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

$ 49

$ 29

$ 11

$ 14

Fixed costs:

Fixed manufacturing overhead

$ 18,180

Fixed selling and administrative

$ 33,440

What is the total period cost for the month under the

variable costing approach?

a. $76,260

b. $51,620

c. $58,080

d. $18,180

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Webster Company uses backflush costing to account for its manufacturing costs. The trigger points for recording inventory transactions are the purchase of materials, the completion of products, and the sale of completed products. Required: 1. Prepare journal entries, if needed, to account for the followingtransactions. a. Purchased raw materials on account, 135,000. b. Requisitioned raw materials to production, 135,000. c. Distributed direct labor costs, 20,000. d. Incurred manufacturing overhead costs, 80,000. (Use Various Credits for the credit part of the entry.) e. Cost of products completed, 235,000. f. Completed products sold for 355,000, on account. 2. Prepare any journal entries that would be different from theabove, if the only trigger points were the purchase of materialsand the sale of finished goods.arrow_forwardThe following production data came from the records of Olympic Enterprises for the year ended December 31, 2016: During the year, 40,000 units were manufactured but only 35,000 units were sold. Determine the effect on inventory valuation by computing the following: 1. Total inventoriable costs and the cost of the 35,000 units sold and of the 5,000 units in the ending inventory, using variable costing. 2. Total inventoriable costs and the cost of the 35,000 units sold and of the 5,000 units in the ending inventory, using absorption costing.arrow_forwardThe following information pertains to Vladamir, Inc., for last year: There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. Required: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3. Assume the selling price per unit is 29. Prepare an income statement using (a) variable costing and (b) absorption costing.arrow_forward

- Weighted Average Method, Unit Costs, Valuing Inventories Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: The costs that Byford had to account for during the month of November were as follows: Required: 1. Using the weighted average method, determine unit cost. 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory? 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.arrow_forwardCicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardInventory Accounts for a Manufacturing Company Fujita Company produces a single product. Costs accumulated at the end of the period are as follows: Assume the beginning raw materials inventory was 62,800, the beginning finished goods inventory was 118,400, and there was no beginning work-in-process inventory. Required: Compute the closing account balances of each of the three inventory accounts: Raw Materials, Work in Process, and Finished Goods.arrow_forward

- Inventory Valuation under Absorption Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. 3. What is the value of ending inventory under absorption costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardCircetrax, Inc. has provided the following financial information for the year: Finished Goods Inventory: Beginning balance, in units Units produced Units sold Ending balance, in units Production costs: Variable manufacturing costs per unit Total fixed manufacturing costs What is the unit product cost for the year using absorption costing? OA. $117 630 1,400 1,500 530 $50 $42,000 Warrow_forwardCost Flow Relationships The following information is available for the first year of operations of Engle Inc., a manufacturer of fabricating equipment: $819,700 221,300 73,800 30,300 13,900 418,000 904,900 30,300 Sales Gross profit Indirect labor Indirect materials Other factory overhead Materials purchased Total manufacturing costs for the period Materials inventory, end of period Using the above information, determine the following missing amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

- Subject: acountingarrow_forwardOber Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense Required: $ 127 0 8,970 8,540 430 $ 37 $ 36.50 $ 5.50 $ 12.50 $ 183,885 $ 109,900 a. Prepare a contribution format income statement for the month using variable costing. b. Prepare an income statement for the month using absorption costing.arrow_forwardCircetrax, Inc. has provided the following financial information for the year: Finished Goods Inventory: Beginning balance, in units 600 Units produced 2,800 Units sold 2,900 Ending balance, in units 500 Production costs: Variable manufacturing costs per unit $60 Total fixed manufacturing costs $42,000 What is the unit product cost for the year using absorption costing? A. $84 B. $75 C. $130 D. $74arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning