Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

How much cash did the business collect from customers on these general accounting question?

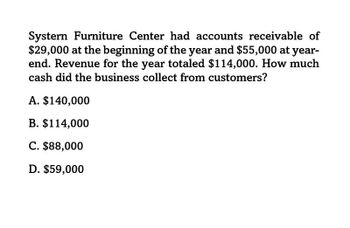

Transcribed Image Text:Systern Furniture Center had accounts receivable of

$29,000 at the beginning of the year and $55,000 at year-

end. Revenue for the year totaled $114,000. How much

cash did the business collect from customers?

A. $140,000

B. $114,000

C. $88,000

D. $59,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Greene Sisters has a DSO of 20 days. The companys average daily sales are 20,000. What is the level of its accounts receivable? Assume there are 365 days in a year.arrow_forwardProvide Answer of this one please need Correct Answer general accountingarrow_forwardPine Hardware Store had net credit sales of $6,500,000 and cost of goods sold of $5,000,000 for the year. The Accounts Receivable balances at the beginning and end of the year were $600,000 and $700,000, respectively. The receivables turnover was 10 times. 9.3 times. O 7.7 times. 10.8 times.arrow_forward

- During the year Tulip reported net sales of $960,000. The company had accounts receivable of $75,000 at the beginning of the year and $120,000 at the end of the year Compute Tulip’s average collection period (assume 365 days a year.)arrow_forwardMy business has a net sales of $3,492,690, of which 40% was cash ($1,397,076), 50% was on account ($1,746,345), 10% was prepaid sales ($349,269). How do I make one compound journal entry to recore the net sales for the end of the year? Date Accounts Debit Creditarrow_forwardOn April 30, Holden Company had an Accounts Receivable balance of $18,000. During the month of May. total credits to Accounts Receivable were $52,000 from customer payments. The May 31 Accounts Receivable balance was $13.000. What was the amount of credit sales during May? O $52,000. O $32,000. O $47,000. $57,000. O 55,000.arrow_forward

- Nathalie Drug Store had net credit sales of P6,000,000 and cost of goods sold of P2,000,000 for the year. The Accounts Receivable balances at the beginning and end of the year were P350,000 and P250,000, respectively. The accounts receivable turnover ratio was * a. 10.0 times. b. 17.1 times. c. 13.3 times. d. 20.0 times.arrow_forwardwiss Clothing Store had a balance in the Accounts Receivable account of $820,000 at the beginning of the year and a balance of $780,000 at the end of the year. Net credit sales during the year amounted to $7,200,000. The accounts receivable turnover ratio was A:9.2 times. B:9.0 times. C: 8.4 times. D: 8.8 times.arrow_forward39. CityMarket, Inc.'s purchases during the year were $118,378. The balance sheet shows an average accounts payable balance of $12,000. CityMarket's payables payment period is closest to: 37 days. 44 days. 52 days.arrow_forward

- Harvey Clothing Store had a balance in the Accounts Receivable account of $390,000 at the beginning of the year and a balance of $410,000 at the end of the year. Net credit sales during the year amounted to $3,000,000. The average collection period of the receivables in terms of days was - 30 days. - 365 days. - 274 days. - 48.7 days.arrow_forwardplease help me answer the followingarrow_forwardIf Hot Tubs Inc. had sales of $2,027,773 per year (all credit) and its days sales outstanding was equal to 35 days, what was its average amount of accounts receivable outstanding? (Assume a 365-day year.) * a. $ 5,556 b. $212,541 c. $194,444 d. $ 57,143 e. $ 97,222arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning