FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

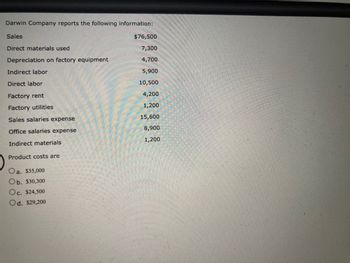

Transcribed Image Text:Darwin Company reports the following information:

Sales

Direct materials used

Depreciation on factory equipment

Indirect labor

Direct labor

Factory rent

Factory utilities

Sales salaries expense

Office salaries expense

Indirect materials

Product costs are

Oa. $35,000

Ob. $30,300

Oc. $24,500

Od. $29,200

$76,500

7,300

4,700

5,900

10,500

4,200

1,200

15,600

8,900

1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer required a,barrow_forwardThe following costs were incurred by ABC Company in January: Direct materials Direct labor Manufacturing overhead Selling expense Administrative salaries Determine ABC's total product cost. Oa. $272,000 Ob. $282,000 Oc. $252,000 Od. $302,000 $100,000 79,000 73,000 25,000 5,000arrow_forwardA company reports the following information: Direct Labor Direct Materials Used Raw Materials Purchased Cost of Goods Manufactured Ending Work-in-Process Inventory Corporate Headquarters' Property taxes Manufacturing Overhead Incurred Calculate the beginning balance of Work-in-Process Inventory O $4,500 O $5,000 O $21.000 59.400 $6,000 3.000 9,000 13,000 1.400 900 400arrow_forward

- Direct Materials Direct Labor Manufacturing overhead Total Manufacturing costs Work-in-process 1/1 Work-in-process 12/31 Cost of goods manufactured Sales Finished Goods 1/1 Cost of Goods Available Finished Goods 12/31 Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income Case 1 $36,000 $12,000 $78,000 $12,000 $66,000 $180,000 $42,000 $78,000 $54,000 Case 2 $5,000 $6,000 $21,000 $2,000 $33,000 $50,000 $9,000 $7,000 $10,000 a Calculate the unknown amounts for both Case 1 and 2 b For Case 1, compute the total prime costs for the year. c For Case 1, compute the total conversion costs for the year. d For Case 1, compute the average price per unit if the company sold 15,000 uni e For Case 1, compute the operating income per unit if the company sold 15,000 units f For Case 1, compute the POHR assuming Manufacturing overhead is applied based on DL cost g For Case 1, review beginning and ending work in process. As an auditor or manager what one question might you possibly…arrow_forwardDetermine the missing amounts. $ Total Manufacturing Costs $272,800 $ $285,200 Work in Process (Jan. 1) $110,400 $425,600 $ Work in Process (Dec. 31) $75,200 $ $90,400 Cost of Goods Manufactured $306,800 $657,800arrow_forwardProduct Cost Flows Complete the following T-accounts: Materials Inventory 1,120 Answer Answer 18,120 250 Wages Payable 9,000 1,050 Finished Goods Inventory 1,500 Answer Answer 1,200 Manufactured Overhead 175 Answer Answer 18,000 4,500 0 Work in Process Inventory 3,500 Answer Answer 9,000 Answer 500 Cost of Goods Sold Answer Save AnswersNextarrow_forward

- Godoarrow_forwardHere is selected data for Lori Corporation: Cost of raw material purchased Cost of requisitioned direct materials Cost of requisitioned indirect materials Direct labor Manufacturing overhead incurred Cost of goods completed Cost of goods sold $77,000 43,000 3,000 80,000 100,000 233,500 OA. credit to Work-in- Process Inventory account for $237,500 OB. debit to Finished Goods Inventory account for $237,500 OC. debit to Finished Goods account for $233,500 OD. debit to Work-in-Process Inventory account for $233,500 142,000 17,000 32,000 35,000 130% Beginning raw materials inventory Beginning work in process inventory Beginning finished goods inventory Manufacturing overhead allocation rate (based on direct labor) The journal entry to transfer completed goods to the finished goods inventory account would include aarrow_forwardDomesticarrow_forward

- Mason Company provided the following data for this year: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,600 $ 5,800 $ 71,000 Ending $ 10,800 $ 20,000 $ 25,400 $ 653,000 $ 82,000 $ 133,000 $ 106,000 $ 45,000 $ 223,000 $ 201,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forwardA manufacturing company reports the following Beginning $ 18,720 10,100 13,160 Ending $ 12,700 11,900 9,330 Inventories Raw materials Work in process Finished goods Activities for the period Raw materials purchases $ 8,800 14,820 9,900 11,740 42,800 Direct materials used Direct labor used Overhead applied Sales 1. Prepare a schedule of cost of goods manufact 2. Compute gross profit. Complete this question by entering your an Required 1 Required 2 Prepare a schedule of cost of goods manufactured Schedule of Cost of Goods Manufactured Direct materials used Direct lahorarrow_forward15. The Logicom Company reports the following information: Sales Direct materials used Depreciation on factory equipment Indirect labor Direct labor Factory rent Factory utilities Sales salaries expense Office salaries expense Indirect materials Product costs are A. $35,000 B. $29,200 C. $30,300 D. $24,500 $76,500 7,300 4,700 5,900 10,500 4,200 1,200 15,600 8,900 1,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education