FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

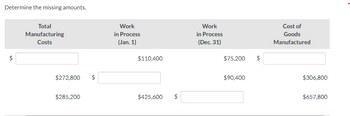

Transcribed Image Text:Determine the missing amounts.

$

Total

Manufacturing

Costs

$272,800 $

$285,200

Work

in Process

(Jan. 1)

$110,400

$425,600

$

Work

in Process

(Dec. 31)

$75,200 $

$90,400

Cost of

Goods

Manufactured

$306,800

$657,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direct Materials Direct Labor Manufacturing overhead Total Manufacturing costs Work-in-process 1/1 Work-in-process 12/31 Cost of goods manufactured Sales Finished Goods 1/1 Cost of Goods Available Finished Goods 12/31 Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income Case 1 $36,000 $12,000 $78,000 $12,000 $66,000 $180,000 $42,000 $78,000 $54,000 Case 2 $5,000 $6,000 $21,000 $2,000 $33,000 $50,000 $9,000 $7,000 $10,000 a Calculate the unknown amounts for both Case 1 and 2 b For Case 1, compute the total prime costs for the year. c For Case 1, compute the total conversion costs for the year. d For Case 1, compute the average price per unit if the company sold 15,000 uni e For Case 1, compute the operating income per unit if the company sold 15,000 units f For Case 1, compute the POHR assuming Manufacturing overhead is applied based on DL cost g For Case 1, review beginning and ending work in process. As an auditor or manager what one question might you possibly…arrow_forwardNonearrow_forwardPlease do not give solution in image format thankuarrow_forward

- b. Materials requisitioned, $680,000, of which $75,800 was for general factory use. Entry Description Debit Credit b. Work in Process fill in the blank 6 fill in the blank 7 Factory Overhead fill in the blank 9 fill in the blank 10 Materials fill in the blank 12 fill in the blank 13 c. Factory labor used, $756,000, of which $182,000 was indirect. Entry Description Debit Credit c. Work in Process fill in the blank 15 fill in the blank 16 Factory Overhead fill in the blank 18 fill in the blank 19 Wages Payable fill in the blank 21 fill in the blank 22arrow_forwardIn the manufacture of 9,700 units of a product, direct materials cost incurred was $171,100, direct labor cost incurred was $108,700, and applied factory overhead was $44,500. The total conversion cost is a. $324,300 b. $153,200 c. $44,500 d. $171,100arrow_forwardH6arrow_forward

- Beginning direct materials Beginning finished goods Beginning work in process Selling & administrative expenses Gross profit Cost of goods manufactured Factory overhead Direct labor $20,900 32,000 21,200 17,000 42,000 328,000 ? Direct materials purchases Ending direct materials Ending work in process Ending finished goods 124,100 24,800 16,500 40,000 Manufacturing costs incurred =arrow_forwardPlease help me with show all calculation thankuarrow_forward(3)arrow_forward

- Vaibharrow_forwardDetermine the missing amount for each letter. Total ifacturing Costs 431600 (a) 567,000 333,900 363,800 Tauthook and Media Work in Process Jan. 1 $40,200 541800 (d) 75,600 EA $ Work in Process Dec. 31 (b) 50,400 100,800 Cost of Goods Manufactured $453,600 592,200 176400 (f) 56,700 283500 (h) 340,200arrow_forwardIf the balance of Work in Process on August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August? a.$390,000 b.$525,000 c.$580,000 d.$170,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education