FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

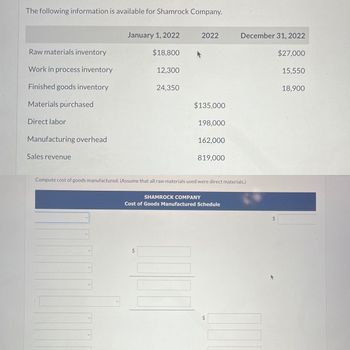

Transcribed Image Text:The following information is available for Shamrock Company.

Raw materials inventory

Work in process inventory

Finished goods inventory

Materials purchased

Direct labor

Manufacturing overhead

Sales revenue

January 1, 2022

$18,800

12,300

24,350

LA

2022

$135,000

198,000

162,000

819,000

Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.)

SHAMROCK COMPANY

Cost of Goods Manufactured Schedule

December 31, 2022

LA

LA

$27,000

15,550

18,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory of work in process Inventory of finished goods Direct materials used Direct labor Manufacturing overhead Selling expenses December 31 $ 40,000 60,000 a. Work in process inventory b. Cost of finished goods manufactured c. Cost of goods sold d. Total manufacturing costs 250,000 120,000 145,000 135,000 January 1 $ 18,000 68,000 Required: a. Find the amount debited to the Work In Process Inventory account during the year. b. What is the cost of finished goods manufactured for the year? c. What is the cost of goods sold for the year? d. What are the total manufacturing costs for the year?arrow_forwardPlease give answer the questionarrow_forwardPlease help mearrow_forward

- The following information is available for Windsor Company. Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue (a) Jan, 1 led Dec 31 V V V > > January 1, 2022 $25,200 << < 17,100 33,150 Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) 2022 $183,000 268,400 219,600 $ 1,110,200 WINDSOR COMPANY Cost of Goods Manufactured Schedule December 31, 2022 183000 171600 $36,600 $ 21.150 25,620 268400 219600 659.600 $ 0000 $ 21 670 21 655arrow_forwardCost of Goods Manufactured and Income Statement with Predetermined Overhead and Labor Cost Classification Assume information pertaining to Bauer Hockey for April of the current year follows. Sales Purchases ● Raw materials Manufacturing supplies Office supplies Salaries (including fringe benefits) Administrative Production supervisors Sales Depreciation Plant and machinery Office and office equipment Utilities Plant Office Inventories $670,950 Finished goods Additional information follows: 202,500 10,800 1,980 92,340 22,050 94,500 21,600 7,200 13,500 5,400 April 1 April 30 $45,315 $47,250 Raw materials Manufacturing supplies 5,580 6,660 Office supplies 1,620 1,350 Work-in-process 34,650 36,180 81,000 79,200 000 panions •Manufacturing overhead is applied to products at 125% of direct labor dollars. Employee base wages are $15 per hour. Employee fringe benefits amount to 20% of the base wage rate. They are classified as manufacturing overhead. During April, production employees worked…arrow_forwardFrom the account balances listed below, prepare a schedule of cost of goods manufactured for Sur Manufacturing Company for the month ended December 31, 2019. Finished Goods Inventory, December 31 Factory Supervisory Salaries Raw Materials Inventory, December 1 Work In Process Inventory, December 31 Sales Salaries Expense Factory Depreciation Expense Finished Goods Inventory, December 1 Raw Materials Purchases Work In Process Inventory, December 1 Factory Utilities Expense Direct Labor Account Balances OMR 42,000 12,000 12,000 15,000 14,000 8,000 35,000 105,000 25,000 6,000 70,000 19,000 21,000 Raw Materials Inventory, December 31 Indirect Labor Sur Manufacturing Company Cost of Goods Manufactured Schedule For the Month Ended December 31, 2019arrow_forward

- Required Supply the missing information on the following schedule of cost of goods manufactured. FISCHER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, Year 2 Raw materials Beginning inventory Plus: Purchases Raw materials available for use Minus: Ending raw materials inventory 118,600 $ 148,600 Cost of direct raw materials used $ 123,500 Direct labor Manufacturing overhead Total manufacturing costs Plus: Beginning work in process inventory | Total work in process 23,700 309,200arrow_forward1arrow_forwardSHAMROCK COMPANY Balance Sheet (Partial) For the Year Ended June 30, 2022 ASSETS $ $ $arrow_forward

- Cullumber Company's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory O $1280000. O $750000. O $840000. O $1230000. Dec. 31, 2022 $390000 Save for Later 300000 190000 Dec. 31, 2021 $340000 160000 During 2022, $890000 of raw materials were purchased, direct labor costs amounted to $670000, and manufacturing overhead incurred was $640000. (Assume that all raw materials used were direct materials.) The total raw materials available for use during 2022 for Cullumber Company is 150000 Attempts: 0 of 1 used Submit Answerarrow_forwardThe following information is available for ABC Company for the year ended December 31: Beginning raw materials inventory Raw materials purchases Ending raw materials inventory Direct labor expense What is the amount of direct materials used in production for the year? Multiple Choice $5,200. $7,500. $4,700. $8,900. $ 3,700 5,200 4,200 2,200arrow_forwardSubject: acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education