FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

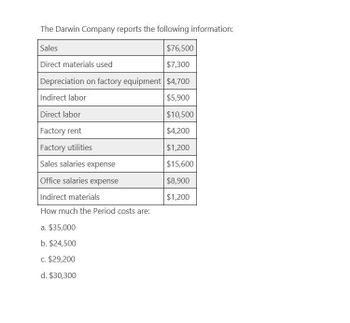

Transcribed Image Text:The Darwin Company reports the following information:

Sales

Direct materials used

$76,500

$7,300

Depreciation on factory equipment |$4,700

Indirect labor

$5,900

Direct labor

$10,500

Factory rent

$4,200

Factory utilities

$1,200

Sales salaries expense

$15,600

Office salaries expense

$8,900

Indirect materials

$1,200

How much the Period costs are:

a. $35,000

b. $24,500

c. $29,200

d. $30,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Sun Inc. has provided the following information: $ 60,000 55,000 Beginning Work-in-Process Inventory Beginning Raw Materials Inventory Purchases and Freight In of Raw Materials Ending Raw Materials Inventory 315,000 80,000 Direct Labor 70,000 Depreciation-Plant and Equipment Plant Utilities, Insurance, and Property Taxes 25,000 15,500 Ending Work-in-Process Inventory Selling and distribution overhead 23,000 40,000 Calculate the cost of goods manufactured. a) $412,500 b) $437,500 c) $477,500 d) $422,000arrow_forwardAssume that a manufacturing company incurred the following costs: $ 90,000 $ 40,000 $ 35,000 $ 15,000 $ 4,000 $ 5,000 $ 20,000 $ 1,000 $ 2,500 $ 105,000 $ 6,000 $ 7,000 Direct labor Advertising Factory supervision Sales commissions Depreciation, office equipment Indirect materials Depreciation, factory building Administrative office salaries Utilities, factory Direct materials Insurance, factory Property taxes, factory What is the total amount of conversion costs?arrow_forwardI want correct solutionarrow_forward

- Assume the following: Purchases of raw materials $ 38,000 Beginning raw materials inventory $ 10,000 Ending raw materials inventory $ 14,000 Direct materials used in production $ 29,600 What was the amount of indirect materials used in production?arrow_forwardThe following is the data for Lauren Enterprises: Selling and administrative expenses $75,000 Direct materials used 265,000 Direct labor (25,000 hours) 300,000 Factory overhead application rate $16 per DLH Inventories Beginning Ending Direct materials $50,000 $45,000 Work in process 75,000 90,000 Finished goods 40,000 25,000 Refer to Figure 2-14. What is the cost of goods manufactured? Inventories Beginning Ending Direct materials $50,000 $45,000 Work in process 90,000 75,000 40,000 25,000 Finished goods Refer to Figure 2-14. What is the cost of goods manufactured? $1,115,000 $965,000 $955,000 $950,000arrow_forwardCompute factory overhead cost from the following costs: Depreciation on factory buildings $ 45,950 Depreciation on office equipment 32,980 Direct materials used 96,840 Indirect labor $ 6,580 a.$78,930 b.$73,000 c.$96,840 d.$52,530arrow_forward

- The following selected account balances are as at the end of the current period. Manufacturing direct labour $140,000 Direct materials purchased Variable manufacturing overhead Depreciation on plant equipment and building Sales commissions Direct materials used Head office overhead costs Marketing costs What are the conversion costs for the period? O $300,000 O $420,000 O $120,000 O $215,000 150,000 75,000 85,000 35,000 120,000 110,000 90,000arrow_forwardAnswer please need helparrow_forwardProvide Answer with calculationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education