FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

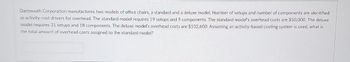

Transcribed Image Text:Dartmouth Corporation manufactures two models of office chairs, a standard and a deluxe model. Number of setups and number of components are identified

as activity-cost drivers for overhead. The standard model requires 19 setups and 9 components. The standard model's overhead costs are $50,000. The deluxe

model requires 31 setups and 18 components. The deluxe model's overhead costs are $102,600. Assuming an activity-based costing system is used, what is

the total amount of overhead costs assigned to the standard model?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Julio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Number of machine hours Number of material moves Number of setups Total estimated overhead costs are $332,860, of which $158,400 is assigned to the material handling cost pool and $174,460 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC. Required 1 Required 2 Standard Model Deluxe Model 30,400 870 520 Complete this question by entering your answers in the tabs below. Standard Model Deluxe Model 25,400 570 90 Calculate the overhead assigned to each product using the traditional cost system. (Round the…arrow_forwardLockTite Company produces two products, Pretty Safe (PS) and Virtually Impenetrable (VI). The following two tables give pertinent information about these products. Solve, a. What is the cost per unit of Pretty Safe if LockTite uses traditional overhead allocation based on number of units produced? b. What is the cost per unit of Pretty Safe if LockTite uses activity-based costing to allocate overhead?arrow_forwardA company which uses activity-based costing has two products: A and B. The annual production and sales of Product A is 12,000 units and of Product B is 10,500 units. There are three activity cost pools, with total cost and total activity as follows: Total Activity Product Product A Activity Cost Pool Total Cost Total Activity 1 Activity 2 Activity 3 52-54 $25,420 130 490 620 $38,400 $122,670 890 310 1,200 820 3,410 4,230 The activity-based costing cost per unit of Product A is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $10.79 $1.60 $4.80 $3.10arrow_forward

- Conspicuous Limo uses activity-based costing for its two models of stretch Hummer limousines: Big and Too Big. There are three activity cost pools related to production, with estimated costs and expected activity as follows: Amount of Activity Activity Cost Pool Estimated Cost Activity cost driver Big Too Big Fabrication $181,500 Labor hours 600 500 Painting $650,000 Machine hours 1,600 300 Finishing $2,750,000 Units 470 530 What are the activity rates for fabrication and painting?arrow_forwardJulio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Standard Model Deluxe Model Number of machine hours 25,800 30,800 Number of material moves Number of setups 590 890 70 540 Total estimated overhead costs are $347,100, of which $170,200 is assigned to the material handling cost pool and $176,900 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC.arrow_forwardPetrillo Company produces engine parts for large motors. The company usesa standard cost system for production costing and control. The standard costsheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs @$5,4) $37,80 Direct labor (1,75 lbs @$18) $31,50 Variable overhead (1,75 lbs @$4) $7 Fixed overhead (1,75 lbs @$3) $5,25 Standard unit cost $81,55 During the year, Petrillo had the following activity related to valve production:a. Production of valves totaled 20,600 units.b. A total of 135,400 pounds of direct materials was purchased at $5.36per pound.c. There were 10,000 pounds of direct materials in beginning inventory(carried at $5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of $656,270.e. Actual fixed overhead totaled $110,000.f. Actual variable overhead totaled $168,000.Petrillo produces all of its valves in a single plant. Normal activity is 20,000units per year. Standard…arrow_forward

- Tri-bikes manufactures two different levels of bicycles: the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150,000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $200,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. It was also estimated that the setup cost pool would have $100,000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. Required: Calculate the amount of overhead assigned per product, under traditional and under ABC costing.arrow_forwardReynoso Corporation manufactures titanium and aluminum tennis racquets. Reynoso’s total overhead costs consist of assembly costs and inspection costs. The following information is available: Cost Titanium Aluminum Total Cost Assembly 500 mach. hours 500 mach. hours $27000 Inspections 350 150 $80000 2100 labor hours 1900 labor hours Reynoso is considering switching from one overhead rate based on labor hours to activity-based costing.Using activity-based costing, how much inspections cost is assigned to titanium racquets? $24000. $40000. $56000. $29000.arrow_forwardLakeside Inc. manufactures four lines of remote control boats and uses activity-based costing to calculate product cost. Activity Cost Pools EstimatedTotal Cost Estimated Cost Driver Machining $ 334,000 13,600 machine hours Setup 76,000 420 batches Quality control 103,000 830 inspections Compute the activity rates for each of the following activity cost pools: How do you find the activitiy costs???arrow_forward

- Gable Company uses three activity pools. Each pool has a cost driver. Information for Gable Company follows: Total Cost of Pool $ 380, 120 86,400 74,672 Estimated Cost Driver 88,400 9,000 525 Activity Pools Machining Designing costs Setup costs E4-5 (Algo) Assigning Costs Using Activity Proportions [LO 4-5, 4-6] Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Product A 34,000 3,600 60 Number of machine hours Number of design hours Number of batches Cost Driver Number of machine hours Number of design hours Number of batches Product A Product B Product C Total Overhead Assigned Product B Product C 10,400 3,400 285 Required: 1. Using activity proportions, determine the amount of overhead assigned to each product. Note: Do not round your intermediate calculations. Round your final answers to nearest whole number. 44,000 2,000 180arrow_forwardneed answer with given information pleasearrow_forwardTri-Bikes manufactures two different levels of bicycles - the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150,000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $180,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. It was also estimated that the setup cost pool would have $120,000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. PLEASE NOTE: Predetermined overhead rates will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). The rates will include their proper label according to the textbook examples (no abbreviations). All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is the overhead cost per product,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education