College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Provide correct option

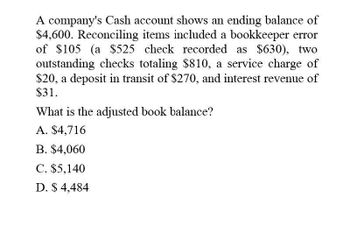

Transcribed Image Text:A company's Cash account shows an ending balance of

$4,600. Reconciling items included a bookkeeper error

of $105 (a $525 check recorded as $630), two

outstanding checks totaling $810, a service charge of

$20, a deposit in transit of $270, and interest revenue of

$31.

What is the adjusted book balance?

A. $4,716

B. $4,060

C. $5,140

D. $ 4,484

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The bank reconciliation shows the following adjustments. Deposits in transit: $1,698 Notes receivable collected by bank: $2,500; interest: $145 Outstanding checks: $987 Error by bank: $436 Bank charges: $70 Prepare the correcting journal entry.arrow_forwardCAn you please answer. General Accountarrow_forwardBook Balance?arrow_forward

- A company's Cash account shows an ending balance of $4,850. Reconciling items included a bookkeeper error of $125 (a $525 check recorded as $630), two outstanding checks totaling $810, a service charge of $28, a deposit in transit of $270, and interest revenue of $43. What is the adjusted book balance?arrow_forwardA company's Cash account shows an ending balance of $4,600. Reconciling items included a bookkeeper error of $105 (a $525 check recorded as $630), two outstanding checks totaling $810, a service charge of $20, a deposit in transit of $270, and interest revenue of $31. What is the adjusted book balance? A. $4,716 B. $4,060 C. $5,140 D. $ 4,484arrow_forwardA company received a bank statement with a balance of $6,100. Reconciling items included a bookkeeper error of $300—a $300 check recorded as $800—two outstanding checks totaling $830, a service charge of $20, a deposit in transit of $250, and interest revenue of $21. What is the adjusted bank balance? A. $5,220 B. $5,061 C. $5,520 D. $4,721arrow_forward

- A company received a bank statement with a balance of $6,400. Reconciling items included a bookkeeper error of $400 a $400 check recorded as $700—two outstanding checks totaling $800, a service charge of $23, a deposit in transit of $280,and interest revenue of $21. What is the adjusted bank balance? A. $5,480 B. $5,178 C. $5,880 D. $5624arrow_forwardA check register shows a balance of $484.95. The bank statement shows a cash balance of $506.27. The check register shows an outstanding check for $27.82. The bank statement shows a service charge of $6.50. Compute the adjusted balance of the check register and the bank statement. 467.45 578.45 None of the above 487.45 $478.45arrow_forwardOn May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. $29.95 $943.80 O $1,003.70 O $1,108.88arrow_forward

- Expert please provide answerarrow_forwardOn December 15, you received your bank statement showing a balance of $2,275.34. Your checkbook shows a balance of $2,437.40. Outstanding checks are $225.50 and $356.10. The account earned $77.55. Deposits in transit amount to $805.21, and there is a service charge of $16.00. Calculate the reconciled balance. O $162.06 O $2,051.73 O $2,375.85 O $2,498.95arrow_forwardA company shows an ending balance of $790. The bank statement shows a $14 service charge and an NSF check for $150. A $280 deposit is in transit, and outstanding checks total $310. What is their adjusted cash balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College